- WLD noted Baissey Momentum on 1-Day and 4-hour charts, which denoted the seller’s dominance

- Despite its baisse -like signals showed the price action a short -term rally may be possible

Worldcoin (WLD) has thrown 17.65% of their value for three days. In fact, technical analysis revealed that its higher time frame trend was firmly baisse -like at press time.

And yet there may be a buying opportunity. Not for investors, but for traders. The potential Partnership with Visa Can help turn the feeling next week.

WLD is Baissein on several time frames, but could see a bounce from $ 0.8 support

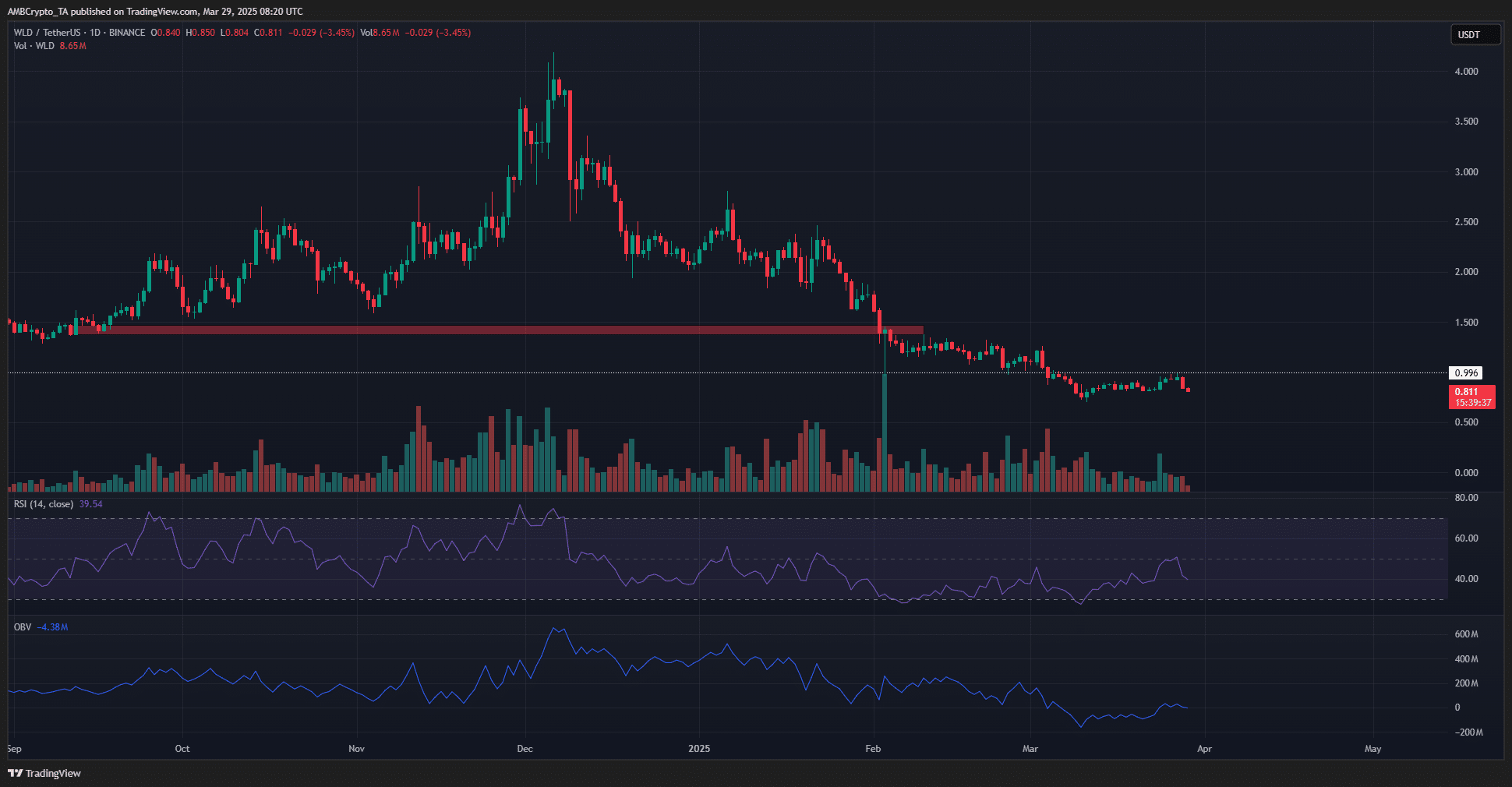

The 1-day time frame revealed that the $ 1 level had been turned into resistance by the end of February. The haussearted hopes for long-term worldcoin investors were seriously affected by the end of January, when the haus-like order block to $ 1.5 (red) turned from a demand to a livelihood zone.

The baisse-like market structure for WLD has been present since the beginning of 2025 when the price fell below $ 2 level. This level marked the higher low from November which was part of the strong rally towards the end of 2024. Like most altcoins, this two -month rally has been completely wiped out.

RSI has been under neutral 50 since mid -January. This can be seen as a sign of persistent baisse -like speed. It was also in accordance with the baisse -liked price measures over the past three months. OBV has also been on a downward trend, which reflects a stable sales pressure.

However, over the past three weeks, Worldcoin’s OBV raised somewhat, which reflected some accumulation. RSI also corrected itself and climbed higher from surveillance conditions. However, this did not signal a trend change and at press time the prospect of the daily time frame was still Baiss.

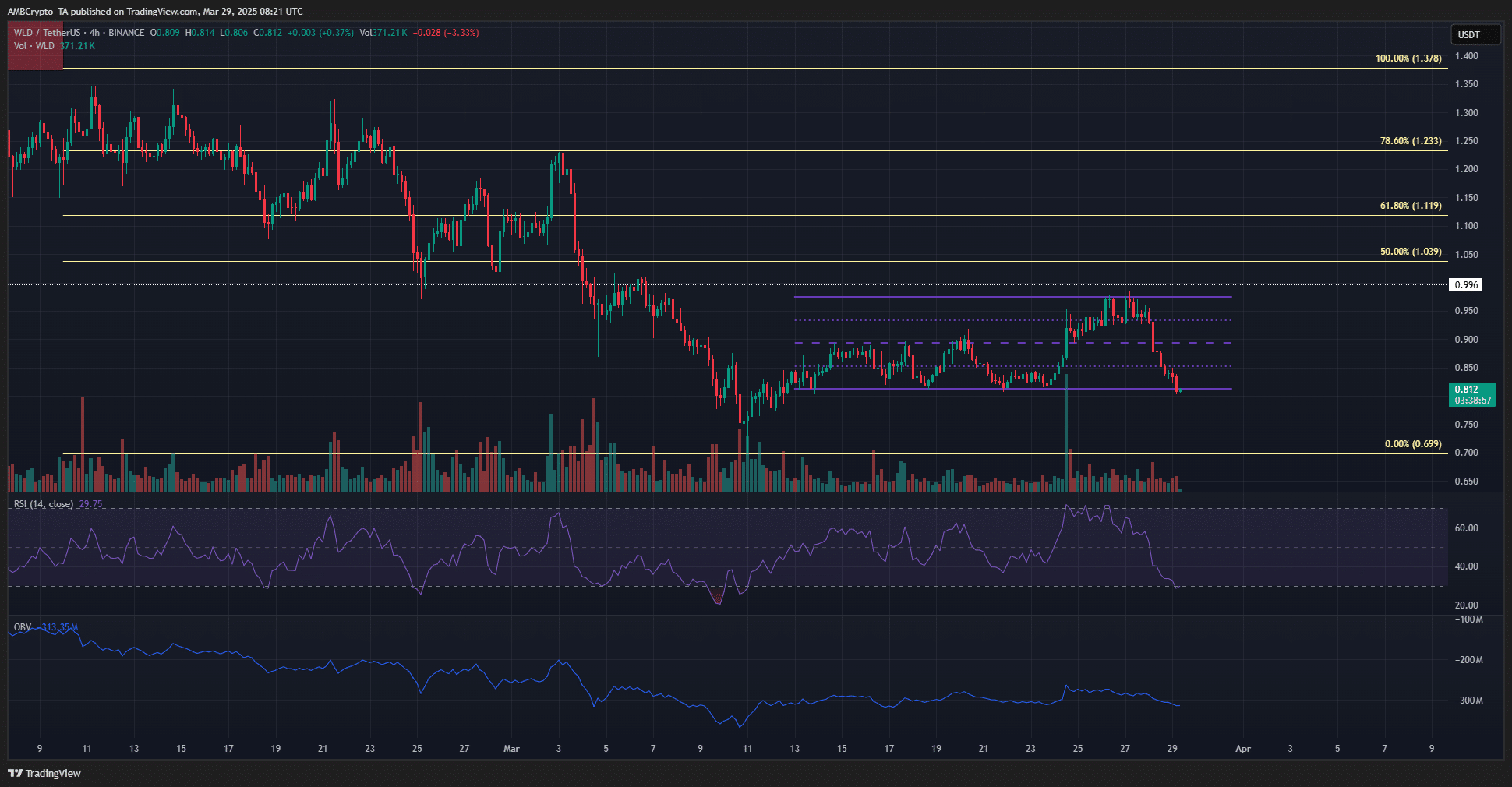

WLD’s 4-hour charts described the last three weeks’ consolidation phase. An interval formation (purple) was detected from $ 0.81 to $ 0.97. The $ 0.89 middle -class level served as both support and resistance earlier in March.

Although the strong losses over the past week, RSI took to 29, there may be a good chance for a raisy reversal. The range is likely to be defended because OBV has not dived under its local lowness yet.

Therefore, despite the rapid losses recently, Worldcoin can present a purchase opportunity to swing traders.

Disclaimer clause: The presented information does not constitute financial, investment, trade or other types of advice and are the author’s opinion solely