Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum acts just under the $ 2,000 brand and keeps critical levels as the broader market shows signs of recovery. After weeks of choppy price measure and bleaching of sales pressure, bulls gradually regain control and drives ETH to a more rarely short -term structure. Momentum builds when Ethereum stabilizes above $ 1,800, and technical indicators indicate that an outbreak may be formed.

Related reading

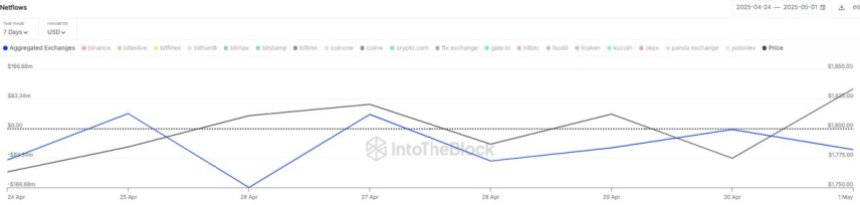

Addition to the growing optimism shows data on the chain from intotheblock an even flow of ETH from centralized exchanges-a indicator that is often associated with accumulation and reduced pressure on the sales side. In the past week alone, net outflows have exceeded Ethereum of $ 380 million, which reinforces the view that investors are preparing for a move higher.

Still, the most important resistance to $ 2,000 remains a psychological and technical barrier. A confirmed pressure above this level can trigger a wider Altcoin rally and signal the beginning of Ethereum next leg up. Until then, the market remains carefully optimistic when bulls test the upper limits of this consolidation zone and are looking for the speed needed to escape it.

Ethereum is facing critical test among the accumulation trend

Ethereum continues to meet headwinds when it acts more than 55% below its heights in December and floats under $ 2,000 resistance zone. While the wider crypto market shows signs of revival, ETH remains locked in a critical battle between supply costs and renewed buying interest. The latest price structure shows some haisse development in lower time frames, as buyers try to build speed. But strong resistance levels are still a loom, and failure to break through can trigger a new movement in lower demand zones about $ 1,700 or even $ 1,500.

Despite these technical challenges, data data paint a more encouraging image. According to intotheblockCentralized exchanges have seen net outflows of about $ 380 million over the past seven days. This steady reduction in the ETH exchange proposes a growing trend with accumulation, often interpreted as investors who move coins to refrigeration storage rather than prepare to sell. This behavior usually reduces pressure on the sales side and can lay the foundation for more durable rally.

The marketing entry remains mixed. Some analysts claim that Ethereum is on their way to a breakout, with varying speed at an imminent force. Others remain cautious and warn that macroeconomic uncertainty and fragile investors’ confidence can still draw ETH to a deeper correction. The coming days will be crucial to defining Ethereum’s course.

Related reading

ETH Price analysis: Test key resistance

Ethereum (ETH) is currently traded at $ 1,837 after several days of consolidation just below $ 1,850. As can be seen from the daily diagram, ETH has tried to form a short -term haussey structure after recovery from April lowness close to $ 1,550. The prize has constantly climbed but is now facing significant resistance close to $ 1,850 – a level that has served as both support and resistance in previous months.

The volume has been relatively stable but not convincingly high, which indicates that bulls are gaining control but lack strong speed to break through. The 200-day Simple Moving Average (SMA) to $ 2,271 and 200-day exponentially variable average (EMA) to $ 2,456 remains removing costs. These levels represent important resistance in the longer term and to recover them would be a large hooked signal.

Related reading

At the moment, ETH must close over $ 1,850 to validate this short -term trend change. A failure with this can lead to another new support for about $ 1,700 or even lower, especially on broader market changes. The price that holds over the latest swing loans and forms higher lows signals that haussearted pressure is gradually being built. A breakout over $ 1,850 would open the door to go against $ 2,000- $ 2200 zone.

Featured Image from Dall-E, Chart from Tradingview