Key dealers

- Grayscale is looking for Regulatory Greenlight to convert its digital large CAP fund to a public ETF that covers large crypto assets.

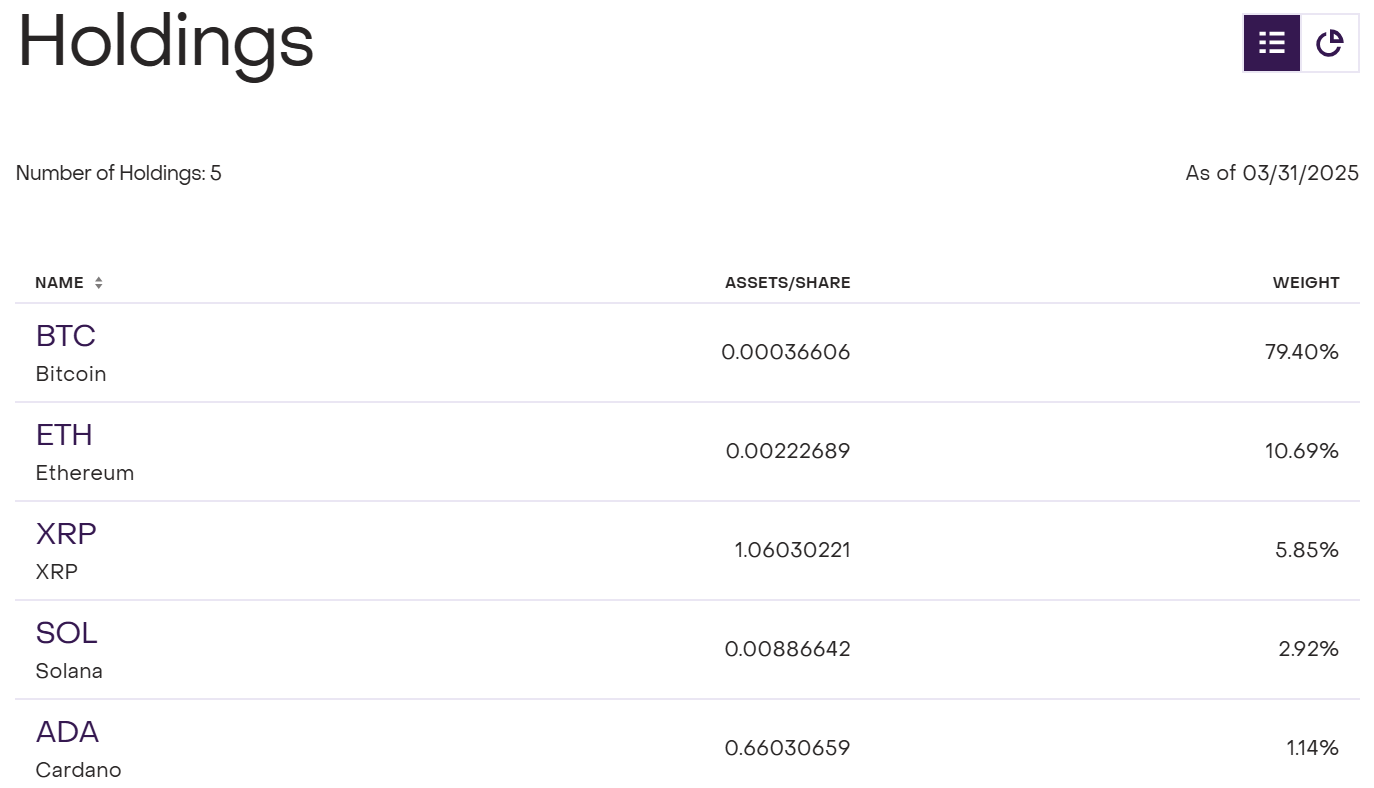

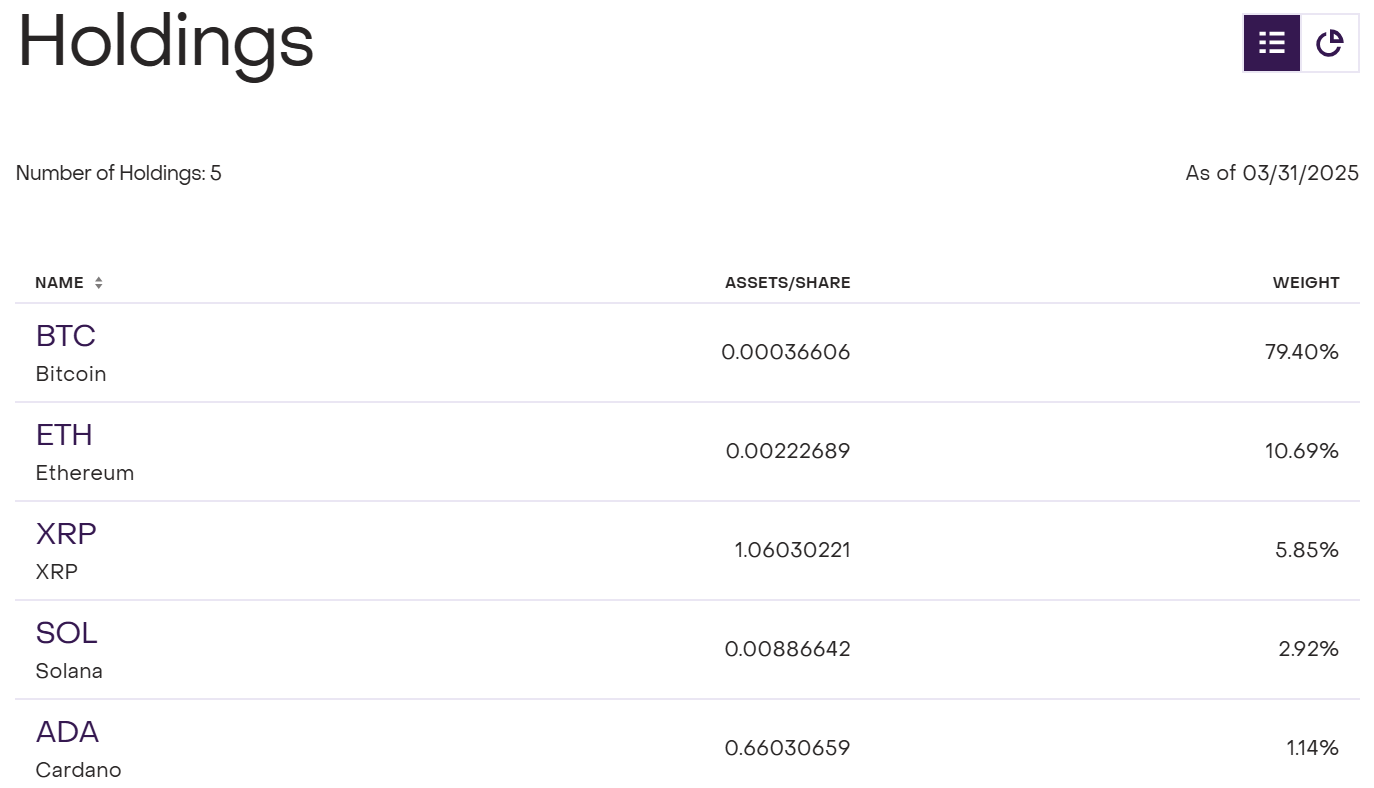

- The proposed ETF will include Bitcoin, Ethereum, XRP, Solana and Cardano, with Bitcoin at the largest allocation.

American Digital Assets Giant Grayscale has submitted An application to Securities and Exchange Commission (SEC) to convert its digital large CAP fund to a spot Exchange-traded product (ETF).

The existing fund, also known as GDLC, currently has a basket of large crypto assets, including Bitcoin (79.4%), Ethereum (10.69%), XRP (5.85%), Solana (2.92%) and Cardano (1.14%).

From March 31, the fund had approximately $ 606 million in the management of assets, according to an update on Gray’s official website. It has won about 479% since its launch in 2018.

Cardano (ADA) was added to the fund’s assets in January after an Index balancingas mentioned in the S-3 archiving. This digital asset replaced Avalanche (AVAX) to get the fund’s holding to match the new index composition.

The proposed ETF would maintain similar allocations at the same time as the availability of the investors widen. This is also part of Greyscale’s mission to integrate crypto investments in ordinary financial markets.

The new archiving follows a form 19b-4 submitted By Nyse Arca in October last year. The management fee structure is not yet completed in the S-3 registration declaration.

With the increase in Krypto -etfs, including Spot Bitcoin and Ethereum approvals 2024, Grayscale’s ETF transformation of DLCs aims to meet the growing investor’s demand for regulated crypto exposure.

Grayscale is looking for active approval for several ETFs tied to large crypto assets such as XRP, ADA, Litecoin (LTC), Solana (Sol), Dogecoin (Dogge), Polkadot (Dot) and Avalanche (Avax).

Bloomberg -analyst assessed that Litecoin ETFs have the highest approval probability among upcoming crypto -etfs, followed by Dogecoin, Solana and XRP.