Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum (ETH) has been traded on its lowest levels since the end of 2023 and struggles to regain speed after a longer period of sales pressure. Since December 2024, ETH has lost over 57% of its value and failed to regain important resistance levels. With the broader crypto market facing macroeconomic uncertainty and persistent volatility, Ethereum’s down trend appears far from over.

Related reading

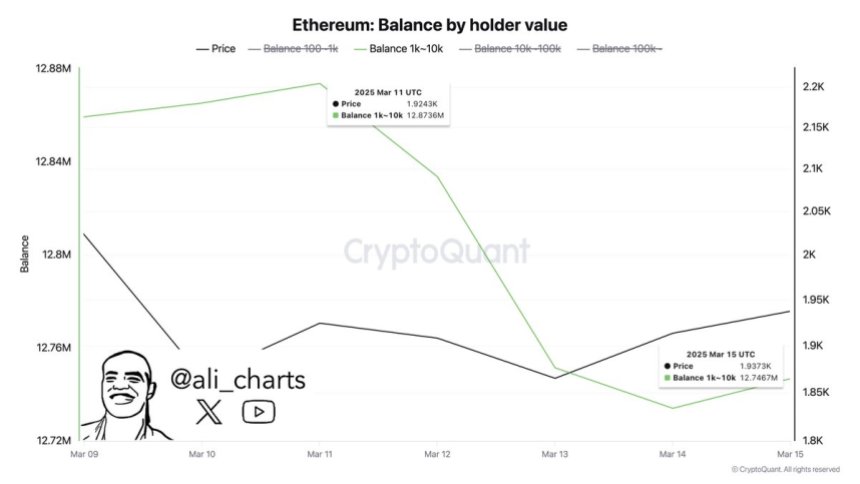

Despite the ongoing decline, data on the chain suggests that large investors can position for a recovery. According to Cryptoquant, whales have moved over 130,000 ETH exchanges over the past week, which signals a growing accumulation trend. This pattern has been developed since Ethereum began to downwards, which indicates that institutional players and long -term holders buy the dip pending future price estimates.

While Short -term feeling remains baisseyHistorical data shows that large valence collections often precede strong returns when sales pressure fades. However, ETH is still facing significant resistance, and bulls must recover key levels to confirm a potential trend change. With market uncertainty that is still struggling, the next few weeks will be crucial to determining Ethereum next big move.

ETHEREUM —THALLICAGATIONSWARE ATTENTION Optimism

Ethereum has been under massive sales pressure and fought in the midst of macroeconomic uncertainty and the trade war’s fear that has shaken both the crypto market and the US stock market. ETH is now acting under a multi -year support level, which can serve as a strong resistance in the coming weeks. If bulls do not recover important price levels, the stage can be set for a deeper correction.

But not all indicators are baisse -like. Despite the ongoing decline, some analysts remain optimistic about Ethereum’s long -term views. Top analyst Ali Martinez shared insights about xReveals that whales have moved over 130,000 ETH exchanges over the past week.

This is important as large investors usually move their holdings of exchanges when they plan to last in the long term rather than selling. When whales transfer ETH to private wallets, it often signals accumulation rather than immediate sales printing. Historically, such trends have preceded market reset collection, as reduced exchange supply can contribute to price stability and future upward potential.

Related reading

While Ethereum is still facing major obstacles, valence activity suggests that smart money positions itself for the next move. The next few weeks will be crucial to determine whether ETH can reverse its downward trend or if further reductions are in the future.