- Moving gained massive speed across the market because open interest and market volumes grew

Movement (movement)At the time of writing, was among the best winners on the market after collecting over 7% over the past 24 hours. Thanks to the same, its weekly gains climbed to over 17.9% on the lists.

Therefore, the marketing position seemed to be Hausse because of it. However, Ambcrypto’s analysis revealed that bears are still active and that they are investing in Move’s decline in the short term.

A flash of hausse -like signals

Movement (move) Performance, over the past 24 hours, has been very impressive. Its price increase, despite the broader market decline, has largely been driven by buying activity in the derivative market. Especially when open interest and the volume of purchases increased.

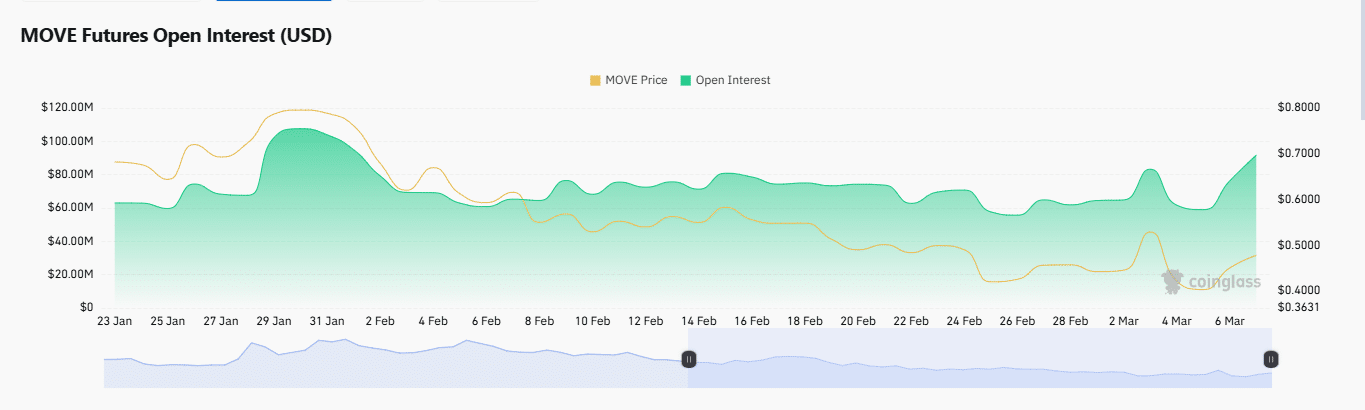

During this period, Interest– Known to represent the amount of unsolved derivative contracts on the market – is praised with 17% to $ 95.36 million. This indicated that more contracts were opened. Ambcrypto analyzed other important measurement values to determine whether purchases or sales contracts dominated.

Altcoin’s Roof-buy-sale ratio confirmed that purchase contracts were likely to dominate, as the volume of buyers considered sellers in the derivative market during the last 24 hours, with a reading of 1,027. A reading above 1 indicates that there are more buyers than sellers in the future market.

Similarly, Move’s total trade volume increased by over 300% during the said period and exceeded $ 700 million. Historically, a price increase is accompanied by a volume over voltage that buyers exceed sellers.

Warning Ahead – Move seller can take responsibility

However, despite the haus -shaped momentum, sellers in both derivatives and spot markets have gained traction lately.

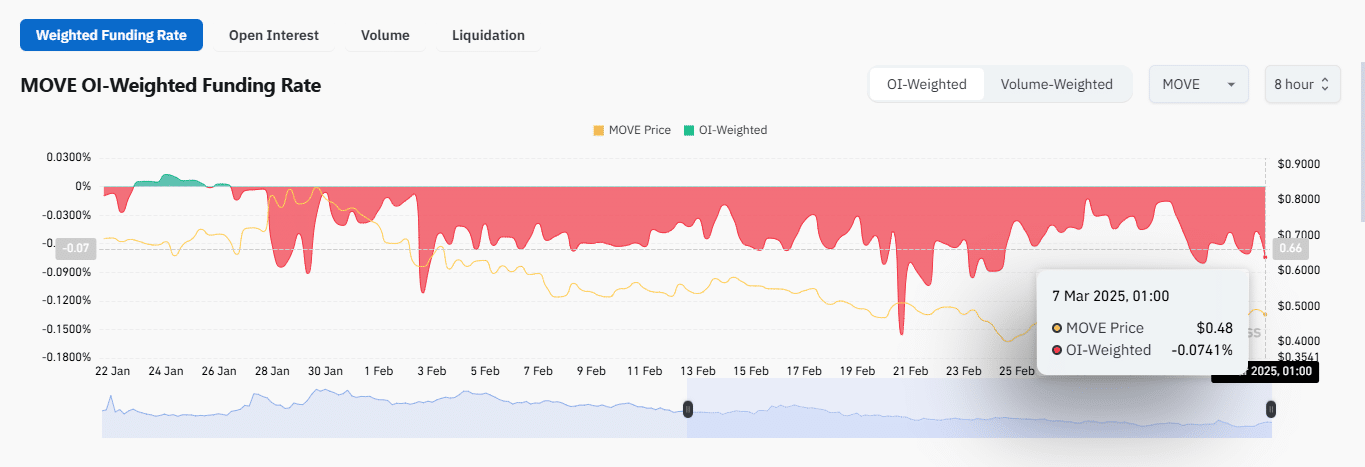

At the time of writing, Altcoin’s open interest -based financing rate had become negative. This suggested the presence of sellers on the market, despite its haus -like trends. Its Oi -weighted financing rate was in the -0.0741 -a significantly high negative figure that refers to a strong baisse -like feeling across the line.

In the market, the open interest -based financing rate is an important indicator of the feeling in the derivative market. Especially since it combines both open interest rate and the degree of financing to provide a more accurate measure of the market direction.

In the spot market, traders sold a total of $ 1.24 million in motion, which is determined by the exchange of Netflow. This sale can be simple profit or the beginning of a more significant decline.

Up or down? Move at a crossroads

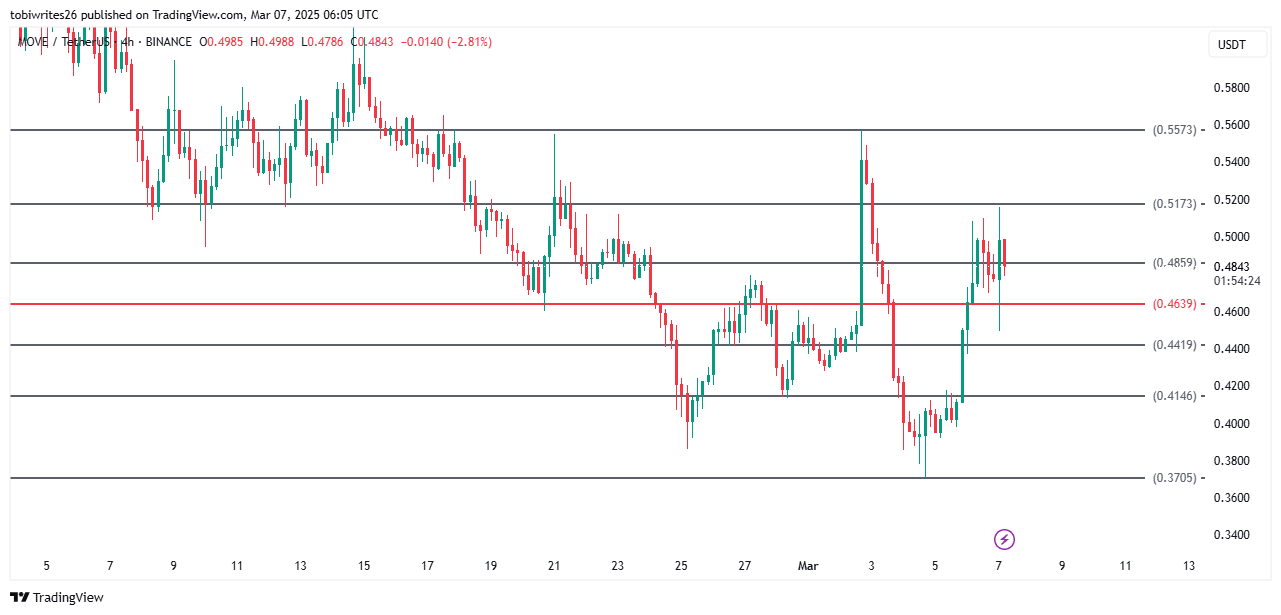

Movement (moving) is currently at a critical time. Using Fibonacci levels marked Ambcrypto key points on the chart.

If bears take control, a confirmation will come if Move’s current candlestick will be closed below the $ 0.4859 support level and will drop further, with the next stop of $ 0.4639.

But if the support level of $ 0.4859 holds, MOVE could see a bounce higher and potentially reach 0.5573 $. If haussearted momentum continues, the price can climb further.