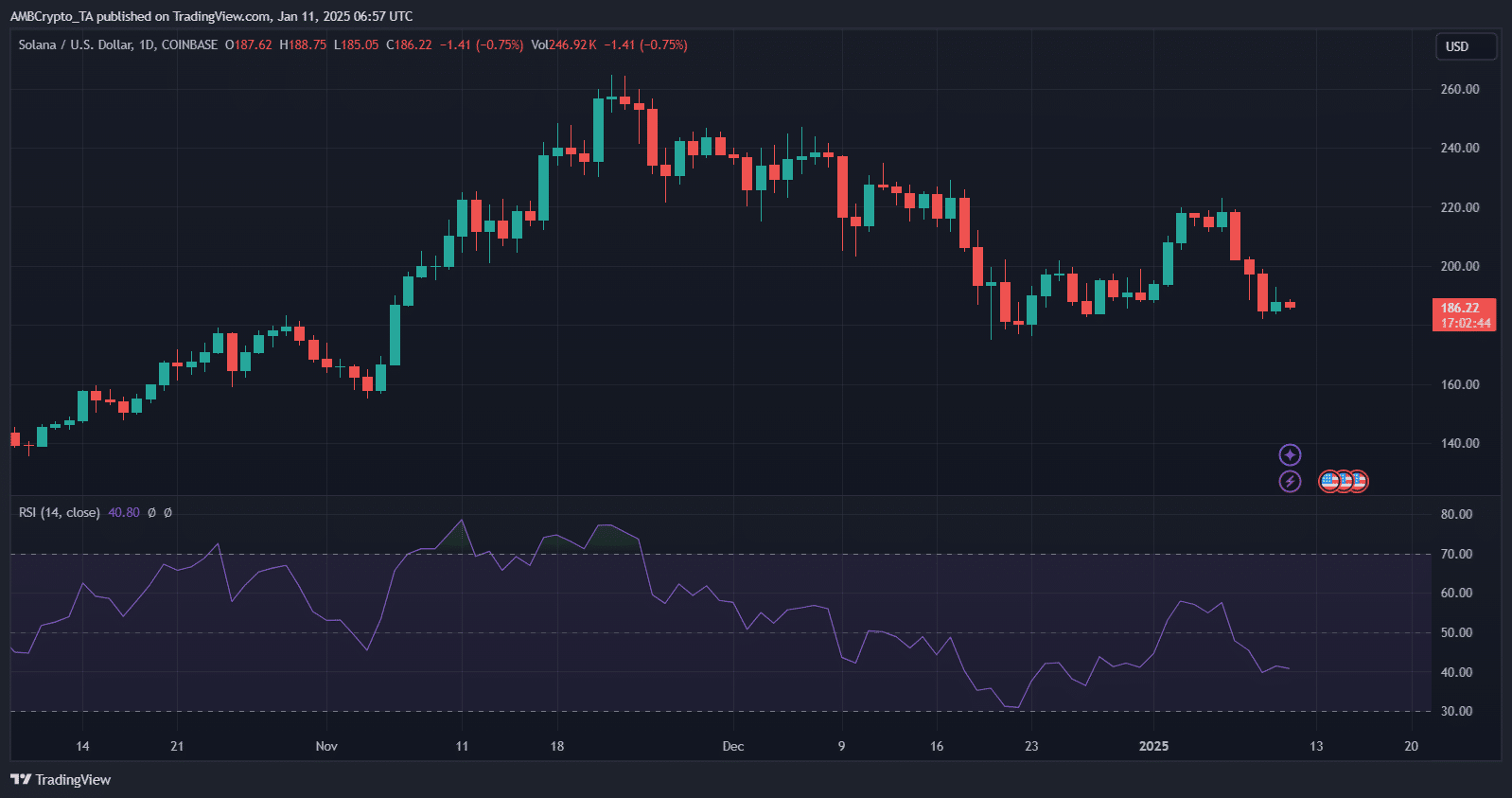

- Solana’s $180 support level is critical to its 2025 price action

- Social volume and declining active addresses could signal further losses for Solana

As we enter 2025, the crypto market is experiencing increased volatility, with various assets testing critical support levels. One such asset under close scrutiny is Solana (SOL)hovering around the key price of $180. This threshold has emerged as a key level for traders, as the market supports potential price swings.

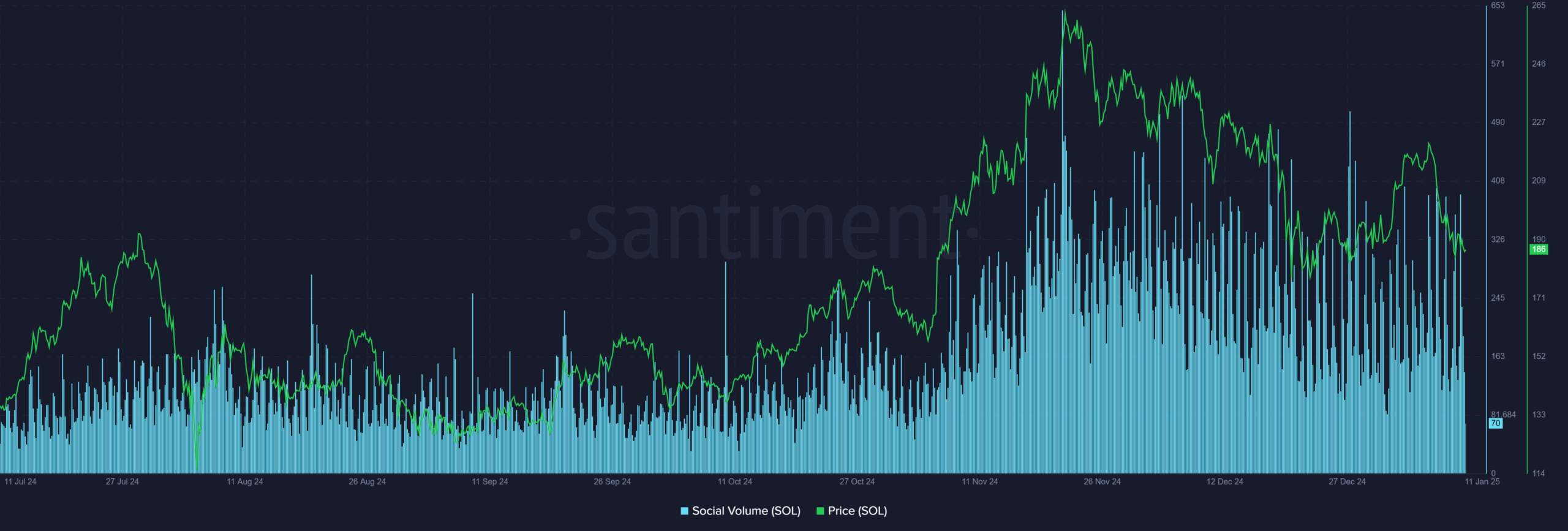

Social volume – A signal for Solana’s price movements

Solana’s social volume has shown a noticeable correlation with its price fluctuations, as can be seen in the accompanying chart. Peaks in social activity often precede significant price volatility.

In recent months, increased social chatter around Solana has coincided with upward price momentum – hinting at a potential sentiment-driven rally.

However, as social volume remains high, it can also act as a double-edged sword, signaling excessive market enthusiasm or the potential for a reversal.

Traders closely monitoring these trends should be wary of sharp sentiment shifts, especially if Solana fails to hold above $180. Sustained increases in social engagement without price validation may point to weakened support and the risk of further declines.

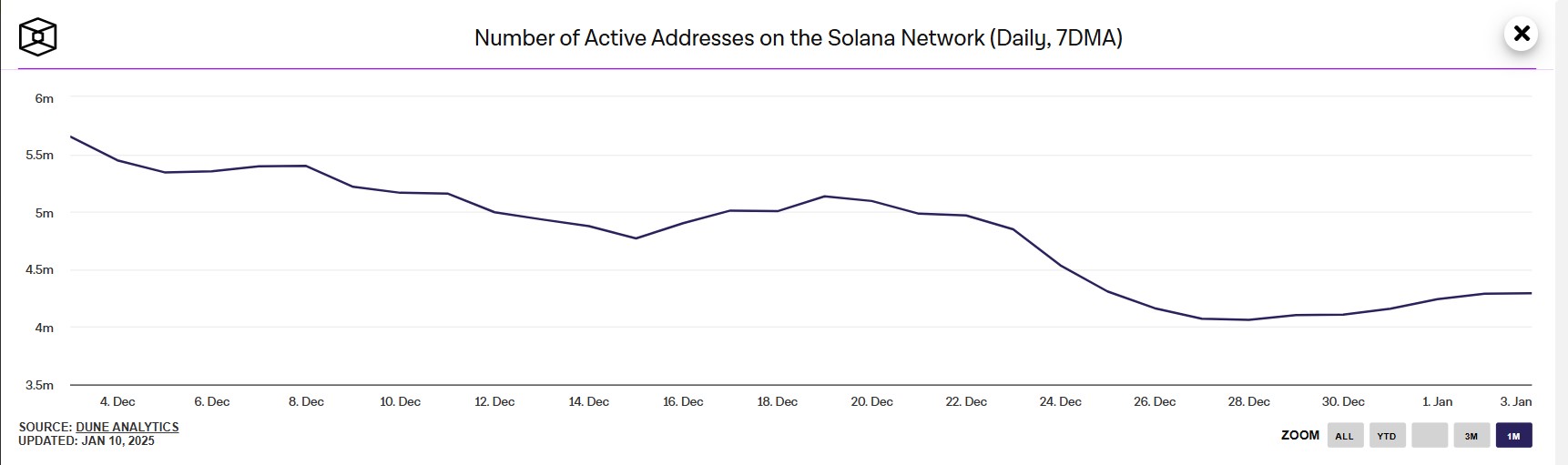

Reduce active addresses

However, the recent drop in Solana’s active addresses revealed a worrying trend. From the beginning of December to the end of December, active addresses dropped sharply, dropping from nearly 6 million to just over 3.5 million – a drop of over 40%.

Although the metric saw a modest recovery towards the start of January, it remains far from its previous highs, signaling a decline in network activity and engagement.

This decline in active participation raises concerns about declining usability and user trust. Historically, sharp declines in active addresses often precede downward price pressure, reflecting waning demand.

For Solana, sustaining price levels near $180 may depend on a reversal of this trend. Without a significant increase in activity in the chain, the risk of further price erosion is high.

Read Solana (SOL) price prediction 2025–2026