Norway’s Bank Investment Management (Nbim)Norway’s superb wealth giant giant, discreetly increased its bitcoin exposure – with a unique twist.

They have strategically increased their indirect holdings by 153% by placing a sharp Invest in micro strategyRather than rushing your head into the fleeting crypto market.

By the end of 2024, NBIM had acquired about $ 500 million in micro strategy, which amounted to more than 1.1 million shares.

Norway can strive for the potential benefits of Bitcoin Without discomfort with direct crypto -owning, thanks to this smart strategy.

Betting on bitcoin – without buying a single coin

The most important point is that the Norway Fund does not actively participate in Bitcoin. Instead, they use Micro Strategy’s significant BTC holdings -to invest in a Gold Rush Shovel manufacturer instead of digging only for gold.

🇳🇴 Norway’s bold crypto movement!

💰 $ 500 million investment: Norway Sovereign Fund acquires 1,123 million shares in Micro Strategy

📈 Bitcoin Exposure: Holdings Surge 153% 2024, now on 3,821 BTC

🌍 Global Positioning: Now among the largest institutional bitcoin holders

🔄 Strategic shift: … pic.twitter.com/grkj3kvadl

– Moneydubai (@moneydubai_ae) January 30, 2025

Maintain micro strategy Helps NBIM avoids the problems related to cryptocurrencies: no regulatory gray areas, custody issues or restless nights carried by market swings.

And it pays off; Their indirect crypto exposure rose from about 1,506 BTC to 3,821 BTC at the end of the year. Not bad for a fund that is officially free from Cryptocurrencies.

Norway’s indirect exposure to Bitcoin has almost tripled over the past year, as a result of increased allocations to crypto-related companies, according to K33 research.

The Norwegian sovereign wealth fund (NBIM) has indirectly 3,821 BTC, which reflects an increase of 1,375 BTC since 30 June 2024 and annual growth of 2,314 BTC increase of 153% compared to its end of 2023 holding.

It is important to emphasize that this exposure probably … pic.twitter.com/seq12cm2rn– Vetle Lunde (@vetelunde) January 29, 2025

What are the reasons behind micro strategy?

Therefore, why do they adapt to this organization? Micro strategy has emerged as the embodiment of the company’s Bitcoin madness. Their layer has become a bitcoin barometer as a result of their aggressive purchasing spree; As BTC increases, they also do their share price.

BTCUSD trading at $104,103 on the daily chart: TradingView.com

This means that the Norway Fund can benefit from Bitcoin’s potential without experiencing the Volatility of Cryptocurrency. It is a win-win situation: maintaining the stability of conventional investments while getting a glimpse of the unmatched side of crypto through a reputable intermediary.

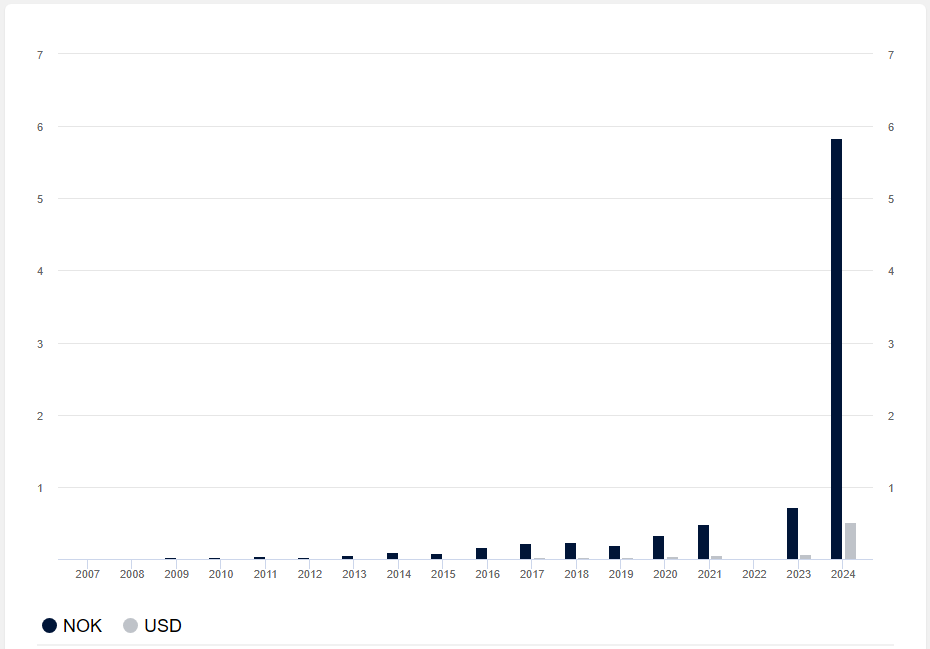

NBIM's MicroStrategy investment value. Chart: NBIM

Big Money’s Crypto Playbook

This is not just a Norwegian anomaly; It is part of a more extensive trend. Institutional investors gradually become more favorable to Cryptocurrency; However, they remain cautious when it comes to their own holding of digital currencies. Rather, they use their imagination. They go into crypto water without completely immersing themselves by supporting companies such as micro strategy.

Eggs in other baskets

In addition to micro strategy, Norway’s Bank Investment Management also owns shares in several companies that trade with Bitcoin. These include Tokyo-based meta plane, Cryptocurrency Exchange Coinbase, Bitcoin Mining Companies Marathon Digital and Riot Platforms and Tesla.

Image from Gemini Imagen, Chart from TradingView