The latest information on the chain shows that Bitcoin network activity has subsided in recent months, with the blockchain meter that reaches a new low recently.

Why does the Bitcoin network activity fall?

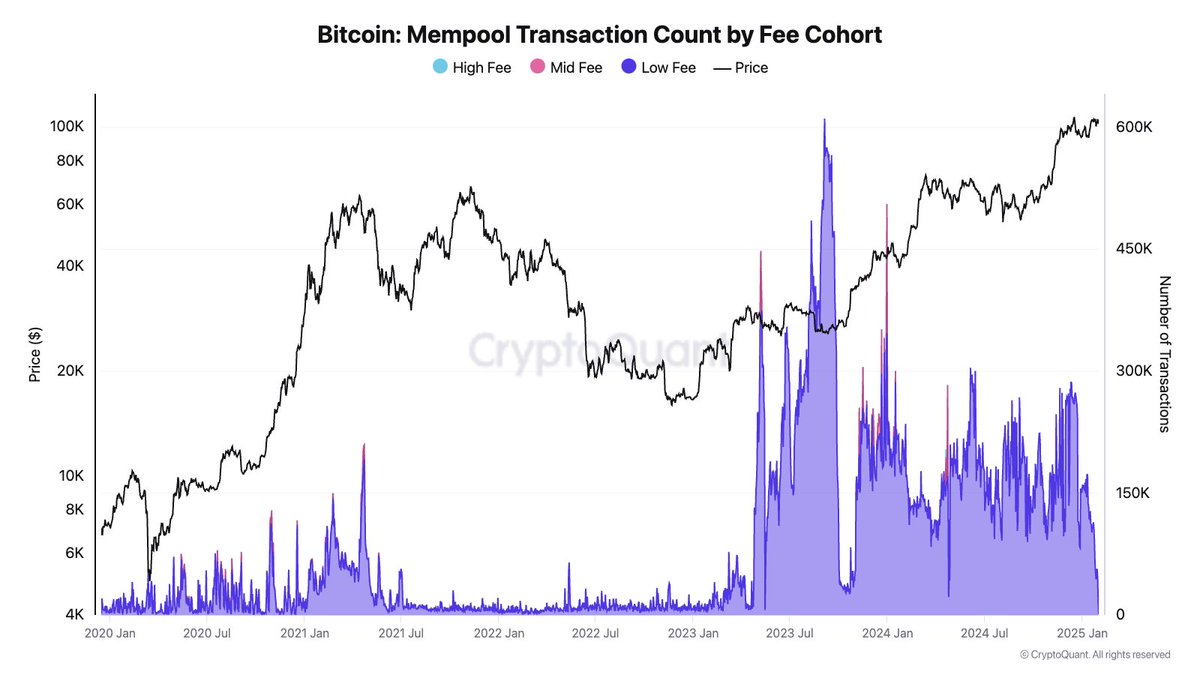

In a new post on the X platform, Kryptoquant Research Manager Julio Moreno discussed How Bitcoin witnesses an unusual period with low transaction activity, with Mempool almost empty and transaction fees fall to 1 SAT/VB. This represents the lowest level of network activity since March 2024, which indicates a remarkable decline in demand for the chain.

For context, Mempool refers to a temporary storage area where ongoing Bitcoin transactions await treatment. The Mempool usually remains overloaded during periods with increased demand for the chain and network activity. However, new information on the chain shows that most transactions have been confirmed, leaving Mempool almost empty.

Source: JJCMoreno/X

An almost empty Mempool is a rare phenomenon that is often associated with diminishing activity on the chain or varying market dynamics. According to Moreno, the largest contributor to this decline is the fading tension around runes and BRC-20 symbols.

Runes and the BRC-20 token standard are protocols that enabled the creation and minting of fungal and non-fungal tokens on bitcoin blockchain. While these protocols met with significant hype at launch, the first voltage did not transmit long -term use.

Source: JJCMoreno/X

However, at the top of the runes and the BRC-20 Frenese, the number of confirmed transactions on the Bitcoin network crossed 1.5 million milestone in a single day. Specifically, Pioneer Blockchain treated over 1.6 million unique transactions between senders and recipients on April 23, 2024, with the launch of Bitcoin Runes that plays an important role.

The decline in the number of transaction has broader consequences for various components of pioneer blockchain, including mining revenue. Miners rely on transaction fees as another source of income, especially since block rewards have been further cut since the last halving event. Consequently, a longer period of low fees can affect mining, which can potentially affect the network’s hash interest rate.

Implications on BTC price

An almost empty mem pool and low transaction activity are not exactly the best combinations for positive price measures. Specifically, it may propose low speculative interest and reduced investors’ enthusiasm, leading to a Consolidation of Bitcoin price.

From this writing, BTC is valued at about $ 100,450, with an almost 2% decline over the past 24 hours. According to Coingeko data, the main Cryptocurrency has lost approximately 3.5% of its value over the past seven days.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView