- Bitcoin topped $ 88,000 after an update of the Trump dull plans.

- For extended recovery, the previous support of $ 90k- $ 93K was a crucial obstacle to be cleared.

On Monday, Bitcoin (BTC) Topped $ 88,000 after President Donald Trump’s “less serious” customs plans scheduled for April 2.

Originally, most macro analysts from QCP Capital and Coinbase had warned of potential disadvantages in cases of renewed customs war during the early second quarter.

As a result, Relief BTC Rally was expanded after last week’s Fed meeting expanded to $ 88,000. However, analysts were still divided into BTC’s potential recovery over $ 90,000.

Mixed bitcoin forecasts

Bullish analysts quoted technical charts and structural changes, suggesting that BTC could recover $ 90K and a maximum time (ATH).

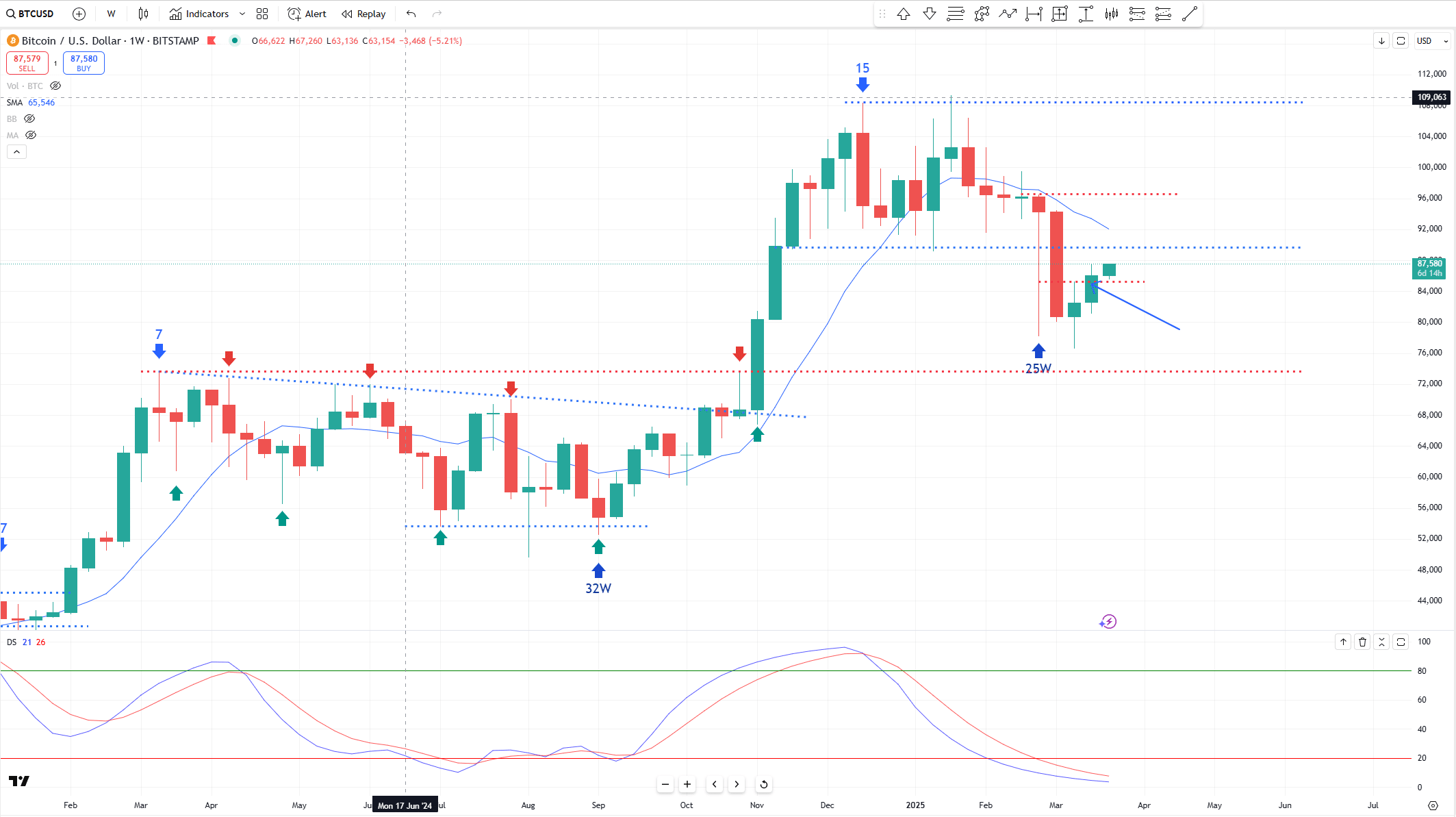

In fact, Bob Loukas, a trader and analyst, found that bulls were in control and the rally could last for 15 weeks, with reference to historical and structural changes on price charts.

The mentionedThe

“No real apologies left now for the bulls, the bike number is on their side. (Week 3) … If the bull market has control we can mostly move up for 15 weeks.”

Arthur Hayes, founder of Bitmex Exchange, repeated a similarly cautious vision but quoted Fed’s shift from QT (quantitative tightening) to QE (quantitative relief) as a key catalyst.

The noted That BTC was able to knock $ 110,000 and zoom to $ 250,000 before testing the latest lows to $ 76,000.

“(Bitcoin) Price is more likely to reach $ 110,000 than $ 76.5,000 next. If we hit $ 110,000, it’s yachtzee -time, and we won’t look back until $ 250K.”

However, others were cautious or calculated range -bound price measures for a while. From his side, BTC Trader, Cryp Nuevo, Expected Another dip to the $ 80K area, with reference to a probable liquidity-driven pursuit of stop losses under $ 83,000.

Pseudonyma ice cream scientist, vizart, careful that an ATH would be a “pipe dream” without recovering $ 90,000-93,000. He said,

“Latest investors, which bought in November 2024 to February 2025, have a cost basis between $ 90,000-93,000. Each bounce in this zone will probably remain that they sell press from those trying to go out at the Breakven. Without regaining this livelihood zone, a new ATH will remain a pipe dream.”

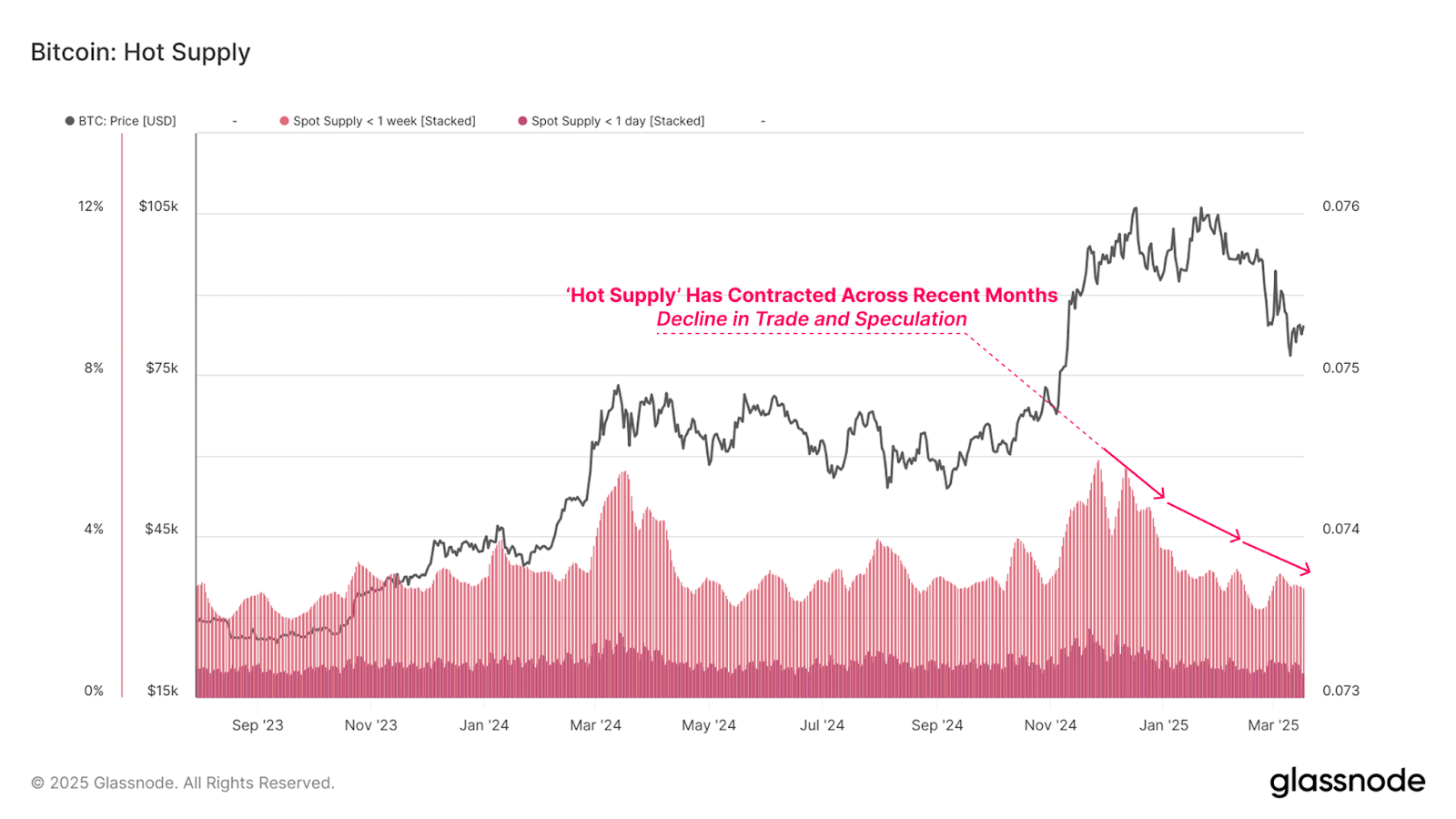

According to Bitfinex analysts, BTC can get stuck in an interval-bound price measure due to reduced speculative interest and activity, with reference to Bitcoin’s hot range. The abandonedThe

“A contraction in the hot delivery metric – from 5.9 percent in December 2024 to 2.8 percent today – teaches the undercooling of speculative participation.”

Per Bitfinex analysts can only be feasible if there were macro -clarity and renewed ETF inflows.

The Spot BTC ETFS saw an inflow of $ 744 million last week and broke out the outflow of 5 weeks. But it remained to see how BTC Price would react to Trump’s April duties.