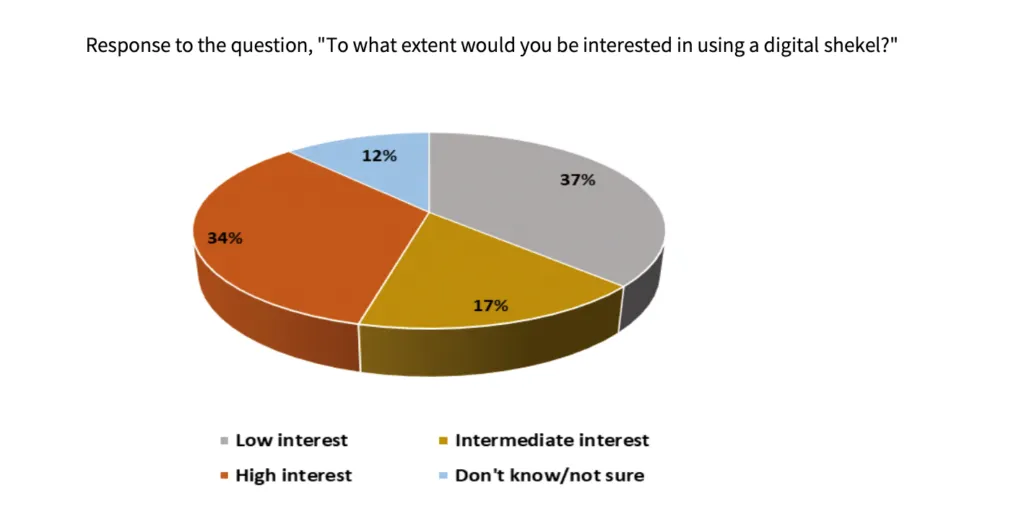

One of three Israelis has a great interest in a digital Sikel, a new study of Israel’s bank (Boi) has found.

With the title “Public’s willingness to adopt a digital Sikel”, Report Found that another 17% of respondents have an intermediate interest in Central Bank Digital Currency (CBDC). 37% of respondents reported low interest, while the rest were uncertain.

Boi has explored a digital Sikel For several years now, but it has not yet undertaken to develop one. In a report from 2023, the Central Bank stated that it would be more prone to issue a digital currency if the EU or the US launched theirs. With Trump rising to the Presidency of the United States, That ship has sailedat least for now, but the EU is still on its way to Start a digital euro.

In Israel, older citizens were the most interested in CBDC. Two out of three respondents aged 60 expressed high interest, with only 43% interested in the age group 18-29. The latter demographics were the only one where those with low interest were more than those very interested.

Male defendants with higher income and non-university graduated registered higher interest rates than their counterparts.

Interest was also particularly higher among Israelis that owned digital assets of 69.5%, compared to 50% for those who had never interacted with digital assets. This contrasts with the story from ‘crypto bros“That digital assemblies are overwhelmingly opposite CBDCs, which they consider as a trick of the government to spy on their people.

Israelis want a CBDC that pays interest

Fast, practical and effective payments were the most quoted benefit of a digital Sikel, even though over 87% of the country’s payments were digital. Accessibility, a better alternative to cash and “Can’t We Lost” is also ranked high.

As a developed nation where most citizens have access to banking services, Israel’s CBDC has not been aimed at economic integration. However, the central bank has proposed Pay interest At Digital Shekel Holdings to the Public, an Oortodok’s strategy that commercial lenders have severely opposed.

The study showed that although the lenders may oppose this approach, it has steadfast support from consumers. “Opportunity to get interest at an interest rate of 3.5% on your balance” was only second to the protection against fraud as the function that most Israelis is about a CBDC.

Other features that are important for Israelis include Offline paymentszero fees for basic functions, universality and acceptance and Programmable payments. Some respondents also demanded that there was no holding limit for digital sikelen. This would be yet another deviation from the global norm, where central banks have proposed to keep caps to prevent the commercial bank’s disinterfi.

Cyberattacks, slow transactions and difficulties Using CBDC were the most quoted disadvantages.

Hong Kong’s digital asset embrace continues

In Hong Kong, the city state’s securities watchdog expands its embrace of digital assets, Green Lighting new products this year.

Securities and Futures Commission (SFC) revealed That it would start a new license regime for trade without a disk to increase market efficiency. It also intends to expand its licensing for custody services and reviewing its rules on derivative trade and marginal financing options.

Hong Kong has emerged as a global leader in digital assets, with its enabling laws that attract some of the world’s largest players. The latest is Global Exchange Bullishwho received a license on February 18 to serve as a virtual trading platform.

“We believe that clear regulation is crucial to promoting confidence in the digital asset industry, and we will continue to invest our efforts to expand the compatible and regulated environment that Bullish Exchange has offered our customers and channel partners from the first day,” commented CEO Tom Tom Farley.

Despite the leap, SFC believes that its regulatory regime is still “restrictive in scope”, said CEO Julia Leung on February 19.

“We have to think about how we will provide a regulation for growth that enables responsible innovation,” she abandoned during a digital asset conference held in the city.

Look: Find ways to use CBDC outside digital currencies

https://www.youtube.com/watch?v=1la33ikf8ou title = “youtube video player” Framebord = “0” Allow = “accelerometer; Autoplay; clipboard writing; encrypted media; gyroscope; image-in-image; web-share” reference policy = “strict-origin-short-origin” allow of screen = “”>