Key dealers

- Franklin Templeton has applied for an XRP-focused ETF with Sec.

- The proposed XRP ETF aims to track the token’s price performance and will shop on the CBOE BZX exchange.

Chicago Board Options BZX Exchange (CBOE) has submitted a 19B-4 form On behalf of Franklin Templeton, which proposes a rule change to list and trading shares in Franklin XRP ETF in the United States.

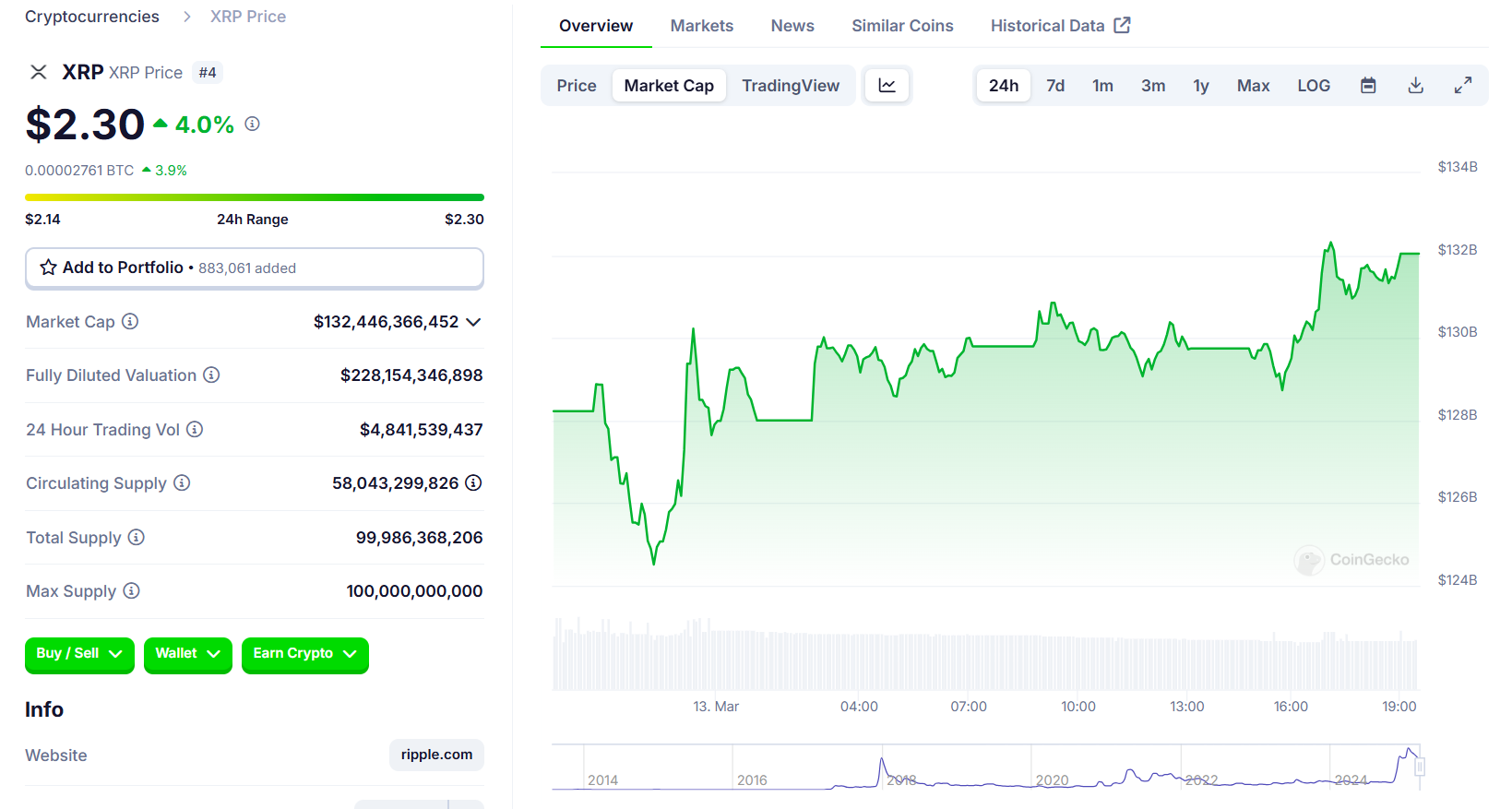

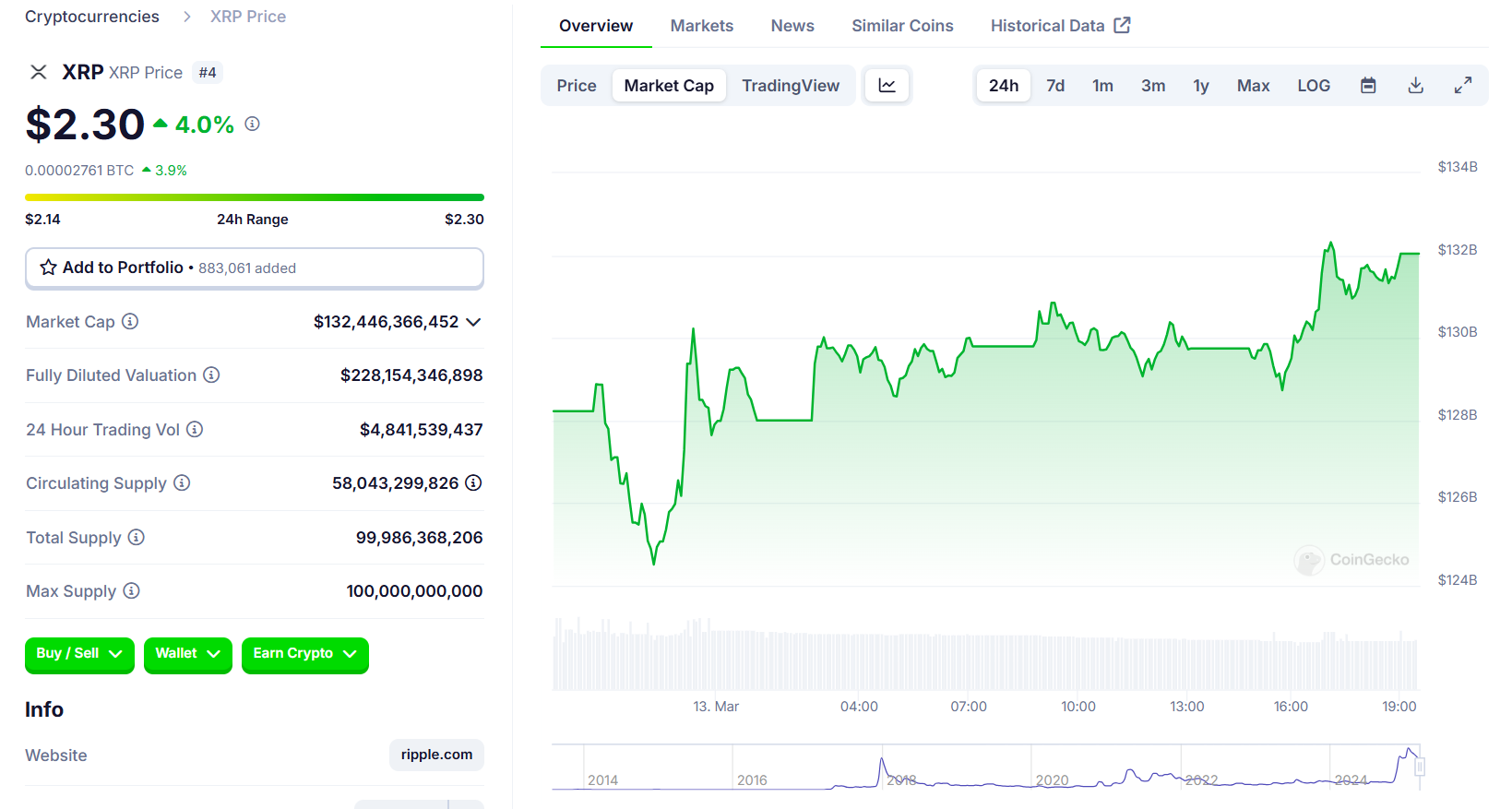

Registration came shortly after Franklin Archived an S-1 Registration form with SEC for its proposed investment product focused on XRP, the fourth largest crypto supply through market value. The digital asset increased by $ 2% to $ 2.3 after the SEC archiving pops up, according data.

The leading asset manager, who monitors $ 1.6 trillion in customer assets, has joined a growing list of large companies that seek approval for ETFs that are bound to crypto assets in addition to Bitcoin and Ethereum.

The proposed Franklin XRP ETF will shop on the CBOE BZX exchange with coinbase custody that serves as custodian for its XRP holdings. The fund aims to track XRP’s price performance and offers investors exposure to digital asset without requiring direct custody.

The registration follows Franklin Templeton’s latest expansion to Crypto ETFs, including a Solana ETF archiving and has previously launched Spot Bitcoin and Ethereum ETFS. Other companies waiting for legislative approval for XRP ETF suggestions include Bitwise, 21 Shares, Canary Capital, Grayscale and Wisomtree.

ETF -analyst James Seyffart noted that although delays are standard procedure, there are “relatively high odds for approval” for these altcoin ETFs in October 2025.