- ETH fell under $ 2K again after being above this level for two days.

- Ethereum buyers bought aggressively, with a negative Netflow that hit 150,000 ETH.

In the past three days, Ethereum (ETH) saw a shift in fortunes and recover $ 2K. In the midst of this reverse trend is a higher activity from the buying side.

According to CryptoquantEthereum saw a negative Netflow of over 150,000 eth on derivative exchanges.

Such a large outflow indicates reduced sales pressure when investors move ETH to refrigeration storage or def. Therefore, the large outflow indicates increased accumulation of large units that signal haus -like feelings from these investors.

This accumulation of large units is further proven by the latest choice of choice purchase.

According to Onchain Lens, A election withdrew 8,313 ETH worth $ 16.46 million from Binance after two months of inactivity. After this transaction, the elections now have 11 197 ETH worth $ 22.17 million.

Source: Onchain Lens

When whales begin to gather, it strongly signals Hausse, which indicates that they believe that the current prices are undervalued and will probably recover soon.

A long -term accumulation of smart money often increases market -confident and attracts increased demand from speculative buyers.

What it means for ETH

Despite the increasing demand from large holders, ETH prices continue to fight.

In fact, on daily charts, ETH has dropped under $ 2K again and hit a low at $ 1,963. This suggests that other market players remain baisse -like and are less optimistic about potential price recovery.

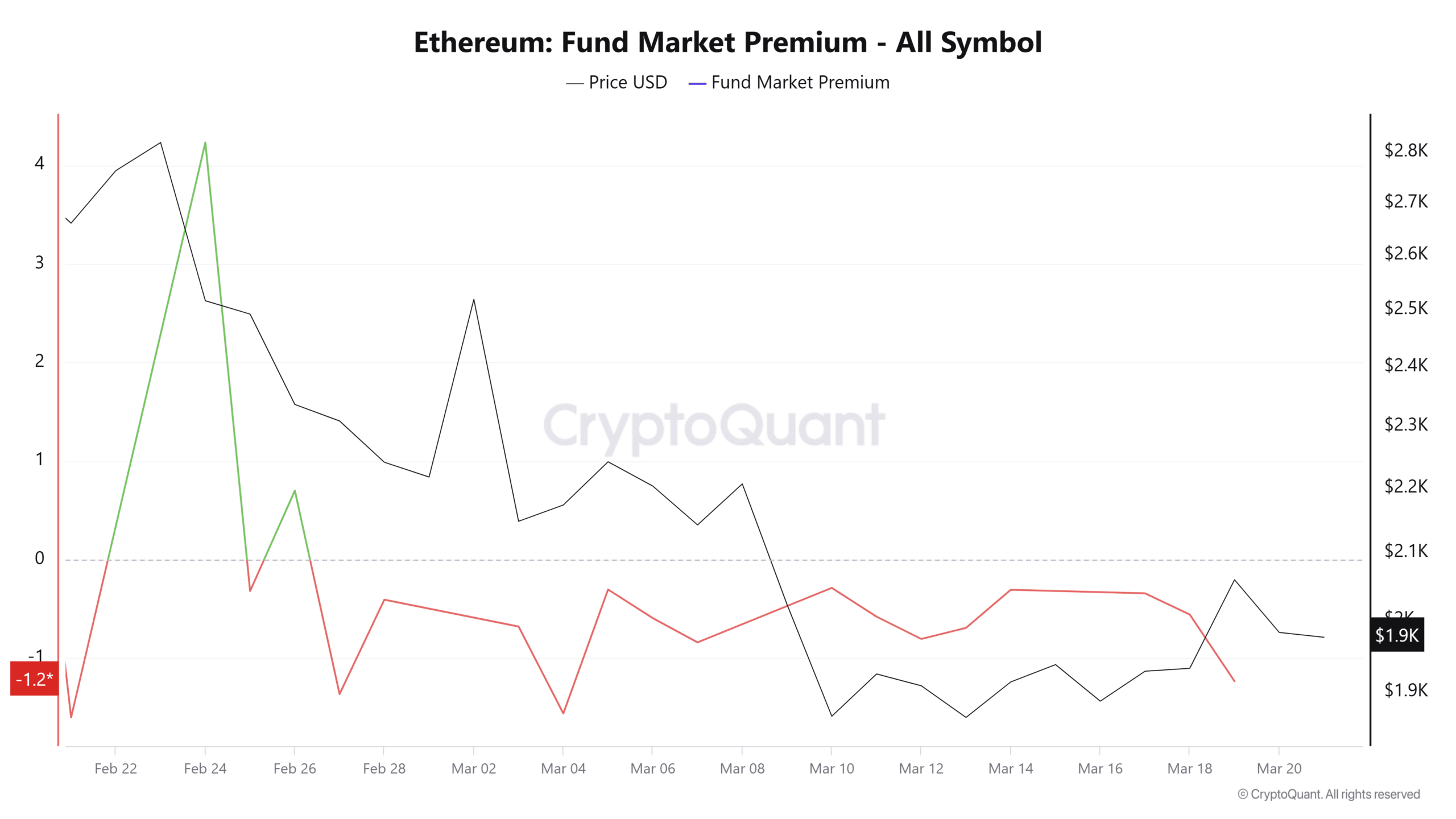

Ambcrypto observed Bearish Market Sentiment as Ethereum’s fund market premium remained negative in the past week.

A long -term negative premium indicates that investors close positions faster than new buyers are entering, which indicates that you prefer to sell at a discount rather than holding. While buyers participate, the sales activity remains particularly high.

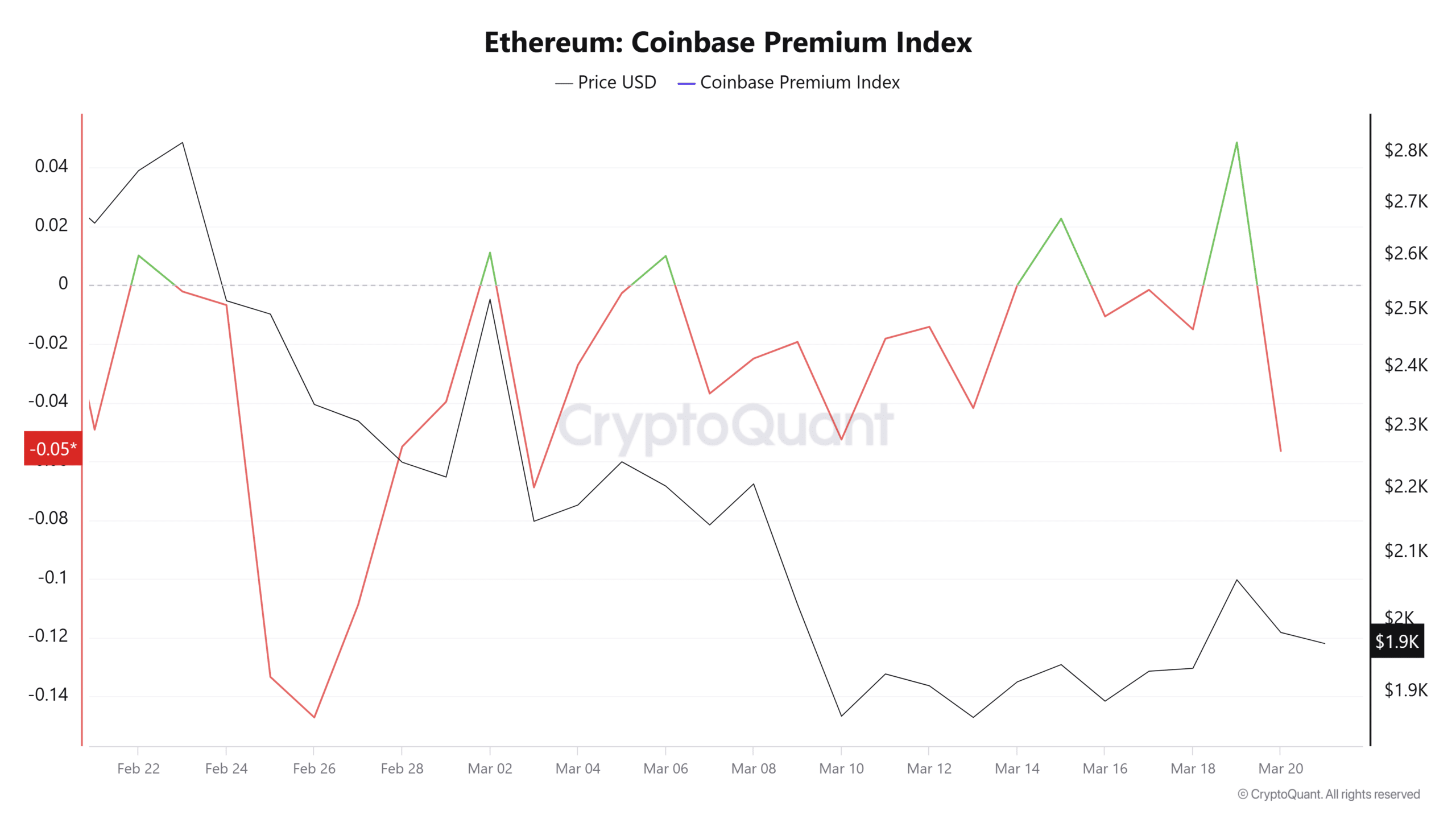

Bearish emotions are particularly pronounced among American institutional investors. Coinbase Premium Index, currently on -0.05, indicates active sale of Coinbase Investors, which reflects a remarkable lack of market confidence.

This feeling places Ethereum under significant downward pressure.

Despite increased negative net flows and valence collection, Ethereum’s demand remains weak. The ongoing tug of war between buyers and sellers can keep ETH prices limited to a consolidation area.

Under current conditions, Ethereum is likely to trade between $ 1,862 and $ 2,100.