Large fluctuations at Ethereum (ETH) market yesterday triggered a wave of reactions to social media, with an Ethereum founder who claimed that some large holders or “whales”-consciously pressed the price of the asset.

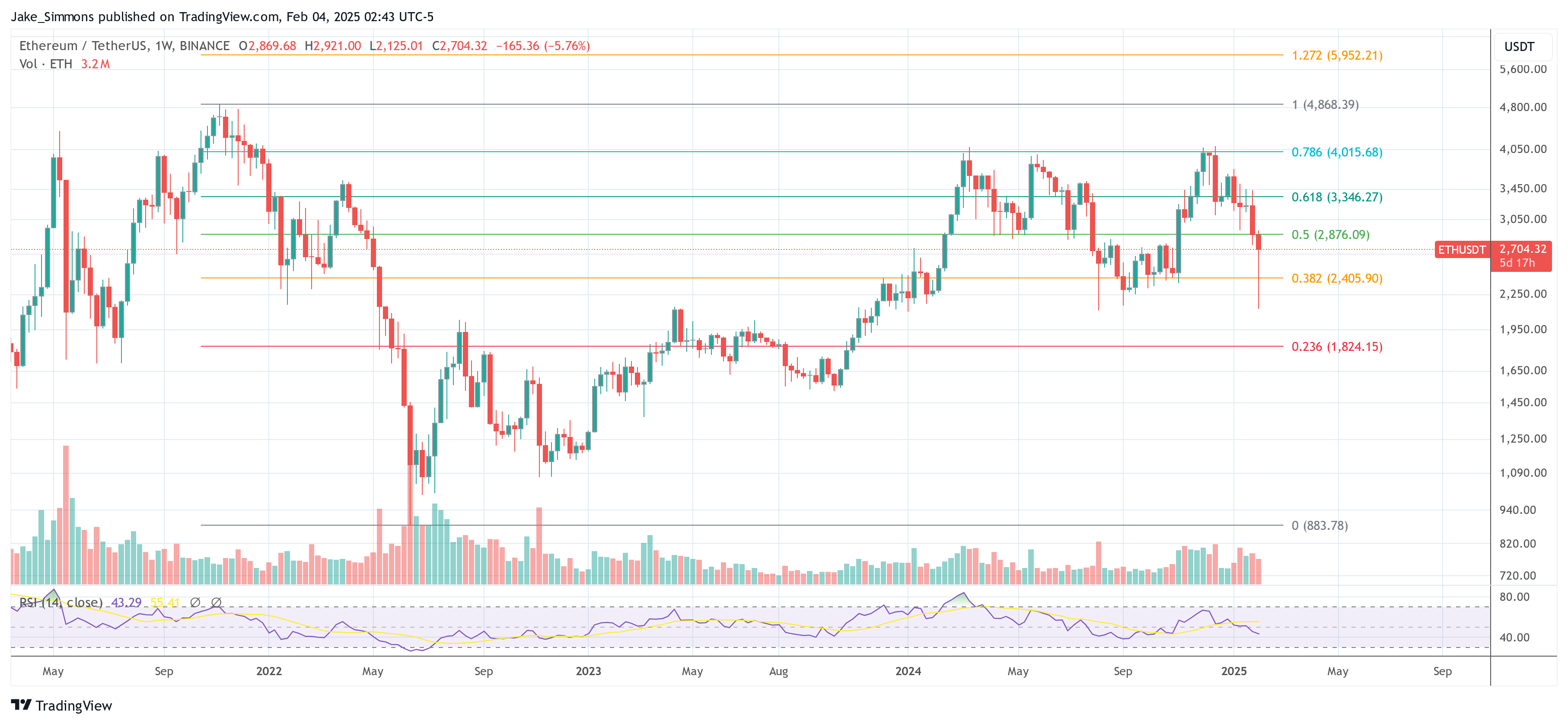

The activity reached a fever pitch on Monday 4 February, when the ETH price swung from about $ 2,900 to as low as $ 2120 before jumping back sharply. Despite the intraidy step, Ether finally closed the day with a 26% green wick – an unusual price recovery in such a short window.

Ethereum -Price manipulated by whales?

Analysts attributed the dramatic movement to external macroeconomic forces, especially the US trade war under President Donald Trump. After introduce customs on Mexico and Canada Early in the day, the president later met an arrangement that stimulated a rapid recovery in global markets, including Cryptocurrency.

Related reading

The turbulence led an observer, simply identified as “trainee” (@intern), the growth director at Monad, to publish a strong feeling on X: “ETH dies right in front of us. Honestly never thought this would happen. “

IN responseEthereum founder and consensus CEO Joseph Lubin offered a compound vision and emphasizes that these types of price fluctuations are not uncommon for digital access: “It happens regularly. Then it grows. What we see is whales Take advantage of financial anxiety and negative feeling to shake out weak hands, run a stop and then buy back when they can run the same playlist in the reverse direction. “

Lubin’s statement presents a cyclic understanding of crypto vollatility, which means that major players utilize market anxiety – often aggravated by macro development – to push less resilient investors to sell.

Several prominent crypto dealers also commented on the events, especially on charges of populated manipulation.

A well -known figure, Haka (@hsakatrades), prevailed newcomers not to assume that ETH’s decline was purely organic market term: “Dear noobs, Ethereum, of course, goes down. It is pushed down via whales that place counterfeit sales orders on exchanges to make noobs and risk manager to sell to “buy back lower”. They steal your bags and make you buy back at a higher price. “

The perception of a coordinated “counterfeit” strategy – where large sales orders are placed and then interrupted or only partially filled – has long circulated within the crypto communities. The tactics are reportedly aimed at triggering panic sales and thus allowing so -called whales to accumulate positions at more favorable price levels.

Prominent trader pentoshi (@pentosh1) offered a short but pointed reaction and highlighted how ETH has Underperformed relatively bitcoin (BTC) Over the past three years: “3 years shakes out so far. Hope you are right. “

The question of why whales would exclude ether in particular was aroused by the community member Evmaverick392.eth (@Evmaverick392): “Maybe I sound naive, but why do whales perform this maneuver exclusively on ether?”

Lubin responded by drawing a parallel with conventional bank robbery and proposing that the latest wave of anxiety surrounding the Ethereum ecosystem has made access to a primarily goal: “Why do bank robbers rob banks – or used to? The (unjust) fud against Ethereum ecosystem is currently most pronounced. “

At press time, ETH acted to $ 2,704.

Featured image created with Dall.e, chart from tradingview.com