- Cardano’s range since December has reduced all price expansion

- Support zone of $ 0.78 is likely to see a strong price bouncing against $ 0.9 next week

Cardano (there) Saw a prize of 72% on Sunday, March 2 on the back of the news that US crypto strategic reserve would include Kardano for. Since then, Ada has recalled most of its winnings on the lists.

At the time of writing, it was within a key support zone that would have been a resistance level in February. From a technical perspective, Cardano seemed to present swing dealers with a buying opportunity.

Cardano falls under the middle class support, but buyers should look for bid

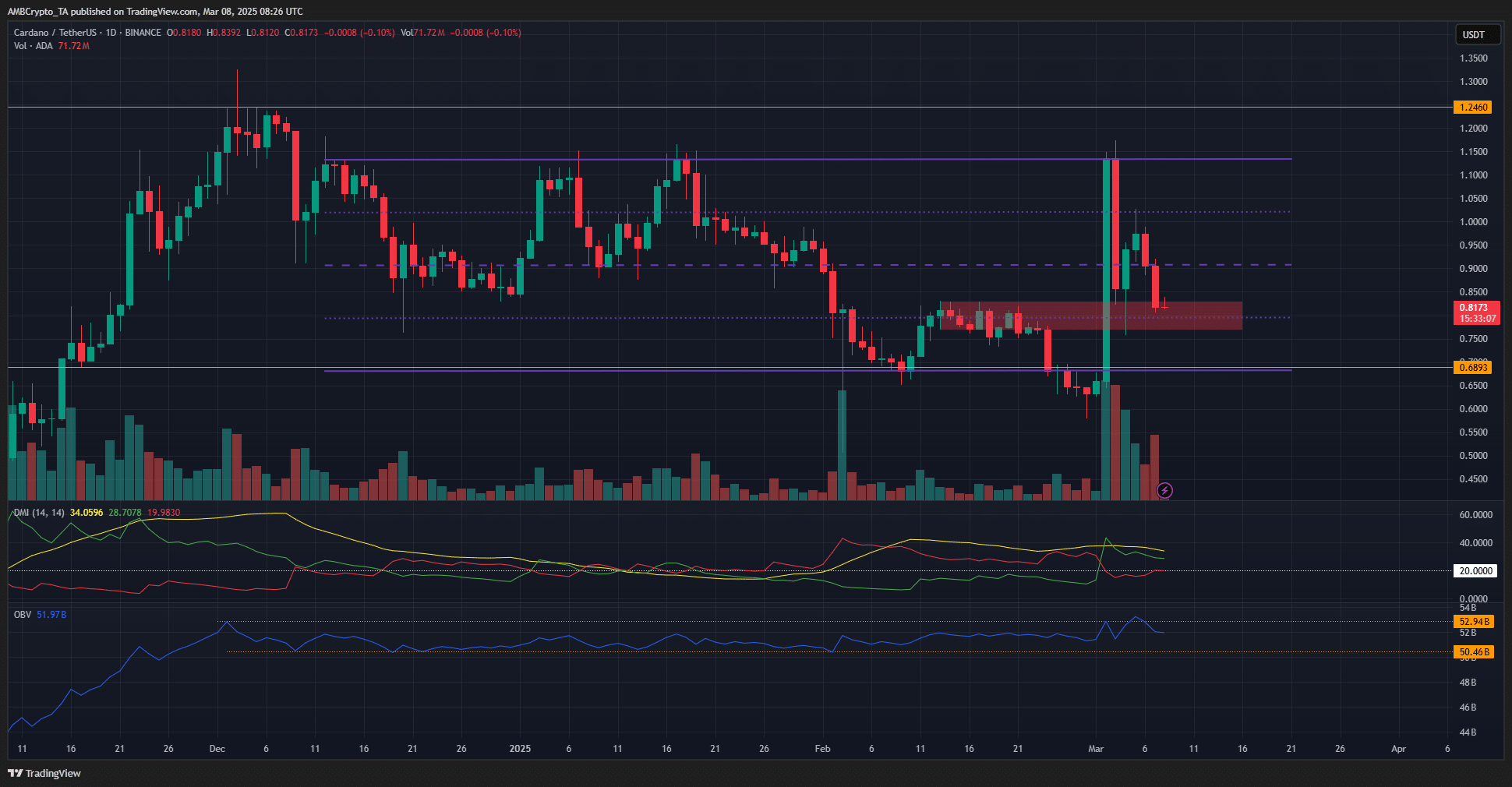

The strong pump last weekend meant that the market structure was Hausse. And yet the structure was not so important right now, given that Ada has been shopping within an interval (purple) since December. This was the fourth day of the last week that the price tested the demand of $ 0.8.

The directional movement index highlighted a strong ongoing trend, with both ADX (yellow) and +di (green) above 20. On the other hand, Obv would not yet break its reach.

The lack of persistent buyingress meant that Cardano can remain reach in the coming days or even the weeks. Here, the importance was that the last month’s resistance was tested as support also remarkable. Therefore, bulls would focus on a transition to $ 1.15- $ 1.2 next, with the interval high at $ 1.135.

Source: Tiled

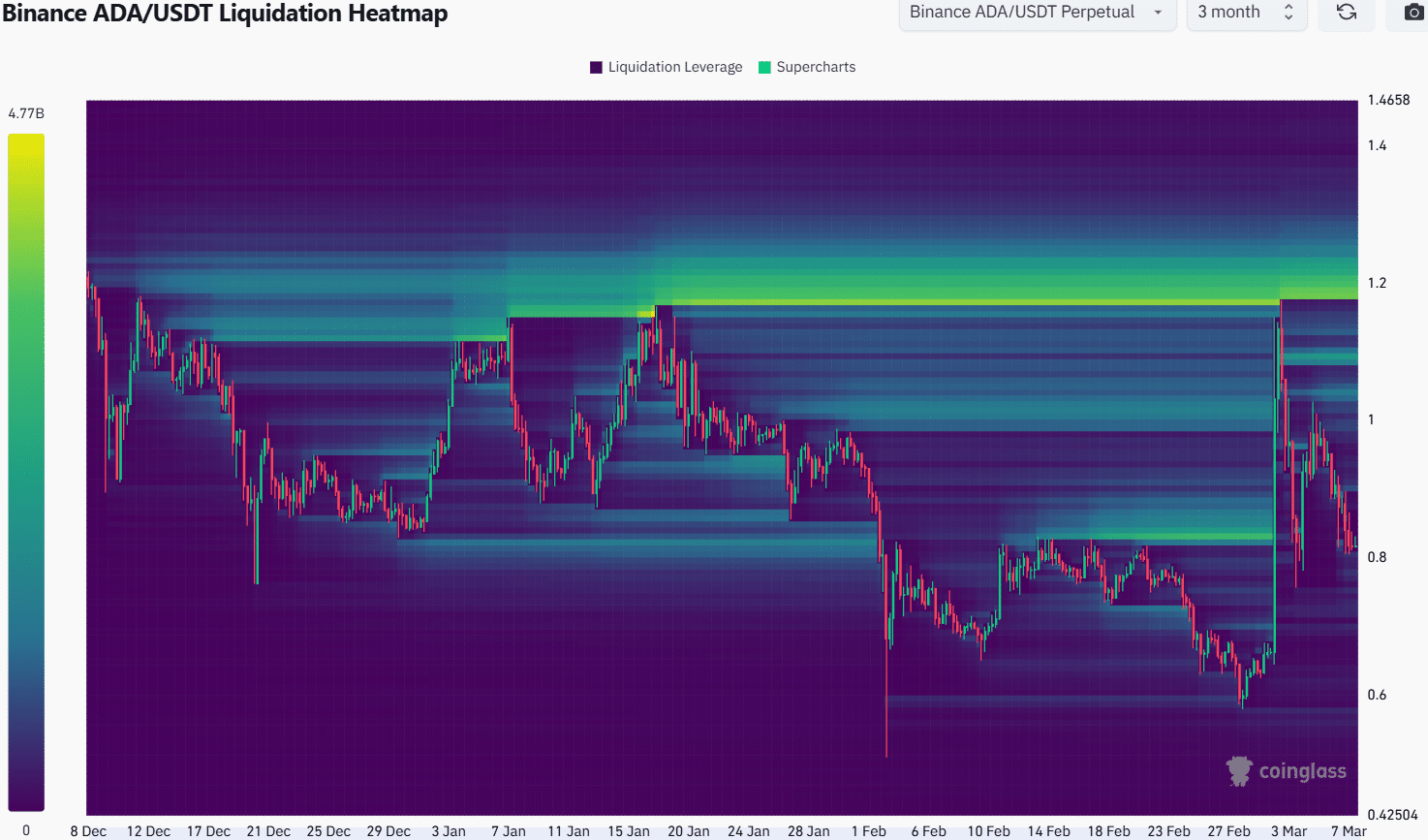

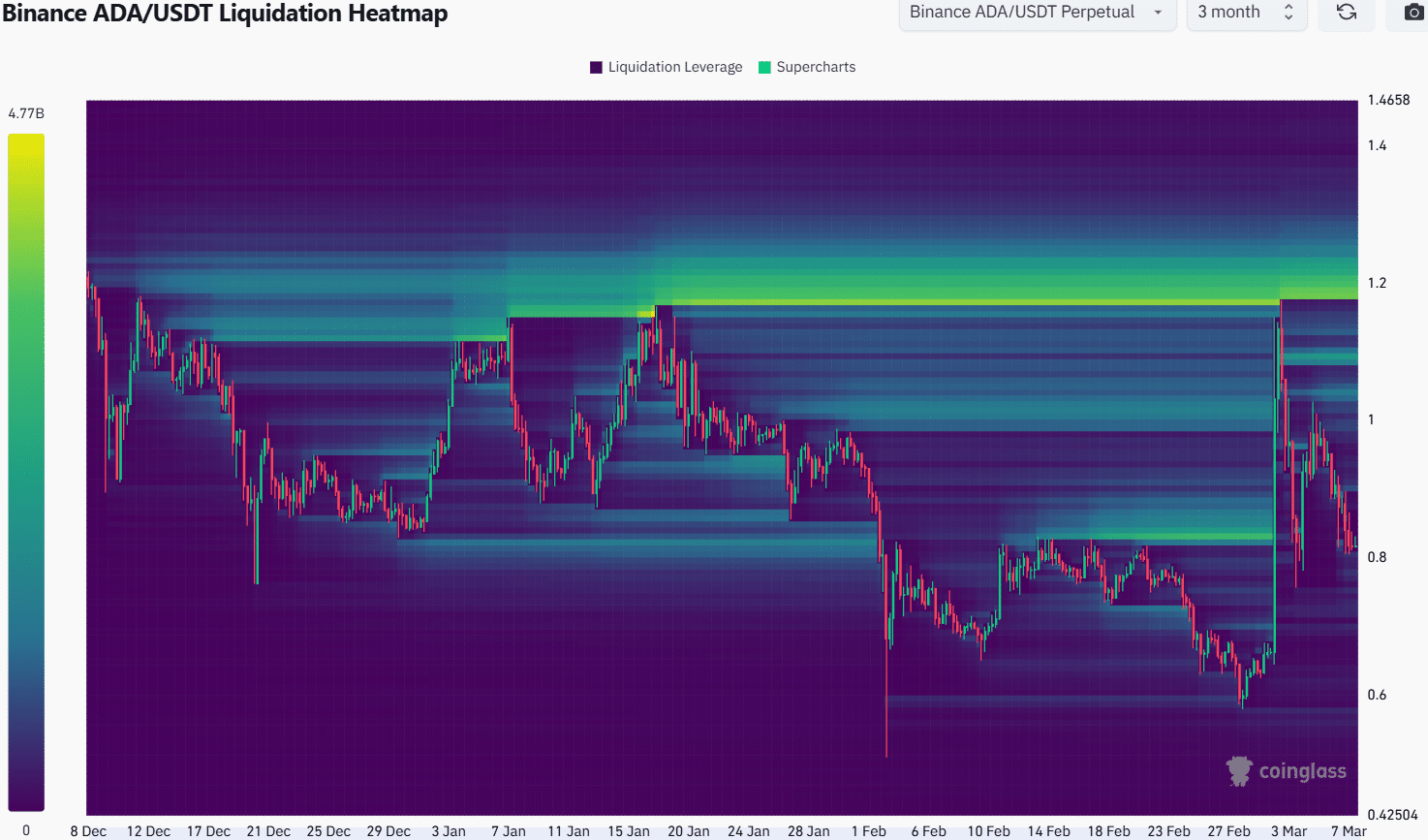

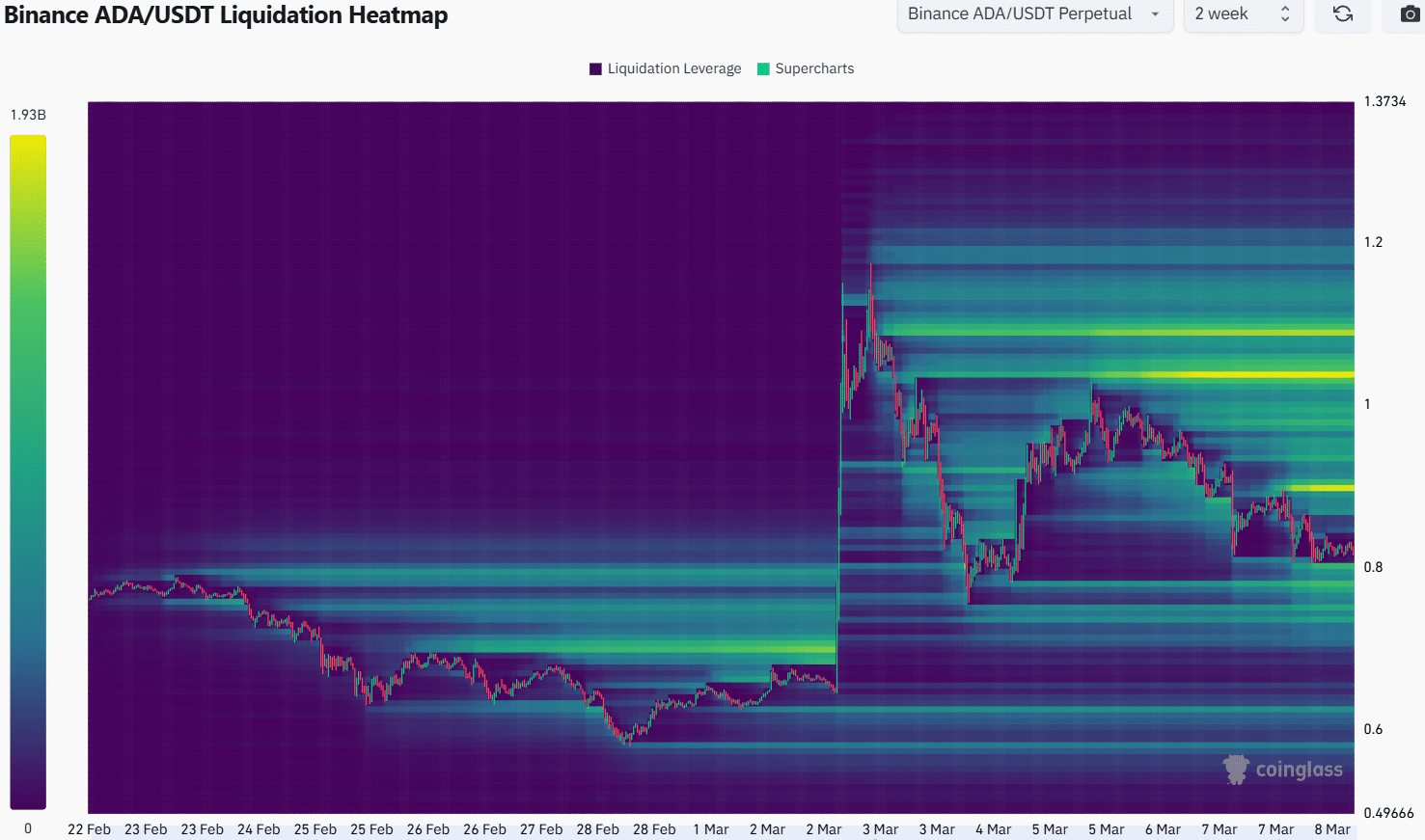

The 3-month liquidation heat map marked $ 1.2 level as the magnetic zone to look for. The density of liquidation levels here means that bulls may find it difficult to drive the price further north.

The liquidity cluster would probably attract prices to it, but is followed by a quick rejection. This has been the pattern since January. Alternatively, a strong momentum movement may drive a liquidation cascade, but the volume of purchases has so far been absent.

Source: Tiled

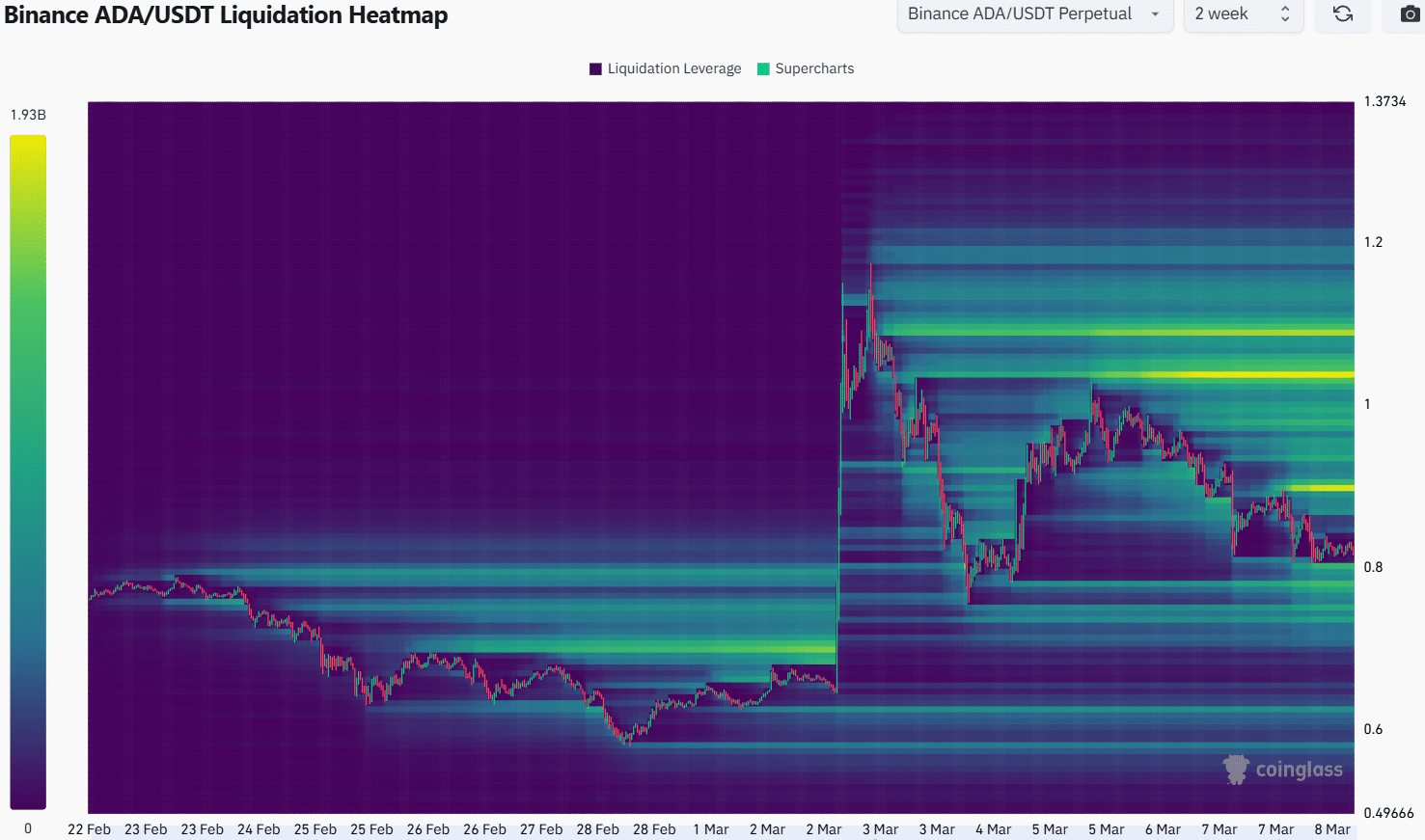

The 2-week liquidation heat map described other threats against Ada Bulls, except $ 1.2. The closest, relatively tight liquidity pockets were $ 0.78- $ 0.8 and at $ 9. Therefore, it can be expected that a transition to $ 0.78 would probably be followed by a strong bounce to $ 0.9.

Additional gains would be dependent on volume, feeling and condition on the rest of the market, especially Bitcoin (BTC).

Disclaimer clause: The presented information does not constitute financial, investment, trade or other types of advice and are the author’s opinion solely