- Eric Trump’s approval strengthened retail confidence as uncertainty about policy fuel decentralized asset interest.

- Institutional accumulation and hausse -like techniques adapt, which indicates that BTC is based on a breakout.

Donald Trump’s explanation of “liberation day” marks an important change in US trade policy, which speculates speculation over global markets and in the crypto industry.

These customs, placed as a strategic feature for negotiating foreign trade dynamics, has introduced new uncertainty into the macroeconomic landscape.

But rather than weakening crypto, some believe that the move can increase the demand for decentralized assets. Analysts suggest that potential market drawing can cause central banks to facilitate monetary policy.

Therefore, Bitcoin (BTC) Could benefit from reduced interest rates and renewed investors’ interest rates in non-soctic stores of value. As global capital is adjusted, the crypto market’s answer will prevent how quickly politics is changing.

Do Eric Trump’s Bitcoin approval momentum run?

Eric Trump’s latest remarks have added fuel to the Bitcoin story. On one Fox Business Interviewhe said,

“It’s cheaper, faster, more transparent and it can’t be interrupted … that’s why I love Bitcoin.”

His words reflect a growing distrust in traditional financing, especially when he quoted de -banking and interrupts culture as key motivators for the family’s crypto engagement.

In addition, the Eric WLFI projected and USD1 Stablecoin emphasized and expressed confidence in their contributions to stabilizing the US dollar. His bold statement, “The best days in BTC are there,” spreads quickly across social media and strengthens Hausse.

Therefore, public support from politically influential figures can be a powerful catalyst for detailed investor -enthusiasm. His comments, while personal, are in line with a broader story of institutional pushback against centralized systems.

BTC Price Action Outlook – Are Bitcoin Flashing Haussearted characters?

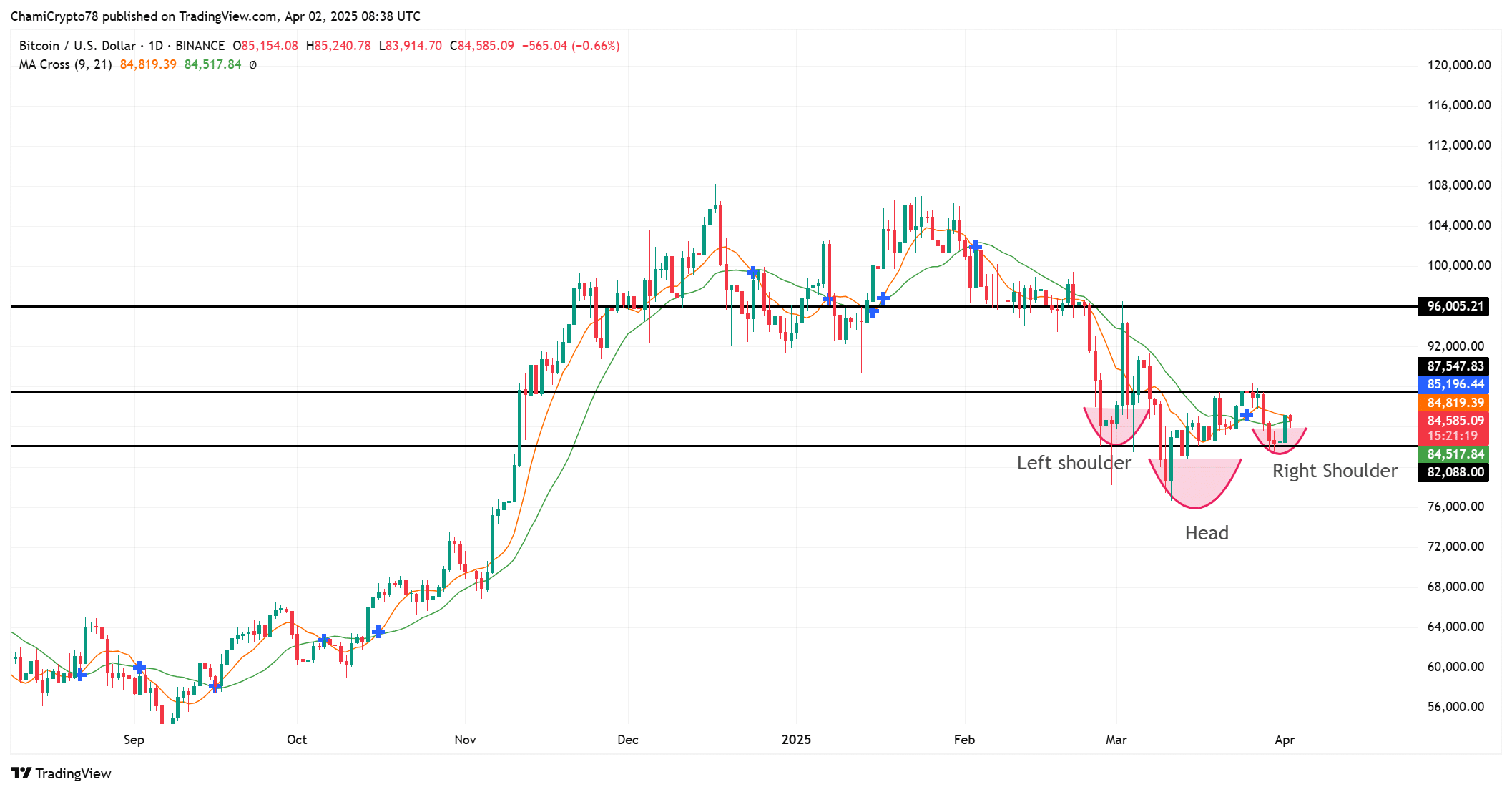

At press time, Bitcoin traded to $ 84,606.67 and registered a 0.75% profit over the past 24 hours. The latest recovery follows a previous dip that is triggered by Trump’s customs message.

More remarkable, at the time of writing, the BTC diagram reveals a reverse head and shoulder pattern, a hausse form that indicates a potential reversal. The neck is close to $ 87,547, which acts as an important resistance zone. If the Bulls manage to break over that level, the price measures can increase towards the $ 96.005 mark.

In addition, the 9/21 daily moving average crossover shows that the buying moment is strengthened. Therefore, technical indicators indicate that BTC can prepare for a breakout. Traders see volume spikes for confirmation.

BTC election activity – gathering institutions despite uncertainty?

Institutional demand for bitcoin shows a steady growth. The meta plane recently dedicated $ 160 BTC worth $ 13.3 million to its portfolio, which gave its total holding to 4,206 BTC. Similarly, Gamestop collected $ 1.48 billion to distribute specifically to Bitcoin for its Treasury.

In another major development, Texas legislators proposed a bill that advocated a BTC investment of $ 250 million for government reserves, which signals increasing political support.

These measures highlight growing confidence in bitcoin as a valuable store of wealth and a strategic asset. Despite market volatility, large units are increasing accumulation efforts, with electoral activity that runs long -term market trends.

Will Trump’s customs crash or fuel crypto?

While Trump’s “liberation day” duties initially caused volatility in crypto markets, the broader consequences suggest a different result.

Current trends on the chain, institutional accumulation and favorable technical indicators point to resilience rather than reducing. In addition, growing political recommendations and macroeconomic changes can place bitcoin as a hedge against traditional market disorders.