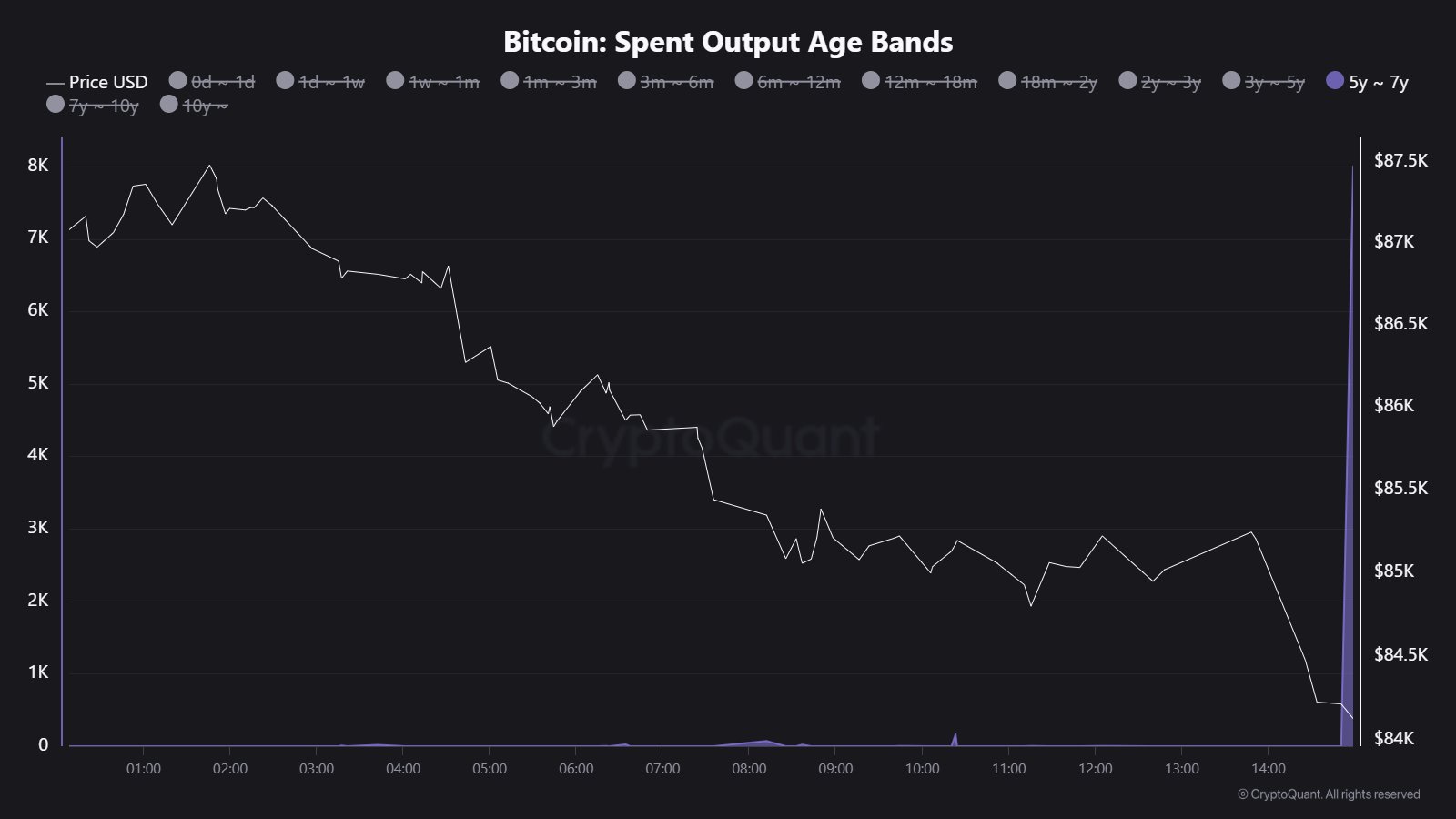

The popular cryptoquant analyst Maartunn reports that 8,000 Bitcoin (BTC) which has been dormant for five to seven years has suddenly been moved, which contributes to current baisse shops in the crypto. This development comes after a rather adventurous week when BTC prices fought to break over $ 89,000After an introductory steady rais -like climb, before underwent heavy sales prints driven by US President Donald Trump’s Hawkian tariff policy.

$ 674 million in old BTC transfers in single blocks – cause of alarms?

They used the production bands is a crucial metric for measuring how long the bitcoin tokens remain inactive before moving. According to Maartuun in a X post, This metric has recently revealed that $ 8,000 worth $ 674 million, which was last transferred between 2018 and 2020, has recently been moved in a single block that draws significant market attention.

This transfer follows a series of recent activations of dormant bitcoin stash. March 24, a 14-year inactive Bitcoin wallet Suddenly 100 bitcoin moved Valued at $ 8.5 million. At the same time, at the beginning of March, six ancient Bitcoin wallets also transferred almost 250 BTs worth $ 22 million.

Noteworthy is the latest transaction reported by Maartuun of much larger size with potentially strong consequences for an uncertain Bitcoin market. In general, a movement is usually interpreted by such a large amount of BTC from prolonged dormant as a signal for incoming sales prints leading to large price corrections.

However, there are other potential non-drilling motives behind such transactions as an internal wallet mixed by institutional investors or large holders and a cold reorganization. Currently, the owners of the new wallets that receive 8000 are unknown and reduce the potential of a BAIS reaction from BTC.

Bitcoin price overview

On the last day, Bitcoin prices fell by 4.00% after the US government announced intentions to introduce a 25% customs on branch gates and goods from China, Mexico and Canada from 3 April. This marks the latest negative reaction to the crypto market for President Trump’s international trade policy following similar incidents in early February and mid -March.

These measures from the Donald Trump administration are flaming fear of a potential economic slowdown that can further drive high risk assets as BTC from investors’ portfolios that lead to a further disadvantage.

At press time, Bitcoin currently deals with $ 83,693 and reflects a decline of 0.72% and 2.53% respectively in the last seven and 30 days, respectively. At the same time, the asset’s daily trade volume increases by 19.38% and is valued at $ 31.58 billion. BTC Market Cap is now at $ 1.66 trillion and still represents a dominant 61.1% of the total crypto market.

BTC trading to $ 83 727 on the daily chart | Source: BTCUSDT -Diaram on tradingview.com