Key dealers

- Vanecke registered a BNB-commercial fund in Delaware and marked its fifth crypto access ETF registration in the state.

- Vaneck had previously applied for a Spot Soana ETF with Sec and was the first to apply for a Futures Bitcoin ETF 2017.

American Investment Manager Vaneck has applied to set up a unit of trust for a proposed BNB-trained fund in Delaware. The establishment of confidence serves as a preparatory measure in the ETF launch process, before the formal application to Sec.

Vaneck’s archiving marks the first attempt to launch a binance coin (BNB) ETF specifically in the US market. While BNB-related products like 21Shares Binance BNB ETP are available, they are not US-based ETFs.

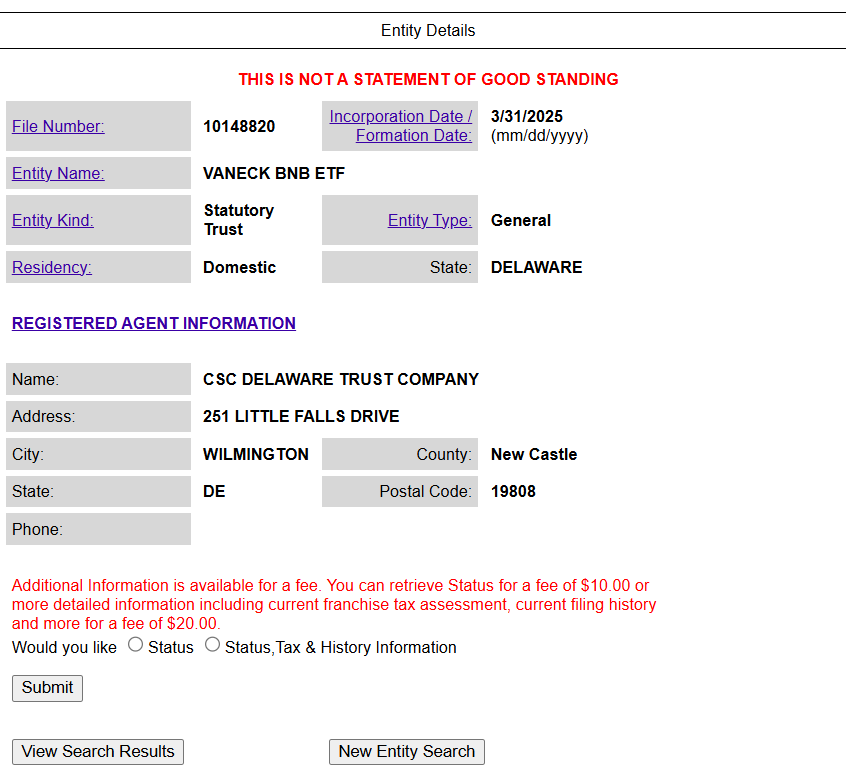

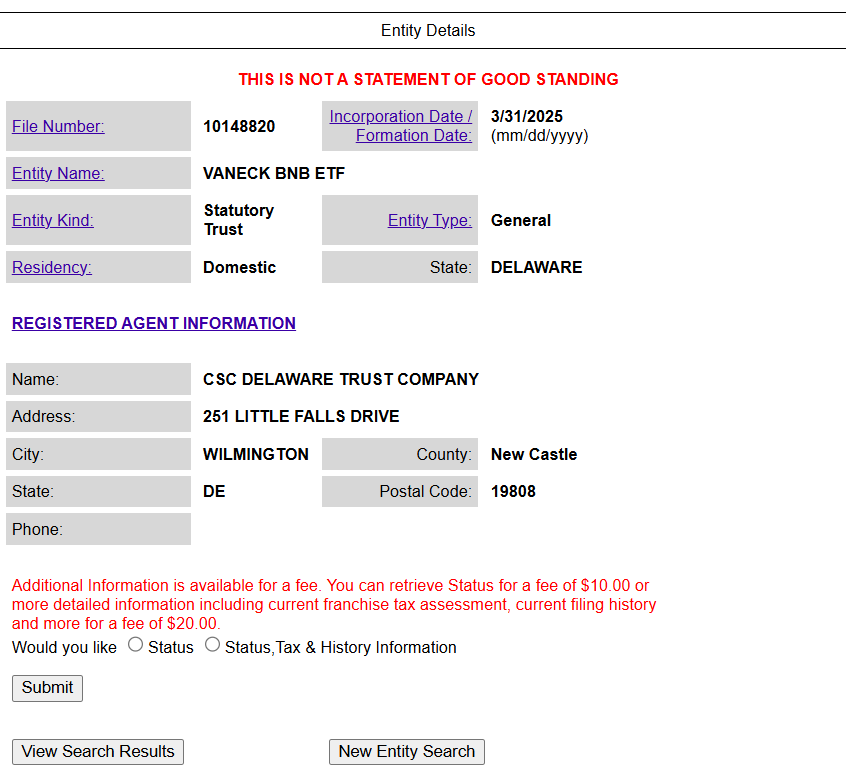

The company, which handled almost $ 115 billion in customer assets globally, registered the new product on March 31, called Vaneck BNB ETF, during archiving number 10148820 as a trust company, according to public registers on the official website Delaware State.

The submission means that BNB joins Bitcoin, Ether, Solana and Avalanche as the fifth Cryptocurrency to have an independent ETF registration initiated by Vaneck in Delaware. Vaneck’s Spot Bitcoin and Ether ETFS debuted last year after ensuring approval from SEC.

The prospective BNB ETF would track the price of BNB, currently ranked as the fifth largest crypto supply through market value. Crypto access was about $ 608 at a press time, with small price movement in the last 24 hours, for coytecko.

Vaneck Archived for a Solana ETF In June 2024. This was the first solar ETF application in the United States. Following this first archiving, Vaneck and other asset managers, including 21 Share, submitted further necessary applications, including the 19B-4 form, to continue with the approval process.

Last month, Vaneck applied for SEC approval to launch the first AVAX ETF, following its success with Tot Bitcoin and Ethereum ETF offers.

The company has established itself as an important player in the Crypto ETF market, after being the first ETF supplier to apply for a Futures Bitcoin ETF 2017.