- Bitcoin goes closer to a high effort. A massive $ 332 million short at 40x leverage is on the line.

- Is a liquidation -controlled squeeze incoming?

While the market takes a breath placed a trader a very leverage 40x Bitcoin (BTC). The trader has risked an entire account of $ 8.3 million to open a position of $ 332 million.

Currently, Briefly Sits on an unrealized loss of $ 1.3 million, with a liquidation price to $ 85,290. With Bitcoin trading close to $ 83 245, the position hangs in a sensitive balance.

If Bitcoin shoots higher, a short press can drive an outbreak. But if bears defend resistance, a sharp back back can follow. However, the battle will not be easy.

Crossing this interval puts 699.2K BTC in focus, when profitable pressure is built. An important stakeholder pool that bought BTC at a top of $ 86,391 may be ready to raise money.

In order for bulls to take control, this liquidity on the sales side must be absorbed by strong demand. Unlike Bitcoin’s case to $ 78K – where 46K BTC flowed out and signaled strongly Spot needs – Its price level of $ 84,000 saw no such capital inflow.

This raises concerns about the buyer force, especially with short-term holders net unrealized profit/loss (sth-nupl) still in Capitulation zoneWhich means that many short -term holders remain underwater.

If BTC hits $ 85K – $ 86K, profit consent can be intensified, which causes some holders to surrender and break evenly rather than Hodl, which increases the sales pressure and risks a long clamp.

With supply that is likely to consider demand, this trader has placed the short around a critical resistance zone. If bears hold the ground, a return to $ 81,000 will be likely.

Volatility in Bitcoin -Terivate market

Despite Weak demandOpen interest rate (OI) increased by $ 2 billion in just two days, which signaled aggressive positioning in Bitcoin derivatives.

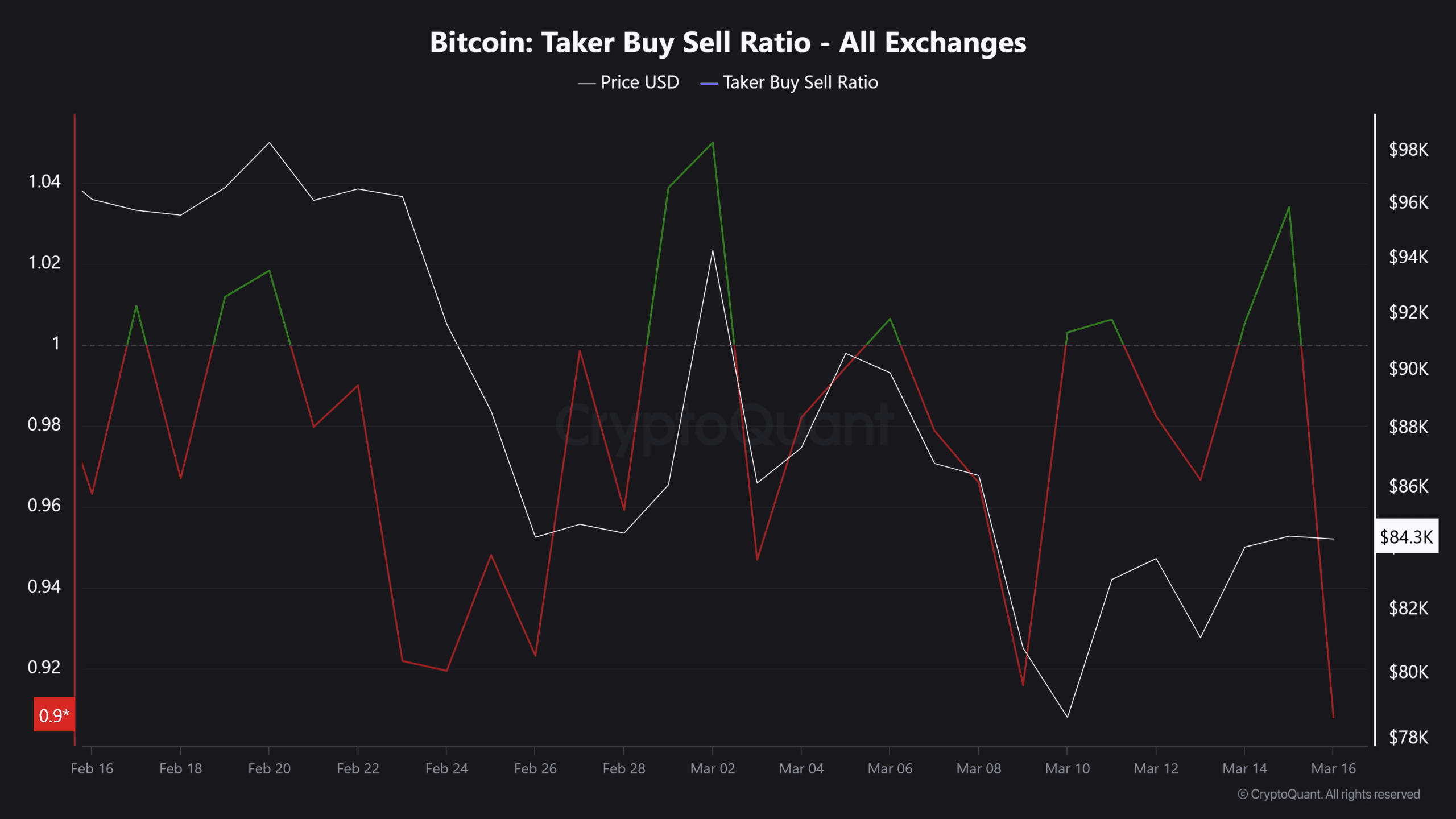

However, with the take-bay/sell ratio still below 1, the sales side continues to dominate in eternal markets.

This suggests that traders are a potential reversal, with many positioning for profit. If speed is weakened, a wave of Liquidations Or closures can reinforce volatility in the coming days.

In order to trigger a short press on the short position of $ 332 million and break the resistance of $ 85,000 – $ 86K, strong space and future needs are needed.

However, with the taker Buy/Sell ratio still below 1, Sell-Sage Dominance Signal’s Bearish Control.

If market conditions change, a short pressing can drive bitcoin higher. Otherwise, a return to $ 80k – $ 81,000 will remain a strong opportunity.