- An EU agency demanded 100% capital support for crypto insurance companies, with reference to high volatility.

- Circle, however, urged the agency to consider a “nuanced strategy” as crypto assets have different risk profiles.

The European Union’s insurance guard, European Insurance and Occupational Pension Authority (EIOPA), has proposed 1: 1 support for insurance companies that handle crypto assets.

According to the agency, 100% capital support was appropriate due to the volatile nature of the asset. Part of his statement readThe

“Eiopa considers a 100% hairstyle in the standard formula that is careful and suitable for these assets given their inherent risks and high volatility.”

Flexibility

The agency stated that this measure would deal with a regulatory gap in Mica (Markets in Crypto Assets) framework, which excludes crypto insurance companies.

In fact, that was noted that Bitcoin (BTC) and Ethereum (ETH) have 82% and 91% earlier, thus the need to use 100% stress (assumption that an asset can reduce 100%).

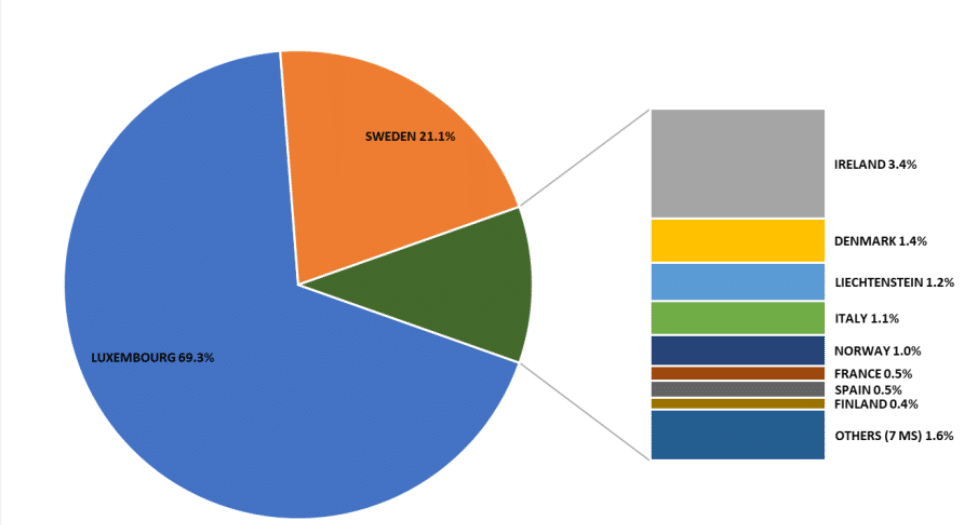

Eiopa stated that Luxembourg and Sweden would meet the greatest impact on the European Commission adopted the proposal. These nations have over 90% exposure to crypto assets, making them particularly vulnerable under the proposed regulations.

The agency admitted that a blanket 100% capital requirement may not suit a future with large -scale crypto adoption. In such a scenario, Watchdog pronounced,

“However, a possible broader adoption of crypto assets may require a more differentiated strategy along the line.”

In a rejoinder, stablecoin emittent circle argued The fact that not all crypto assets have similar risk profiles and should not be slammed into 100% stress factor. The company recommended a “nuanced strategy” for capital support.