Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum has experienced a much needed increase above the level of $ 2,000, an important psychological and technical brand that bulls have struggled to regain since March 10. This outbreak led to optimism on the market, but the momentum was short -lived, as ETH quickly withdrew below the level and could not confirm a fixed direction. Analysts generally agree that a strong and sustainable feature over $ 2,000 is crucial for Ethereum to initiate a broader recovery rally.

Related reading

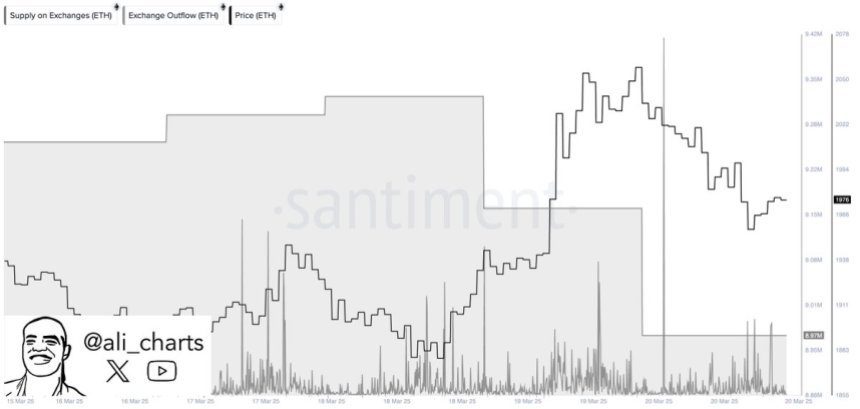

Despite the doubt in resistance, data on the chain shows signs of growing investors’ confidence. According to Santiment, investors have taken over 360,000 ETH from centralized exchanges in the last 48 hours. This displacement is often interpreted as a hooked signal, which indicates that large holders move their assets to private wallets, possibly pending higher prices.

At the same time, the broader macroeconomic landscape continues to apply pressure. Trade war stresses and unpredictable political decisions by the US government have weighed heavily in both crypto and traditional markets, intensifying volatility and insecurity in investors. Still, Ethereum’s latest exchange outflows suggest a potential trend shift – one that can benefit accumulation and set the stage for the next big move, provided bulls can recover and hold over the $ 2K threshold.

Ethereum is facing critical test in the middle of exchange flows

Ethereum has dropped over 57% of its value since mid -December and has fallen from a high of about $ 4,100 to the latest lows close to $ 1,750. This sharp correction has created a challenging environment for bulls, which have repeatedly failed to recover and maintain higher price levels.

Now the $ 2,000 brand stands as a psychological and technical battlefield. If Ethereum can determine support over this level, it can provide the basis for a recovery rally. However, a failure with it would probably result in additional disadvantages and reinforce the baisseed trend.

The current market landscape is struggling with uncertainty. On the one hand, continued macroeconomic headwinds – increased trade voltages, inflation problems and political changes from the US government – weakened investors’ confidence and driven volatility over risk resources. On the other hand, there are signs of potential recovery and accumulation.

Top crypto analyst Ali Martinez shared Data from Santimentrevealed that investors have withdrawn over 360,000 ETH from centralized stock exchanges in the last 48 hours. Historically, large -scale withdrawals are regarded as a hooked signal, as they propose that investors move assets to refrigeration storage for long -term holdings rather than preparing to sell.

This movement may indicate growing confidence among large holders and signal the early stages in a new accumulation phase – provided Ethereum can hold over $ 2,000.

Price holds steadily below $ 2,000

Ethereum is currently traded at $ 1,960 after trying to recover the $ 2000 brand in yesterday’s session. The psychological and technical resistance to $ 2,000 is still a crucial barrier that bulls must overcome to change market moments to their advantage. Despite a small bounce from the latest low, Ethereum has struggled to gain traction in the midst of the sustained market uncertainty.

Bulls must press ETH over $ 2,000 and recover higher levels such as $ 2,150 and $ 2,300 to confirm the beginning of a recovery phase. A long -lasting move above these levels would not only signal a potential trend use but can also attract the investor back to the market. Until this happens, Ethereum remains vulnerable to continued disadvantage.

Related reading

If Bulls does not break over the $ 2,000 resistance in the upcoming sessions, Ethereum may lose support at current levels and go through lower demand around $ 1,850 or even $ 1,750. With the broader crypto market still under the influence of macroeconomic volatility and weak feeling, the coming days will probably be crucial for ETH’s short -term direction. A decisive feature either above or below this key area is likely to set the tone for the next big price measure.

Featured Image from Dall-E, Chart from Tradingview