- BNB has decreased by 3.5% over the past week.

- Binance’s Spot Volume surpasses all other exchanges together.

While the crypto market has experienced a sustainable period of uncertainty, Binance market dominance has continued to increase.

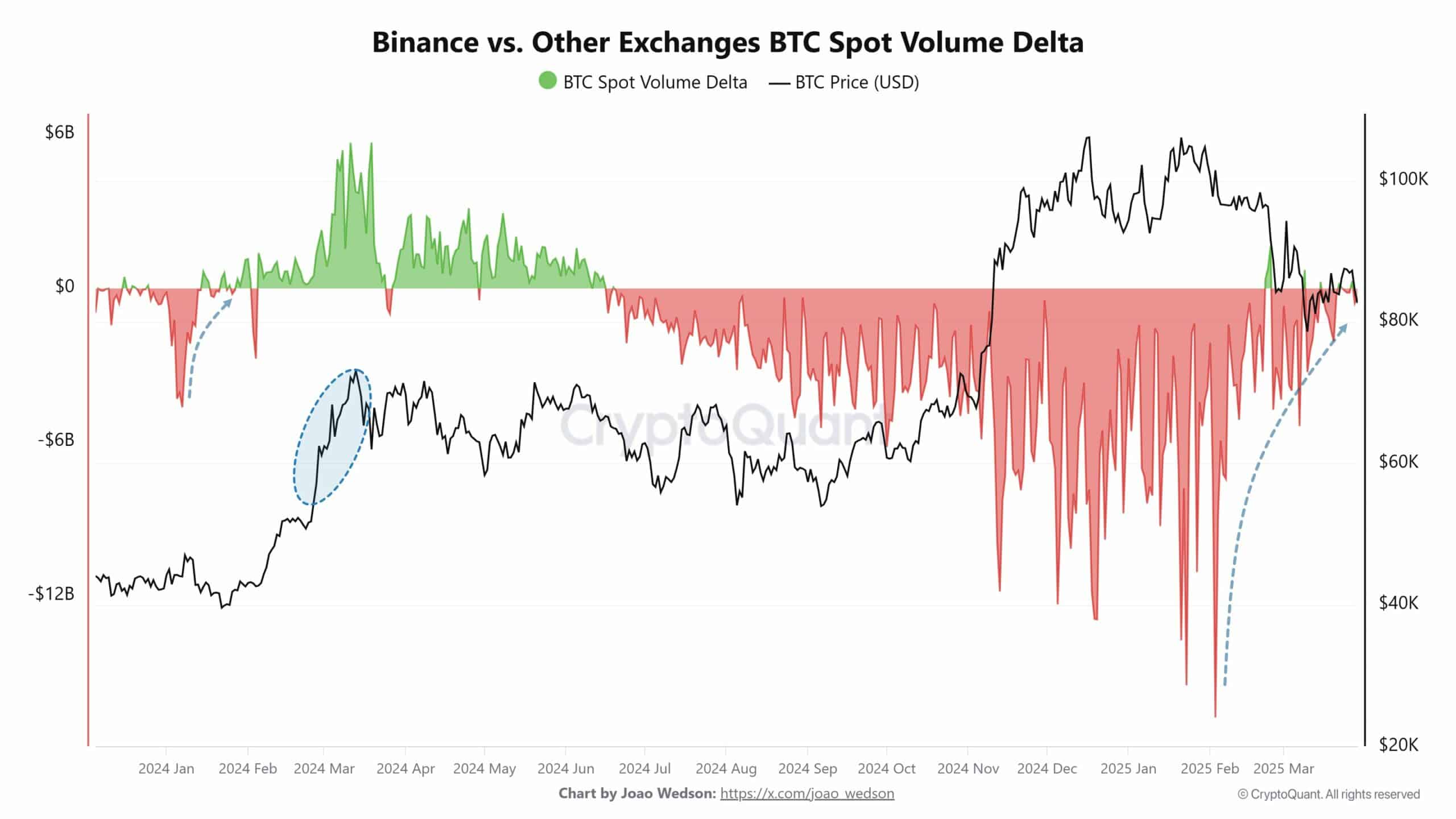

According to the analyst Joao WedsonBinance’s Spot Volume has exceeded all other exchanges together.

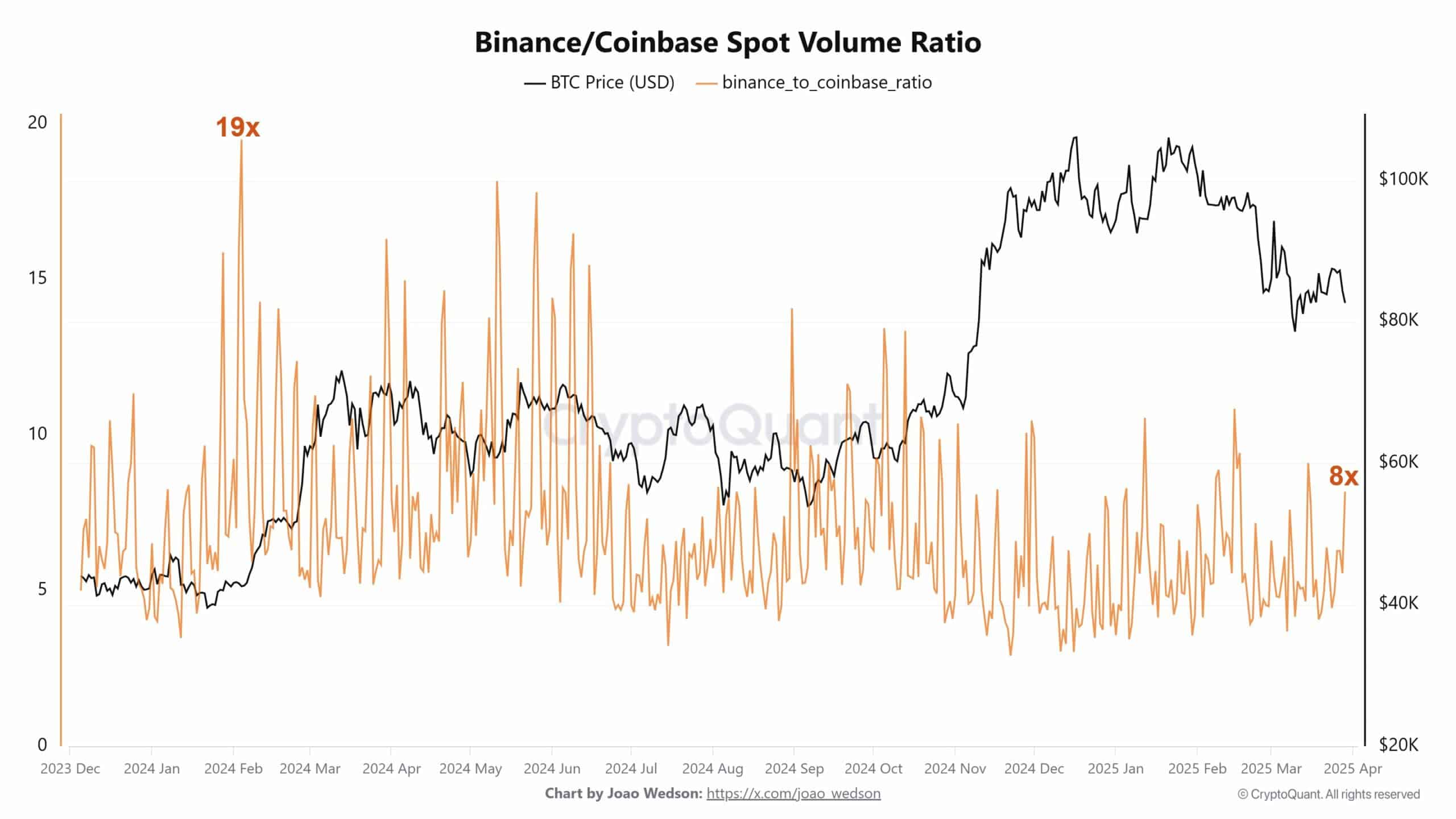

It is currently 8x larger than Coinbase, which shows its superiority in the market share. Although the spot volume has decreased over exchanges over the past two months, Binance’s dominance continues to increase.

At the beginning of 2024, Binance trading volume exceeded the significant influence on liquidity and market dynamics for all other exchanges.

For example, in January 2024, when Binance Volume rose past its competitors, Bitcoin price from $ 42,000 to $ 73,000 within weeks. Similarly, Binance’s Native Coin, BNB, experienced remarkable growth and increased from $ 335 to $ 645 during the same period.

Historically, Binance has strong performance in spot trade volume has often signaled a raised market trend during the weeks that followed.

Binance versus other exchanges BTC Spot Volume Delta indicator is again positive, which indicates a potential haisseatic view in the coming months, despite a decrease in the total aggregated spot trade volume.

Any impact on BNB?

Despite the rising dominance, the market will not yet become hausse for Binance Coin (BNB). In fact, BNB investors, both large units and retail, remain Baisse.

The latest sale of 10,850 BNB symbols, valued at $ 6.51 million, of Gnomelabs gives the first indication of this feeling. Onchain -data reveals that Gnomelabs have deposited a total of USDC 76.37 million in Binance and Bybit.

When such a large proprietor turns to selling, it shows a lack of marketing believers, which reflects Baissian feelings.

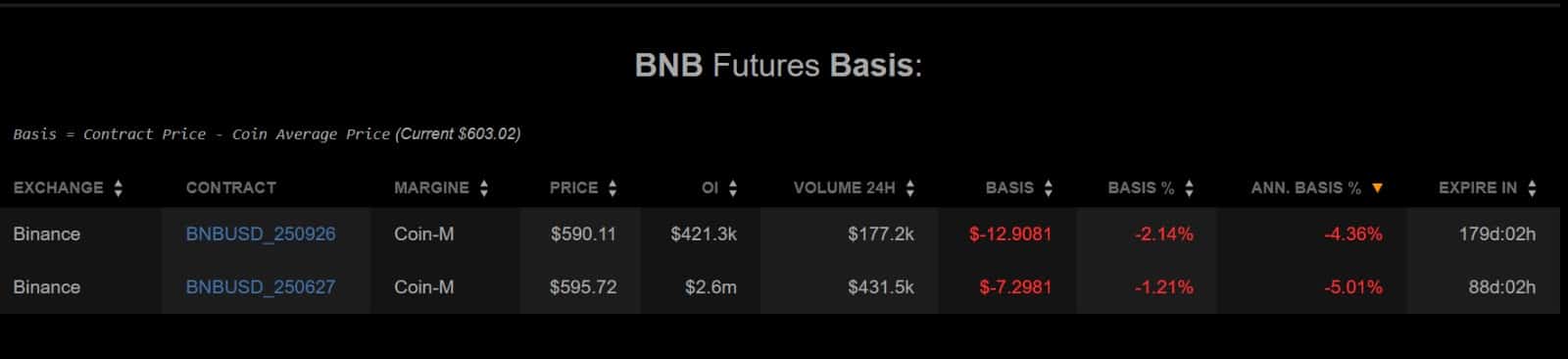

When you look further validates a negative future base’s strong bearness. When the futures base becomes negative, this means that the future price is lower than the spot price.

Such a market setting indicates that traders expect lower prices in the future, which reflects a strong Baissian feeling.

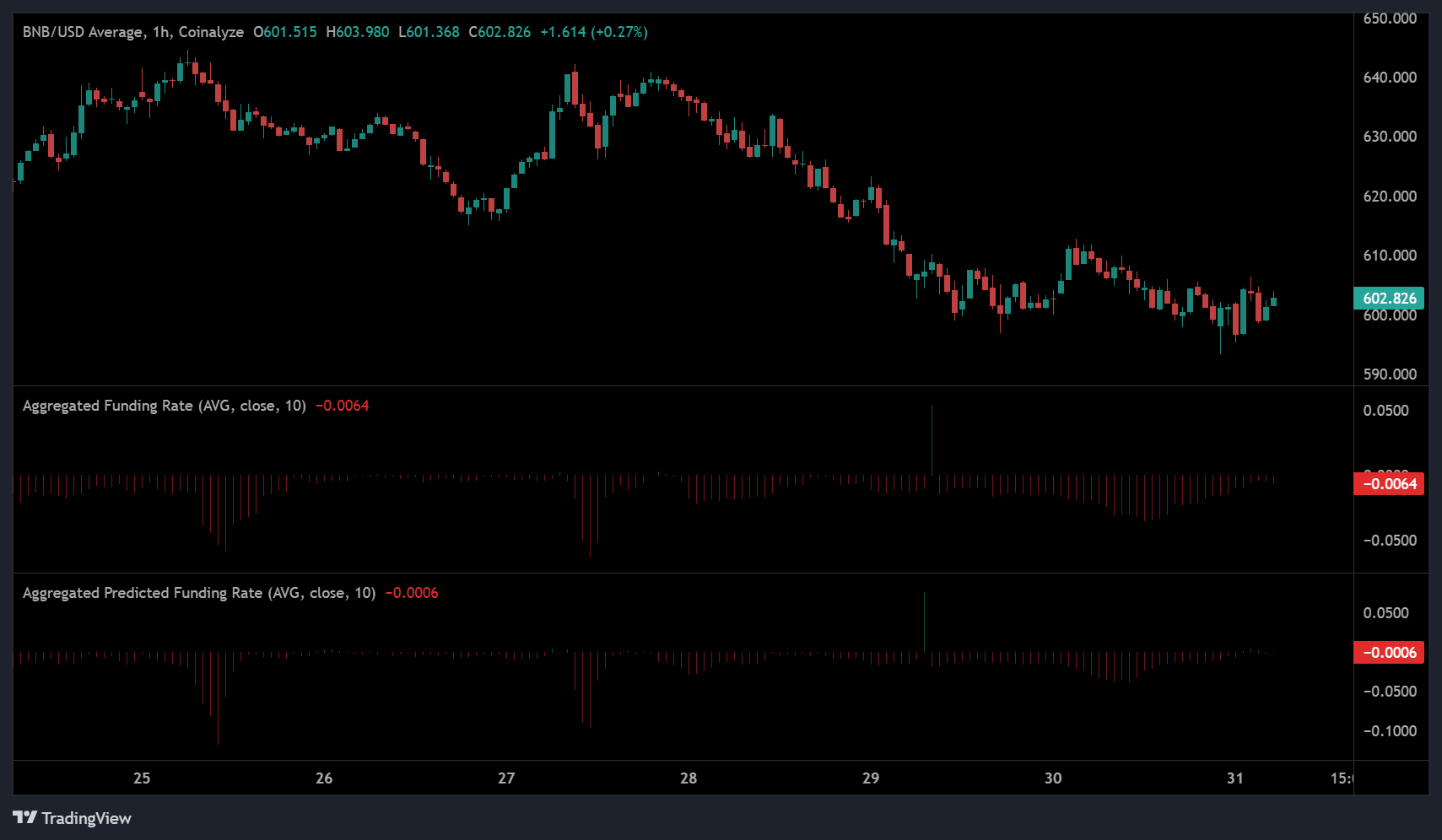

With futures that enter negative territory, BNB’s aggregated degree of financing has also become negative, which indicates baice -like feeling in the future market.

Over the past week, the degree of financing has consistently remained in negative territory, which indicates that an increasing number of traders take short positions. As a result, Shorts pays long -lasting, which reflects the expectations of further price declines.

Although the dominance of the bin continues to increase, BNB has not reflected these profits in the short term. Consequently, Binance Coin Baisse remains and current market conditions point to a potential further correction before any upward movement.

If this feeling persists, BNB is likely to fall below $ 600, which potentially reaches $ 576.

But if the past is any indicator, a repetition of the previous cycle – where Binance’s dominance increased – could drive a recovery against $ 618, which strengthens Altcoin for a possible rally to $ 638.