- Stablecoin reserves on derivative exchanges have increased.

- Until Stablecoin volume flows back to location, volatility is expected to remain.

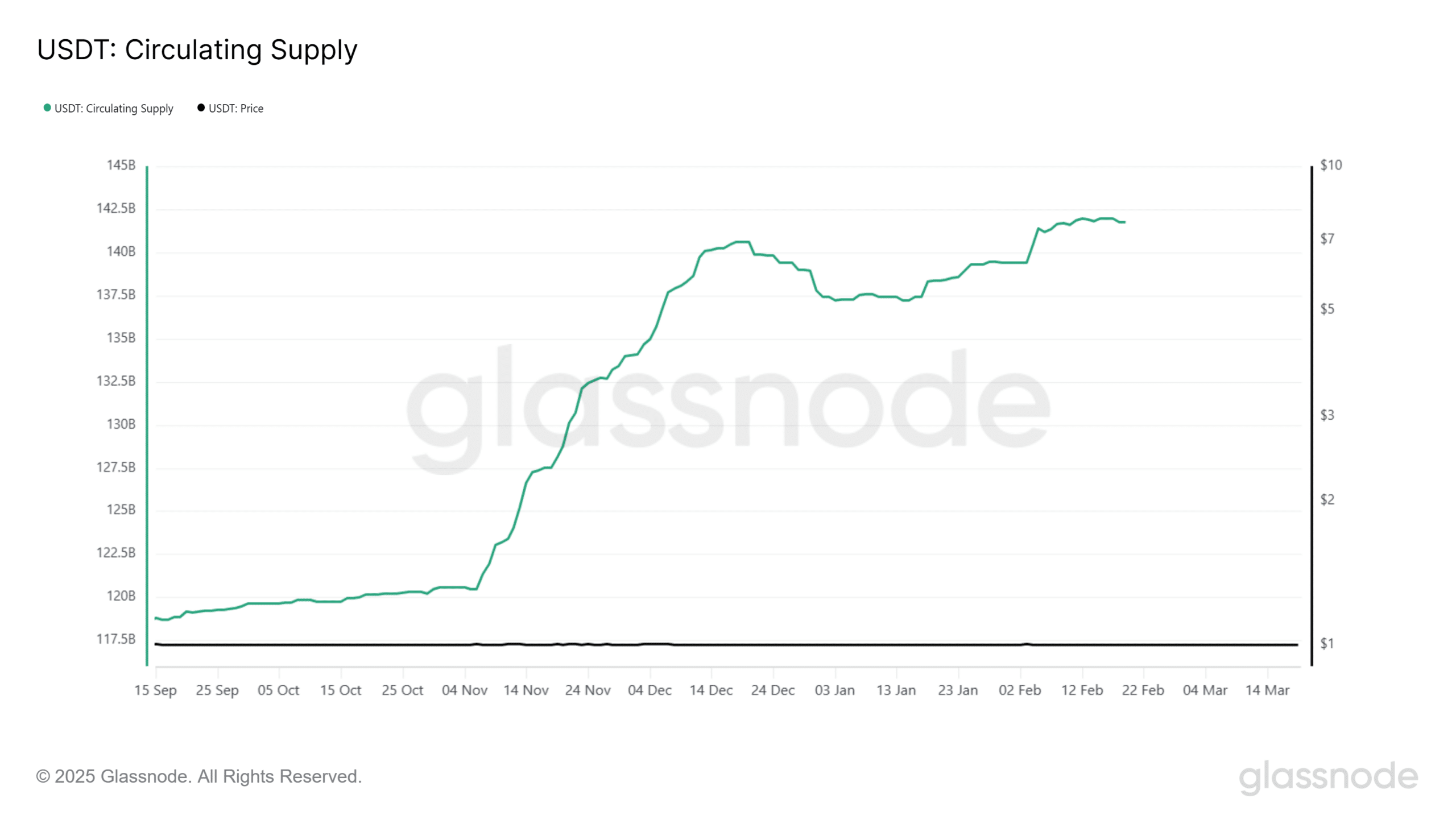

Since November, there has been a significant increase in the range of Stablecoins, coinciding with Bitcoin’s (BTC) Bullish rally.

However, this liquidity has mainly flowed into derivative markets rather than spot markets.

This report analyzes the consequences of this trend. Is the market survived, and can excessive trade in high return put Bitcoin’s short -term price measure at risk?

Exploited bets lead the road in Stablecoin use

A growing one Stablecoin Delivery usually indicates increased purchasing power. However, its diversion to derivatives suggests that traders favor utilized positions in front of direct BTC accumulation.

Since November, traders have added approximately $ 20 billion in Tether (USDT) to circulation, coincides with Bitcoin climbing to its maximum time of $ 109,000.

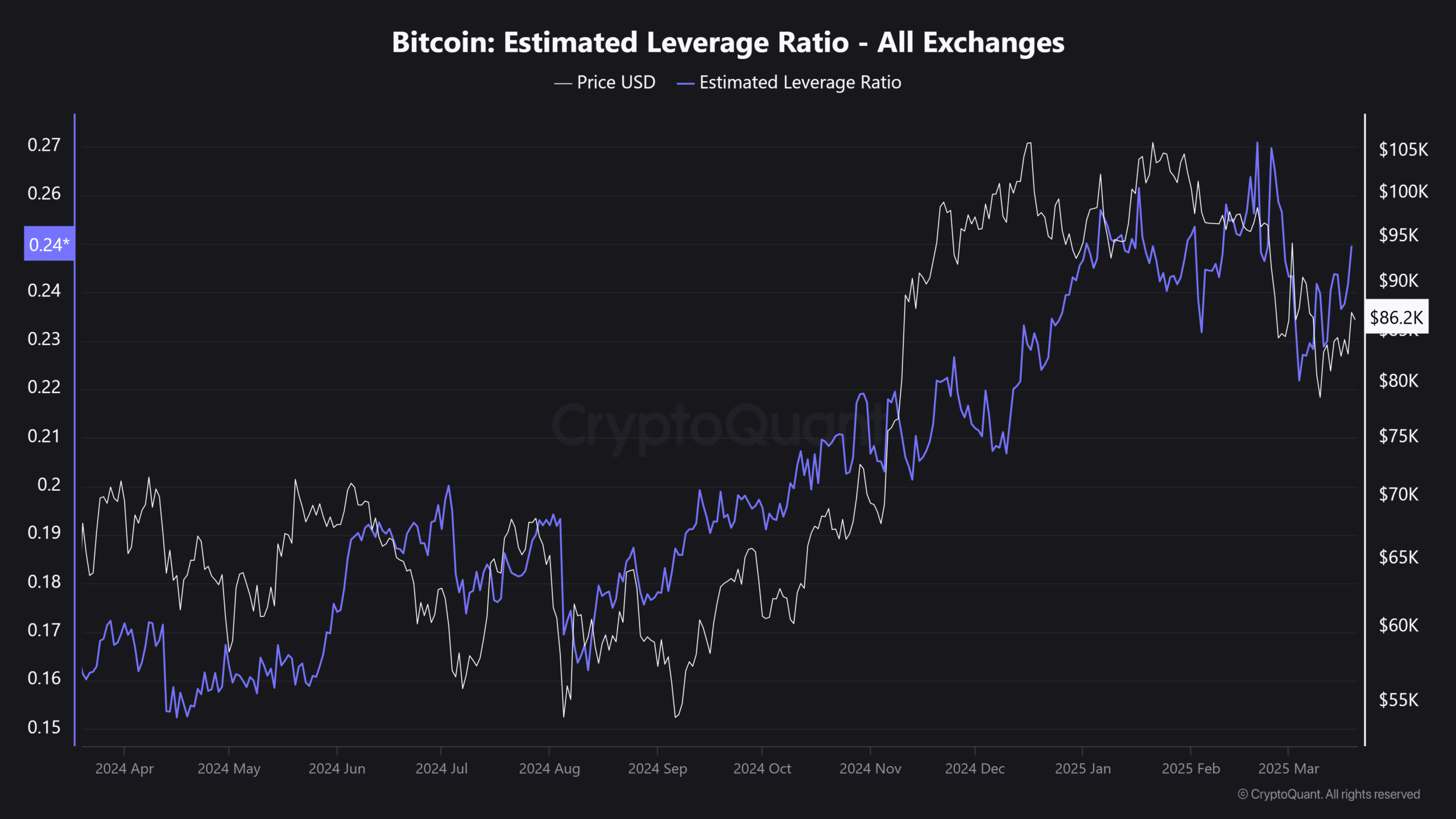

While this wave pointed to increased USDT -likeness in the market, especially in BTC purchase pressure, data From Cryptoquant revealed that much of this liquidity was drooling to high -risk leverage.

When the derivative market saw a top in purchase order, open interest (OI) Raised to a maximum time of $ 70 billion on January 22.

It currently amounts to $ 52 billion. The closure of these positions has exerted intensive downward pressure on BTC’s price, making it challenging for Bitcoin to recover the $ 90K brand.

Weak spot needs put bitcoin’s future at risk

USDT movement On Election Day, this shift clearly shows. On November 6, the net outflow of StableCoins from Spot Exchanges increased buying activity – usually a baisse -like indicator.

However, the derivative market saw an explosive inflow of 1.2 billion in USDT and pointed to an increase in leverage.

While such liquidity inflows in derivatives may indicate raisy feeling in a strong market, they introduce significant risks in a fleeting environment.

Following the FOMC meeting, which led to little optimism for potential speed cuts, Bitcoin saw the leverage (ELR) appreciated a dramatic increase.

As expectations of lower loan costs grew, traders flocked to high -quality positions. This trend is one to look carefully as Q2 progresses.

Given the weak accumulation in the spot market, these utilized positions face a higher probability of liquidation.