- Valks accumulated 200 million dove, which signals the potential for future price increases despite volatility.

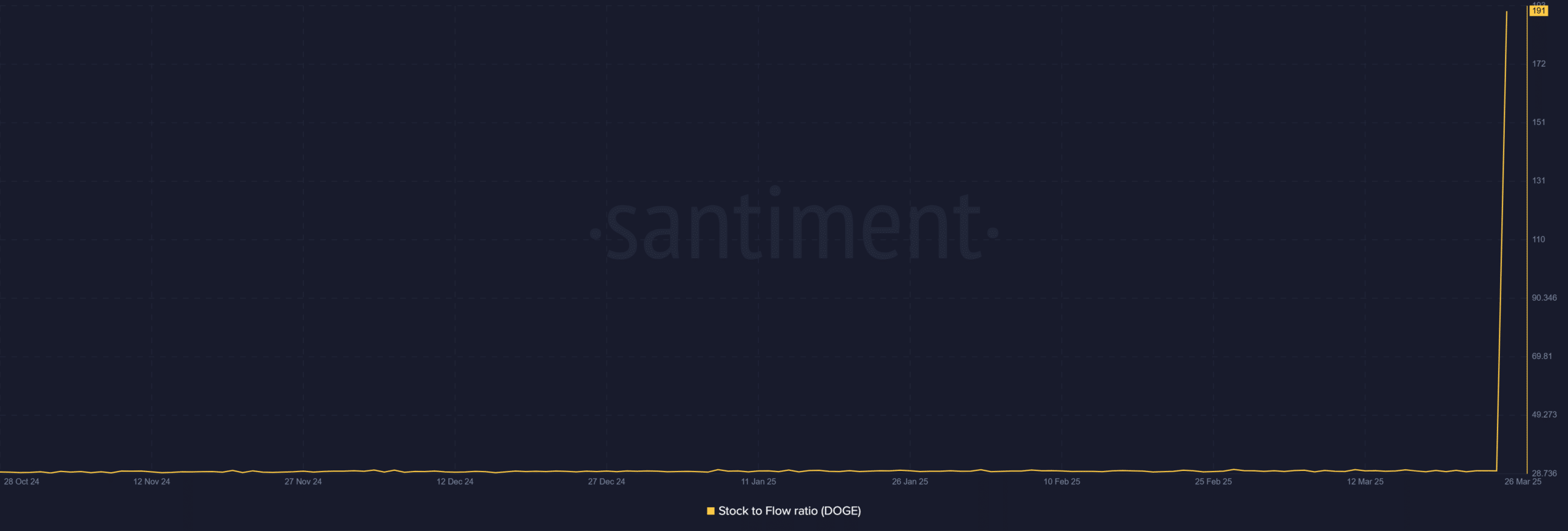

- Doges Lager-to-Flow Relationship has increased sharply, indicating increased scarcity and upward price pressure.

Whales have gathered over 200 million Dogecoin (Doge) Over the past two weeks, a strong confidence in the asset shows despite ongoing volatility.

This significant increase in holdings indicates that large investors believe in memecoinS Potential for future growth.

From the press time, Dogecoin traded to $ 0.1929, an increase of 4.59% over the past 24 hours. Therefore, this vault accommodation can potentially signal the beginning of a price collection, although market dynamics will eventually dictate the next move.

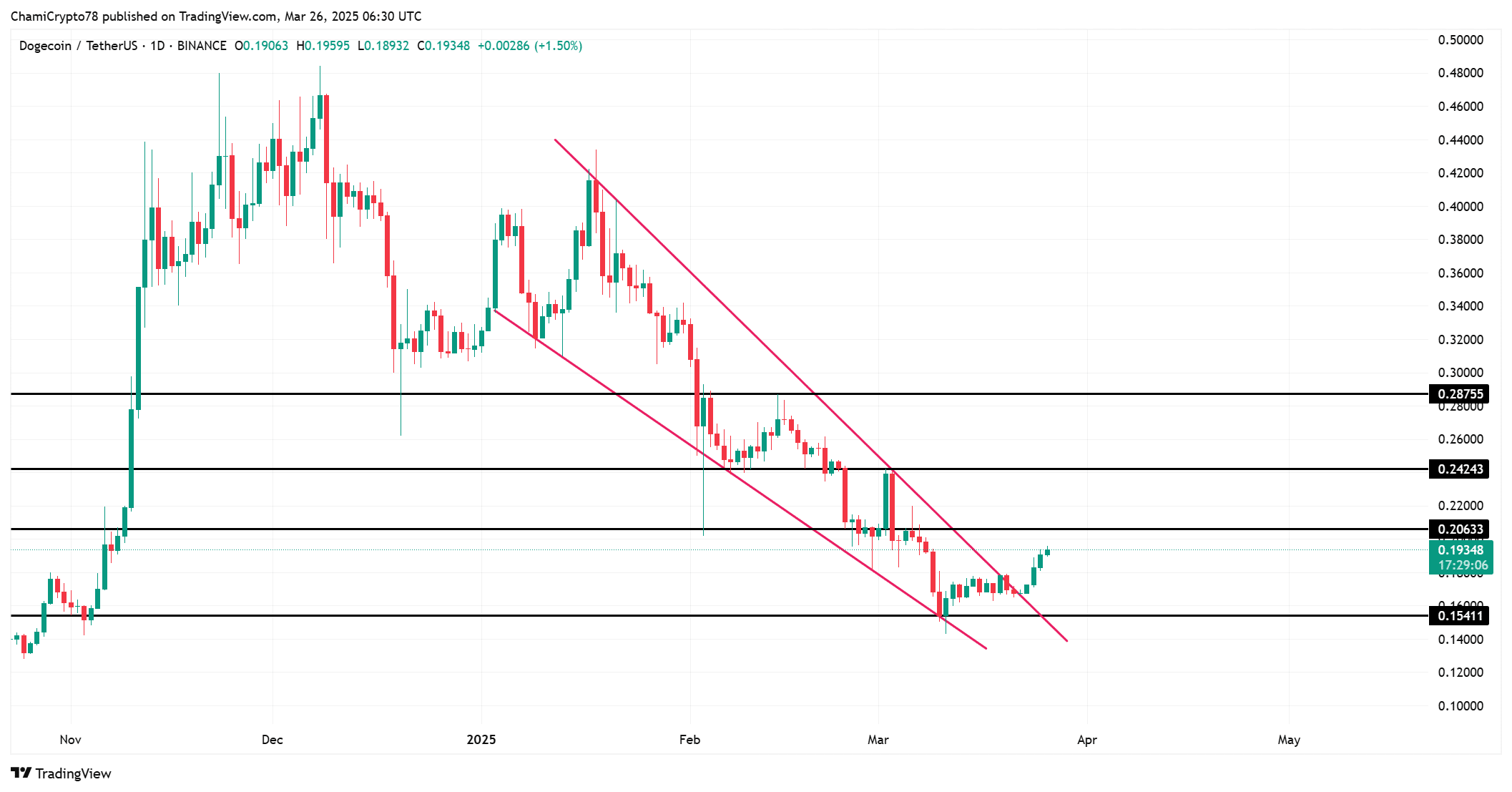

Dogecoin: Breaking Through Key levels

A closer look at Dogecoin’s latest price measure reveals an interesting development. After fighting in a falling wedge channel, Dogecoin successfully broke out and bounced from an important support level of $ 0.24243.

When the price now floats around $ 0.19311, there is immediate resistance of $ 0.24243, which will be crucial for further movement upwards.

The price measure shows a potential turning point, as breaking through this resistance can lead to a more sustainable rally.

However, the success of this trait depends on whether Dogge can maintain its upward speed and not fall back into the falling wedge channel.

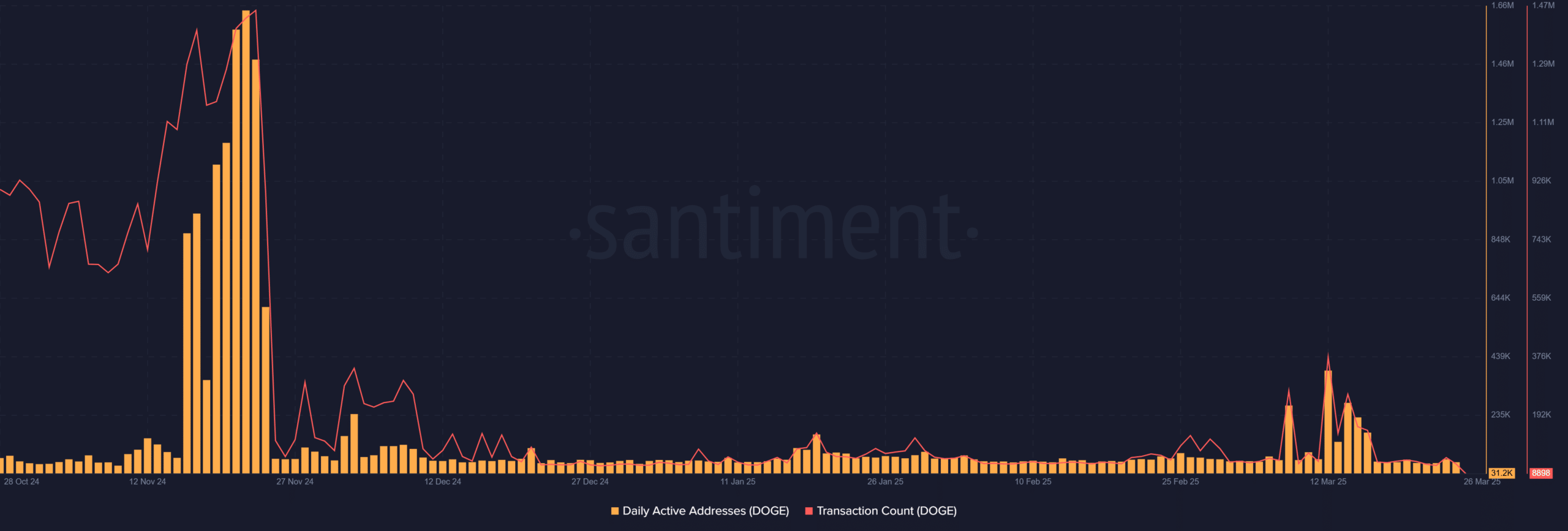

DOGE Daily active addresses and transaction bill: still low

Despite the positive election activity, Dogecoin’s network remains relatively inactive in daily active addresses and transaction volume.

At press time, Dogecoin has only 31,212 active addresses, with a low transaction number of 8,898.

These figures indicate that while large investors actively accumulate Dogge, the broader market participation remains limited.

Therefore, in order for Dogecoin to experience a more significant rally, it will need an increase in the user’s adoption and transaction activity, which can help drive long -term growth.

Without these factors, some gains can be short -lived, mainly driven by election influence.

Sharp increase and consequences

The stock-to-feed relationship for dogecoin has seen a sharp increase and is currently sitting in 191.12. This indicates a potential reduction in the available range of Dogge, which suggests increased scarcity.

A higher layer-to-feed relationship often correlates with the upward price, as fewer coins in circulation can lead to higher demand.

However, this metric is not enough to guarantee long -term growth.

In addition, the increase in the warehouse to the flow reflects the broader market’s response to limited supply, but it is important for this trend to be maintained for the price to climb further.

Can Dogecoin keep up for a pricing?

Election activity and a sharp increase in Dogecoin’s warehouse-to-feed relationship provide a strong case for the possibility of a price collection.

However, the current lack of broad market participation, which is indicated by the low number of active addresses and transactions, may limit the potential for a sustainable price increase.

Therefore, while the whaling collection points to optimism, significant price movement will be due to greater market engagement and lasting increases in delivery lack.