- Micro Strategy aims to collect $ 2B to finance BTC purchases.

- Micro Strategy Bitcoin Holdings could soon hit 500K BTC; Will it increase MRST again?

Strategy, former micro strategy, plans to raise $ 2B in capital through convertible notes to facilitate its bitcoin acquisition.

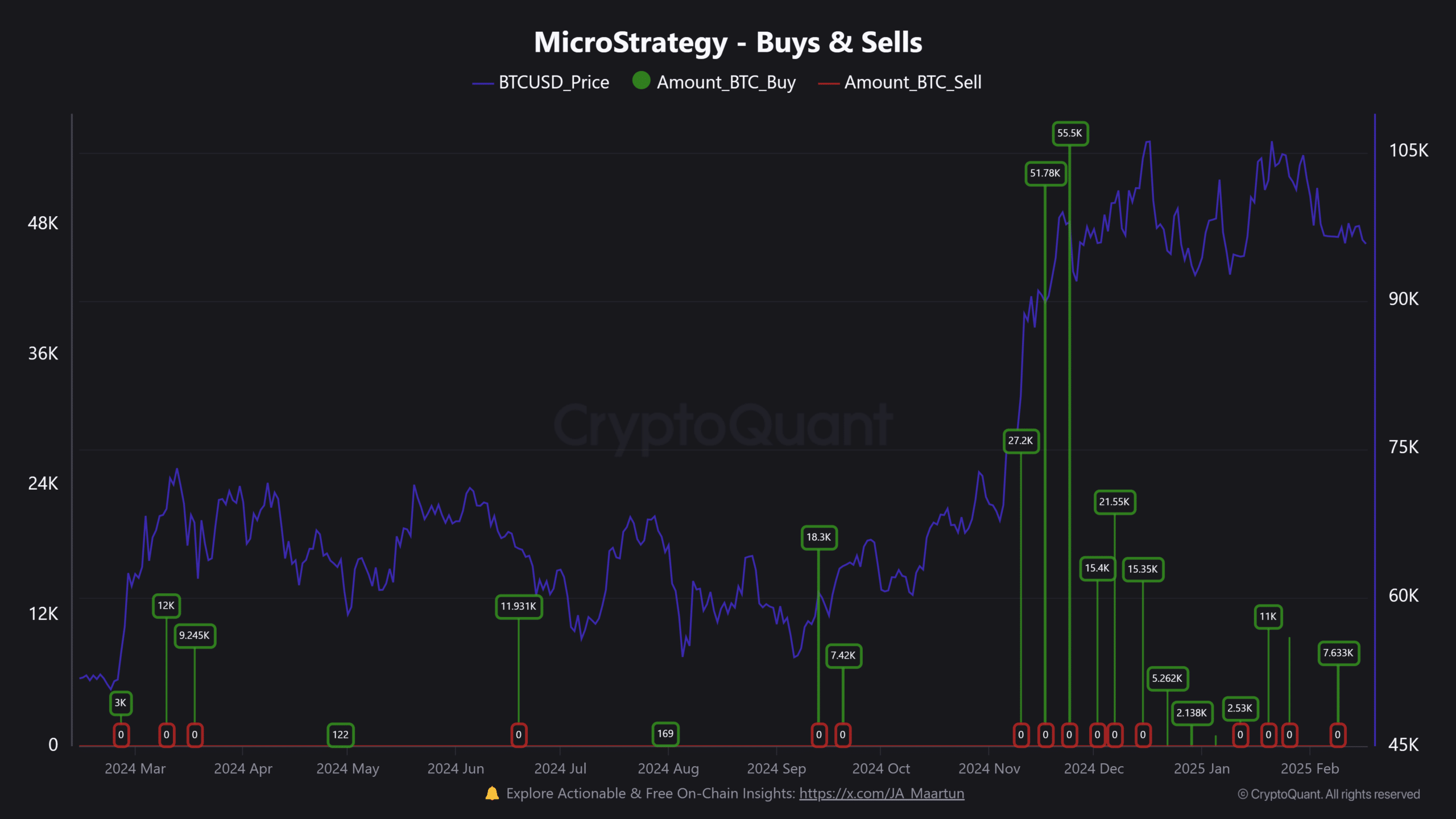

In 2025, the pioneer in BTC Corporate Treasury strategy made five bids (over 30k BTC), which provided its total holding to 478740 BTC. That’s $ 46.15 billion in BTC stash based on current market prices.

Micro Strategy Eyes 500K BTC Holdings

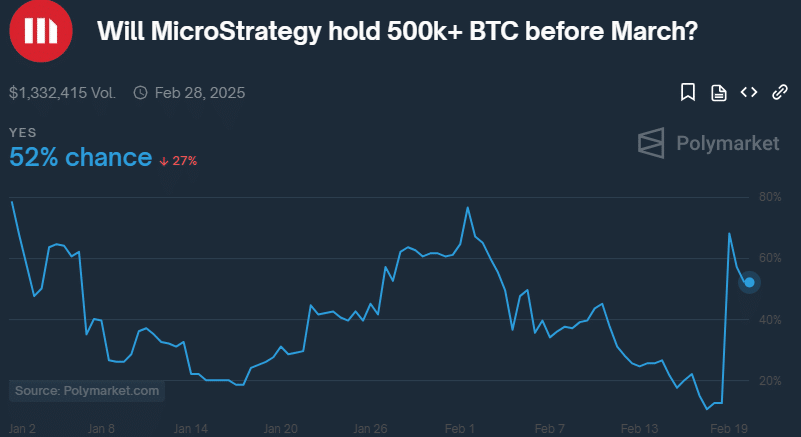

The latest plan to raise capital for additional BTC purchases would increase the company’s holding to 500K BTC before March. However, from this writing, the market seemed uncertain about such a result.

Prediction Site Polymarket priced 53% chance of the company hit $ 500,000 BTC target at the end of February.

This was after a peak to 80% when the $ 2B increase was announced, which indicates that speculators were 50/50 on strategy -Stash growth to 500K BTC within a week.

Source: Poly market

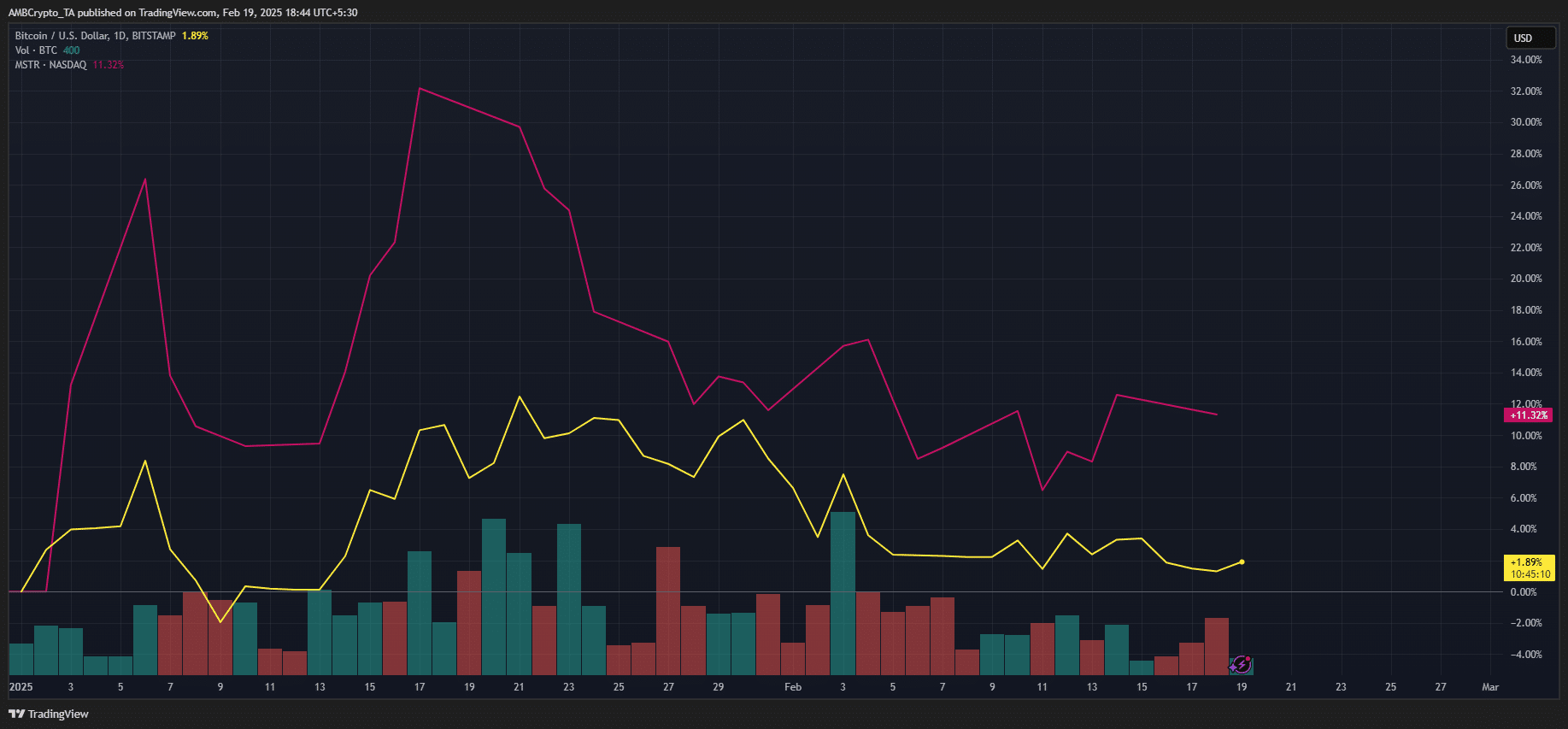

That said, MRST was reduced by 16% from the end of January and was valued to $ 333 at press time. But macro analyst Felix Jauvin projected The $ 2B capital increase the micro strategy can mark BTC’s local bottom.

During the same period, BTC has lost 12% from the latest heights and acted at $ 96,000. This emphasized that BTC performed moderately well under the current marketing entry.

But on an YTD basis, MRST logged a profit of 11% in 2025 compared to BTC’s 1.9%.

When they zoomed to a Yoy (year to year), MRT increased 373% compared to BTC’s 85%. Simply put, the stock was still a BTC beet, thanks to the micro strategy’s huge holding on Cryptocurrency.

In fact, MSTR was one of the top performing American shares, given its BTC strategy. Whether the star performance will be repeated during Q4 2025 remains to be seen.