Ethereum has experienced a massive case and reaches its lowest level since the end of November 2023. The entire market has been affected by extreme volatility, uncertainty and aggressive price swings, with ETH losing over 20% of its value in just hours. Investors are afraid that this correction may extend further as Ethereum struggles to regain important demand levels.

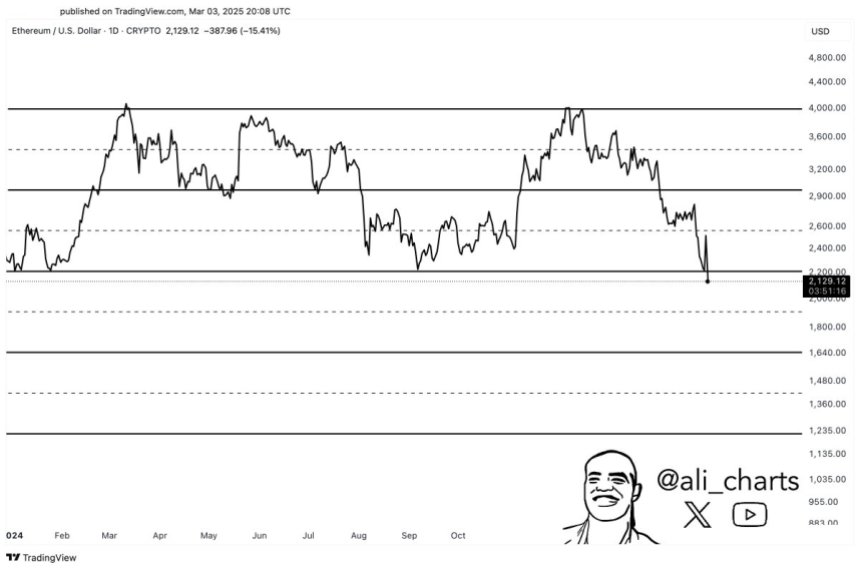

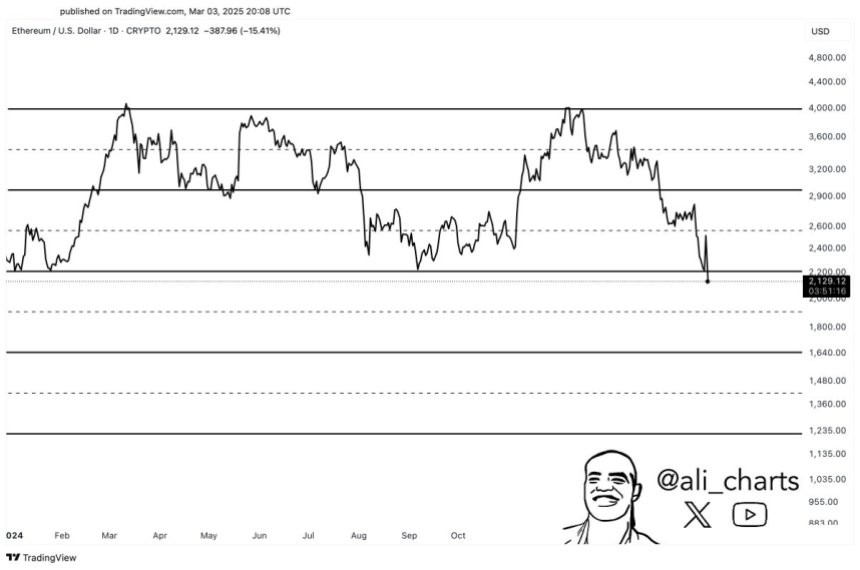

Analysts carefully monitor Ethereum’s price measure, as the next few days can determine the short -term prospects for the second largest Cryptocurrency. Top analyst Ali Martinez shared a technical analysis on X, which indicates that Ethereum is about to break out from a parallel channel to the disadvantage. If this pressure under the $ 2000 mark occurs, ETH can be set for a deeper correction before any recovery attempts.

Ethereum’s weakness causes concern about the wider crypto market, as altcoins have also been hit hard during this latest sale. Sentiment remains Baisse and traders are waiting for confirmation of whether ETH will regain strength or continue to fall towards lower demand. The upcoming trading sessions will be crucial to determining whether Ethereum can hold over critical support or if further disadvantage is inevitable.

Ethereum is facing more neck risk

Ethereum’s price measure has been overwhelming as the wider crypto market is struggling to find stability. Despite short rally and sharp reductions, ETH has failed to create a clear trend, which has left investors uncertain in its future direction. Access has been stuck in a long -term downward trend, consistently sets new lowness and reinforces the Baisse feeling throughout the market.

Currently, Ethereum is traded at bear market prices with little or no signs of a sustainable recovery. When the market structure is weakened, many investors expect ETH to fall further. Analyst Martinez has marked One regarding development and notes that Ethereum seems to break down from a parallel channel that has contained price for months. ETH may be on the right track for a strong movement towards $ 1,250, a level that would signal a deeper market collapse.

A case to $ 1,250 would not only strengthen Ethereum’s Baisse view but also serve as a key signal for a wider market distribution. This scenario can lead to panic that sells across the line, drawing other large assets lower and confirms an extended bear market. Despite temporary price swings, Ethereum remains at a critical time, with bulls struggling to regain important levels of support. Unless ETH can recover lost land and establish a strong support base, the risk of the further disadvantage remains high.

Since Ethereum does not show strength among market vollatility, investors remain cautious and anticipate lower price levels before any meaningful recovery can take place. The coming days will be crucial to determining whether ETH can stabilize or whether Martinez’s target of $ 1,250 will become reality, which confirms the baisse -like prospects for the entire crypto market.

ET —testing Critical Demand Level

Ethereum is traded at $ 2,090 after a period of weak price measure, which marks a decline of 30% since February 24. This significant reduction has left investors questioning whether ETH can retain its long -term hausse -like structure or whether a deeper correction is imminent.

At present, Ethereum is at a critical support level that must hold to maintain all hope for a haus article. A division below this level would probably confirm a bear market scenario and drive ETH towards lower price levels when sales pressure intensifies. The uncertainty surrounding Ethereum’s price measure has left trader cautious, as further weaknesses can speed up the decline.

However, a recovery remains possible if ETH can recover the resistance level of $ 2500. Such a movement would signal renewed shopping moments and can lead to a strong recovery and possibly reverse the latest baisse trend. If Ethereum manages to turn $ 2500 into support, it would indicate renewed confidence in access and set the scene for higher prize goals.

At the moment, all eyes are on Ethereum’s ability to defend $ 2,090. The coming days will be crucial to determining whether ETH can stabilize or if the market is on its way to a more long -lasting baiss phase.

Featured Image from Dall-E, Chart from Tradingview