It is not for nothing that Ethereum is one of the most important cryptocurrencies in the world. The current number 2 in the crypto world is primarily receiving its applications for decentralized funding.

Here, the so-called “smart contracts” are the focus of the business interest. The “automated” contracts no longer require a central authority and increasingly exclude banks from the financial cycle.

Course correction before the next rise

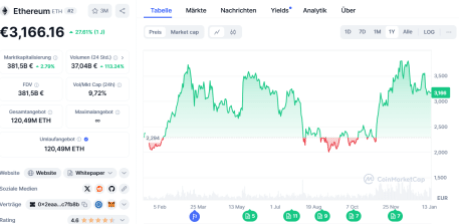

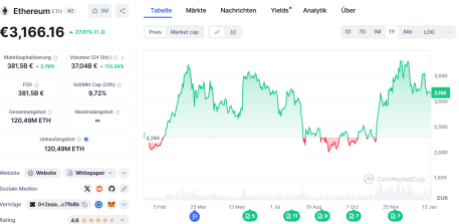

Given this innovation, it is not surprising that the Ethereum network is considered future-proof. Yet its cryptocurrency Ether most recently a burglary of around 10 percent. Now investors fear a further decline in prices.

Considering the upcoming Donald Trump takes office In the US, many investors had hoped that things would only go up from now on. But the backlash came as expected, after all, corrections are part of crypto’s high volatility.

In addition, an Ethereum election caused concern, it seemed to have lost patience and sold some of its positions, thereby accepting losses. That’s great, after all, the crypto future seems bright, at least on paper.

Expected price increases

Finally, like Bitcoin, Ethereum may point to the first approved spot ETFs, which should ensure greater penetration of Ether in the markets. The former implacable opponent Gary Gensler, head of the American Securities and Exchange Commission (SEC), has resigned and Donald Trump wants to do everything he can to strengthen crypto in the United States.

Still, Ethereum is showing weakness and is far from its all-time high. With the approval of the first ETH spot ETF, the price briefly rose above the $4,000 mark, but it has been downhill ever since.

Just a week ago, Ethereum experienced another rally, but it was short-lived. But this development was also observed when the first Bitcoin spot ETFs were approved.

The markets had already anticipated the expected price increases and needed some time to analyze the further developments and react to them. This will obviously be no different with Ethereum.

New lift after Trump’s inauguration?

In any case, the history of Ethereum shows that ETH usually turns out to be bullish during January of a year. Given this history, it would not be surprising if the coin rallied again in the next two weeks.

In any case, many analysts are optimistic that with the implementation of the new US government’s first deregulation measures, the crypto market and thus also Ethereum will make significant price gains again.

Alternative Solaxy

However, if you are an investor looking for an alternative to Ethereum, you can take a look at the new one Meme-Coin Solaxy Throw ($SOLX). This is currently completing its pre-sale on Ethereum, but due to its technical design, it forms a bridge to the Solana blockchain.

As a multi-chain coin, it uses low cost and speed to generate the best of both worlds for itself. 10 million euros flowed into the new project in a very short time, proving that investors believe in Solaxy’s idea.

With a price of just $0.0016 for 1 Solaxy ($SOLX), the token is still cheap, but that could change dramatically when the coin is listed for purchase on one of the crypto exchanges.

All information about Solaxy ($SOLX) can be found on the corresponding pages of X and Telegram.