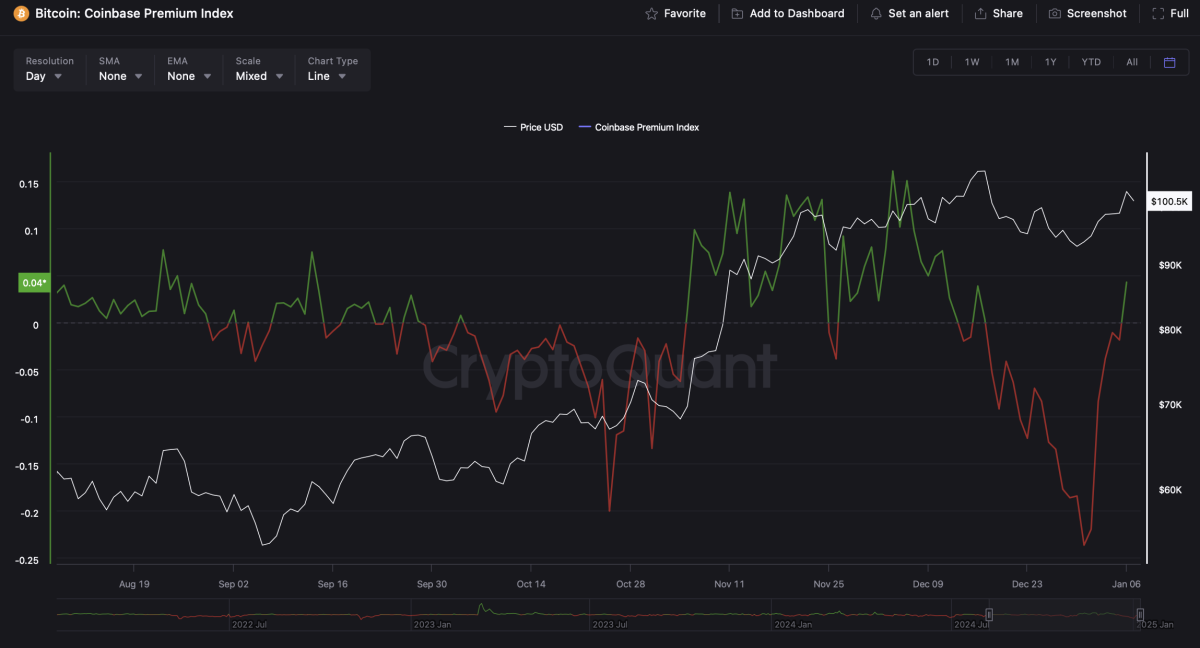

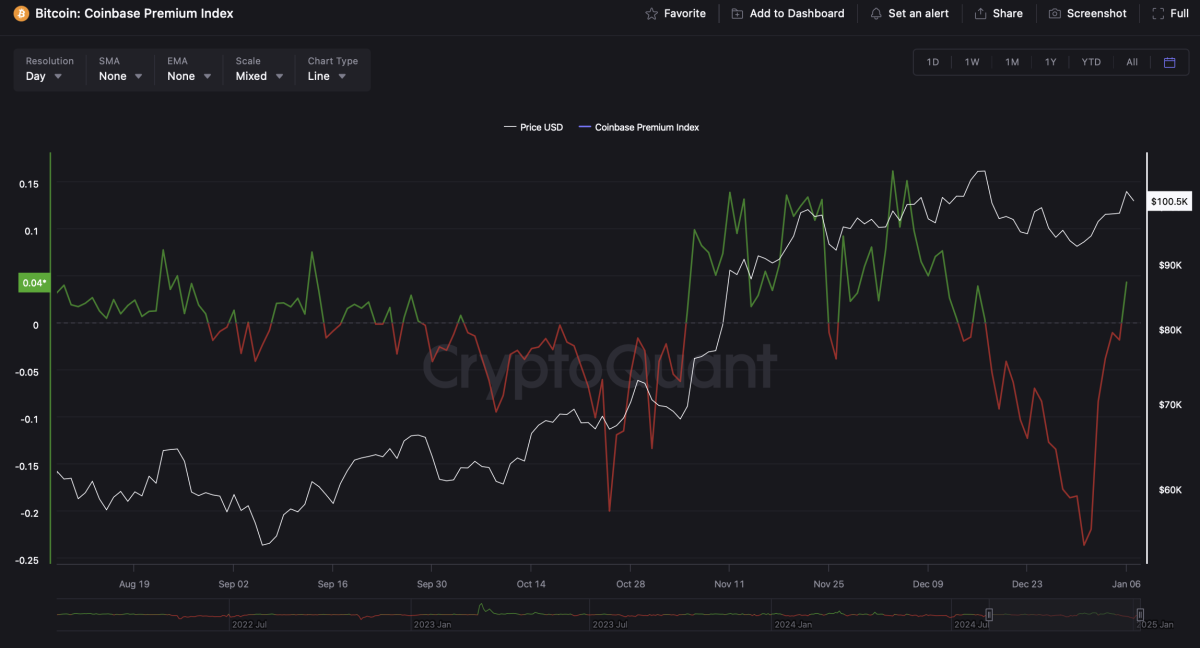

The Coinbase Premium Index (CPI) has turned positive for the first time since mid-December 2024, signaling renewed demand from US investors, according to CryptoQuant analysis.

“Since the approval of US-based spot bitcoin ETFs, the behavior of US investors has been a leading indicator for the crypto market,” said analyst CryptoQuant. Burak Kesmečí he said. “The data suggests that US investor behavior is once again shifting towards the dominance of buying pressure.”

The positive premium on Coinbase indicates increased buying interest, especially from institutional players who use Coinbase for large transactions, Kesmeci said. “In addition to the CPI going into the positives, there was a single block outflow of 4,012 bitcoins from Coinbase on Monday at 18:04 local time,” the analyst noted.

Coinbase’s premium has turned positive for the first time in weeks, indicating growing demand for Bitcoin from US investors. Image: CryptoQuant.

Tightening liquidity and miner behavior are supporting Bitcoin’s uptrend

Bitfinex analysts pointed to several metrics that suggest much of the pressure was pushing down bitcoin to the local low of $91,000 at the end of December may now ease.

“Bitcoin’s sales liquidity is decreasing at a rapid pace,” the analysts said. They pointed to the Liquidity Inventory Ratio (LIR) – a metric measuring how long current supply can meet demand – which fell from 41 months in October to just 6.6 months now. This sharp decline in liquidity reflects trends seen during strong growth in the first and second quarters of 2024, suggesting a tightening of supply as demand rises.

Analysts also highlighted changes in miner activity, which is a key driver of the bitcoin spot market. After the halving event in 2024, when mining rewards were cut in half, many miners had to sell their reserves to raise capital for operations and equipment upgrades. However, this selling pressure is diminishing as 2025 begins, according to Bitfinex.

“Bitcoin flows from miners to exchanges are falling rapidly,” analysts said, suggesting miners are increasingly sticking to their bitcoin rather than selling.

Miners’ profitability is rising, but still below pre-halving levels

In addition, the JPMorgan report, cited CoinDeskhe showed it bitcoin miner profitability rose for the second month in a row in December 2024, reaching its highest level since April 2024. Despite this improvement, however, daily miners’ income remains 43% and gross margins 52% below pre-halving levels.

According to Coindesk, JPMorgan estimates that in December, Bitcoin miners earned an average of $57,100 per exahash per second (EH/s) in daily block reward revenue last month, up 10% from November.

The Bitcoin network’s hashrate rose 6% in December to an average of 779 EH/s, the report said. However, this growth rate was significantly slower than the 103% increase seen in 2023.

Disclaimer: The Block is an independent media outlet that delivers news, research and data. As of November 2023, Foresight Ventures is the majority investor in The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is the anchor LP for Foresight Ventures. The Block continues to operate independently to provide objective, compelling and timely information on the crypto industry. Here are our current ones financial disclosure.

© 2024 The Block. All rights reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial or other advice.