Key dealers

- Bitcoin fell 1.3% after the US inflation data exceeded expectations.

- The Federal Reserve can maintain a restrictive policy attitude due to increasing inflation problems.

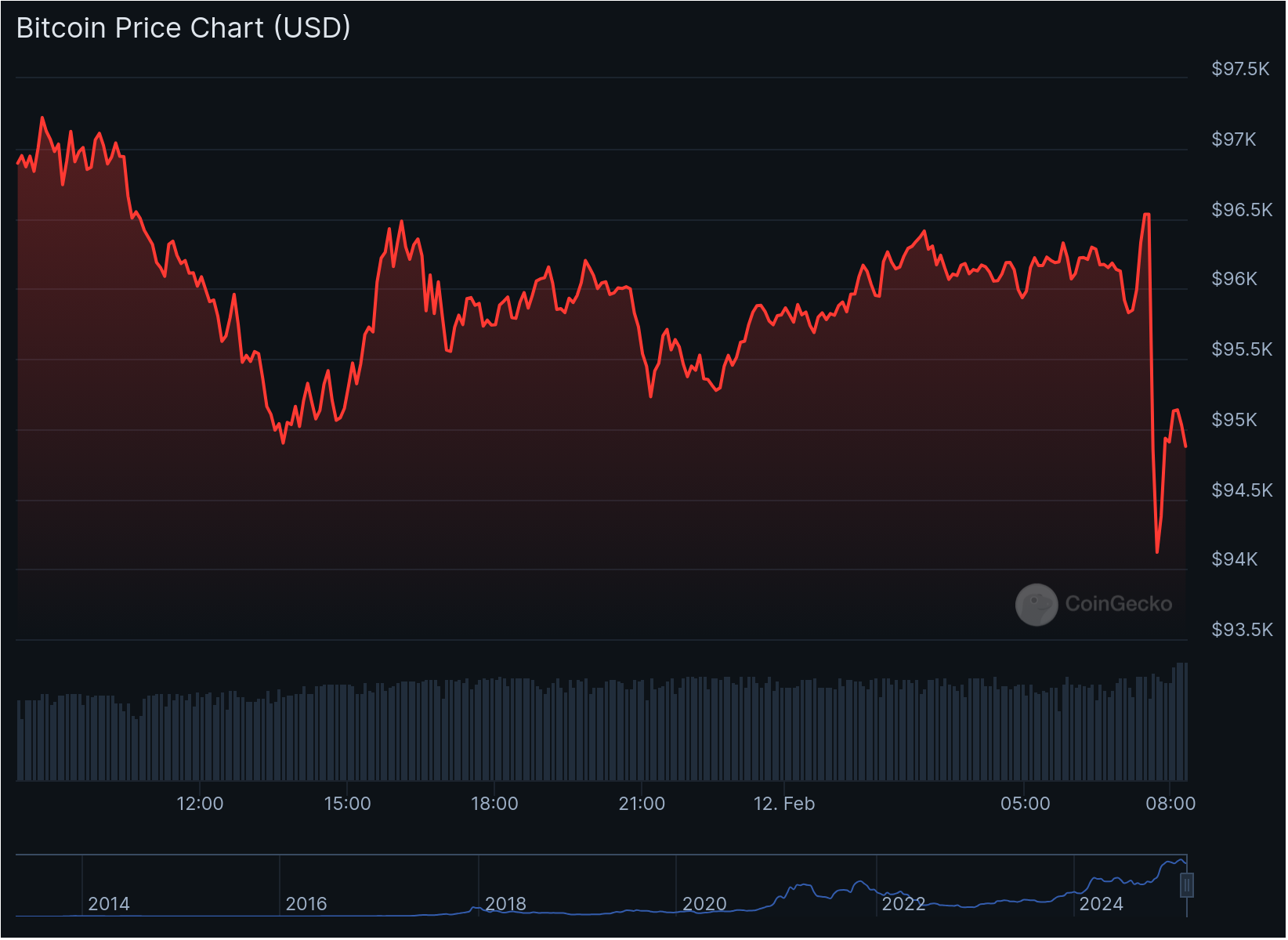

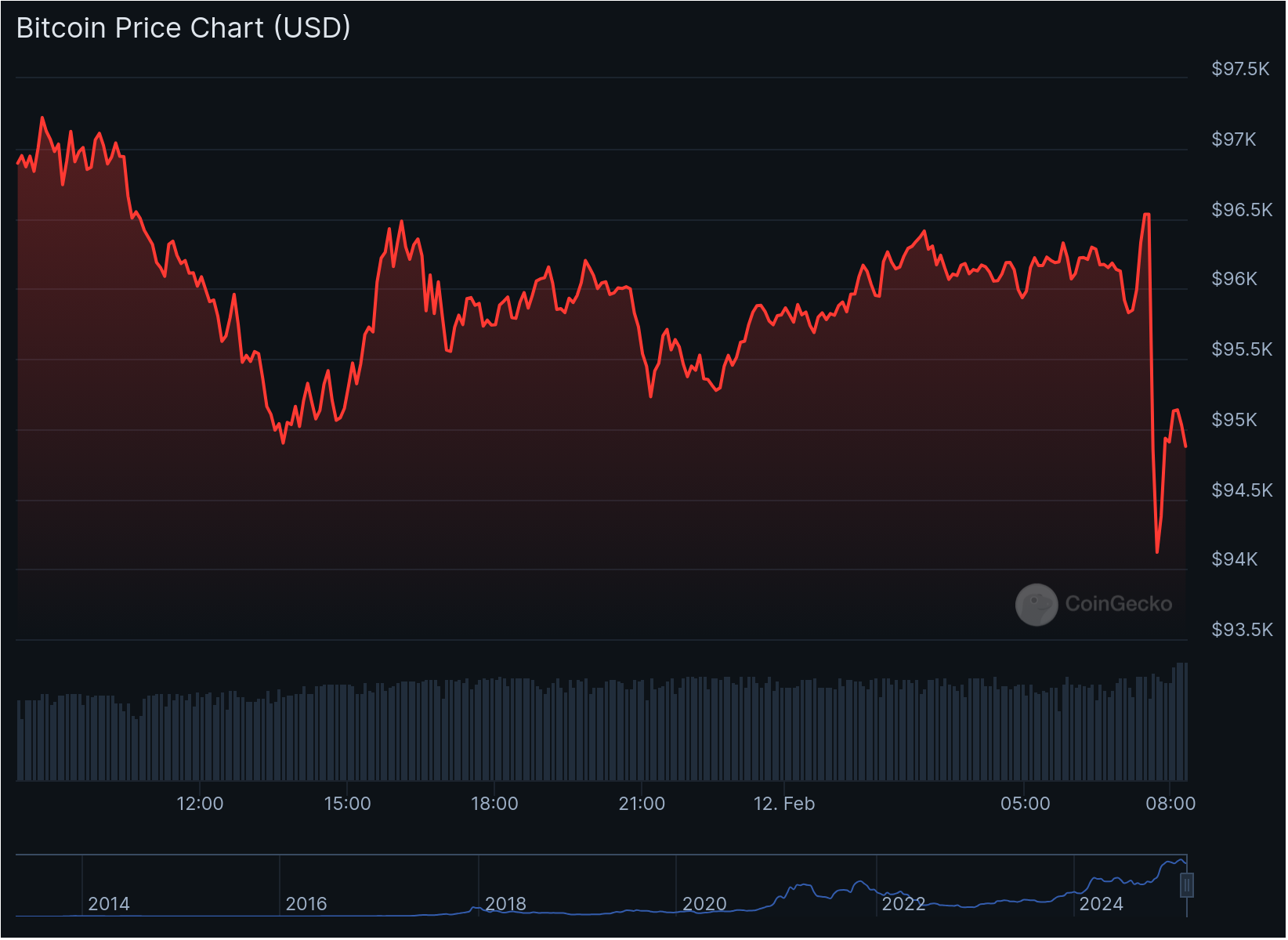

Bitcoin fell to a low of $ 94,081 after the US inflation data for January came in beyond expectations, with Consumer Price Index rises 3.0% Economists’ forecast from year to year.

Nuclear inflation, which excludes food and energy prices, increased 3.3%and exceeded the estimated 3.1%. The higher than expected figures triggered to sell over crypto markets, with altcoins also decreased.

The inflation report follows the Federal Reserve Chairman Jerome Powell’s testimony to the Senate Bank Committee, where he emphasized a measured strategy for monetary policy.

“Since our current political attitude is considerably less restrictive than before and the economy remains robust, we do not need to rush our political adjustments,” Powell said.

Powell claimed that there was “no urgency” to lower interest rates while confirming the Fed’s inflation target of 2%.

During the hearing, Senator Elizabeth Warren demanded for interest rate cuts at the meeting in March, with reference to concern about potential economic damage from continued monetary sharpening.

The heading CPI reading increased from December 2.9%, suggesting that the Federal Reserve can retain its restrictive political attitude longer than previously expected.

Bitcoin, often seen as a hedge against inflation, has struggled to maintain that story in recent months.

The crypto market remains very sensitive to US financial data and Federal Reserve Policy.

With inflation that is still going hot, the Fear & Greed Index returned to the “Fear” zone today after the recovery that in recent days saw.