- Although he is haussey, speedcoin can see a slight decline before continuing its market rally.

- Growing interest rates among market participants can drive the price even higher.

In the last day, Speedcoin (fartcoin) Has remained on the best winning list with a significant 18% rally, according to Coinmarketcap.

This gives its total price increase over the past month to 54%, despite turbulence on the broader market.

Ambcrypto’s analysis indicates that speeding coins up track is likely to continue, as the marketing entry shows active purchase and an increase in long positions.

A short slide before a run

Fartcoin’s price measure shows that the supply is on a causal path. However, it has encountered a key resistance zone to $ 0.522, which has previously triggered a fall in prices.

If a decline occurs, several support levels may enter the game, between the Fibonacci lines of $ 0.486 and $ 0.405.

A 50% retracing between these two end points would place the price of $ 0.461 (marked with a red line on the diagram), from which a renewed rally could be expected.

Ambcrypto’s analysis suggests that this trait is likely to be the mixed signals from technical indicators on the market.

Some price drop confirmed, continued driving likely

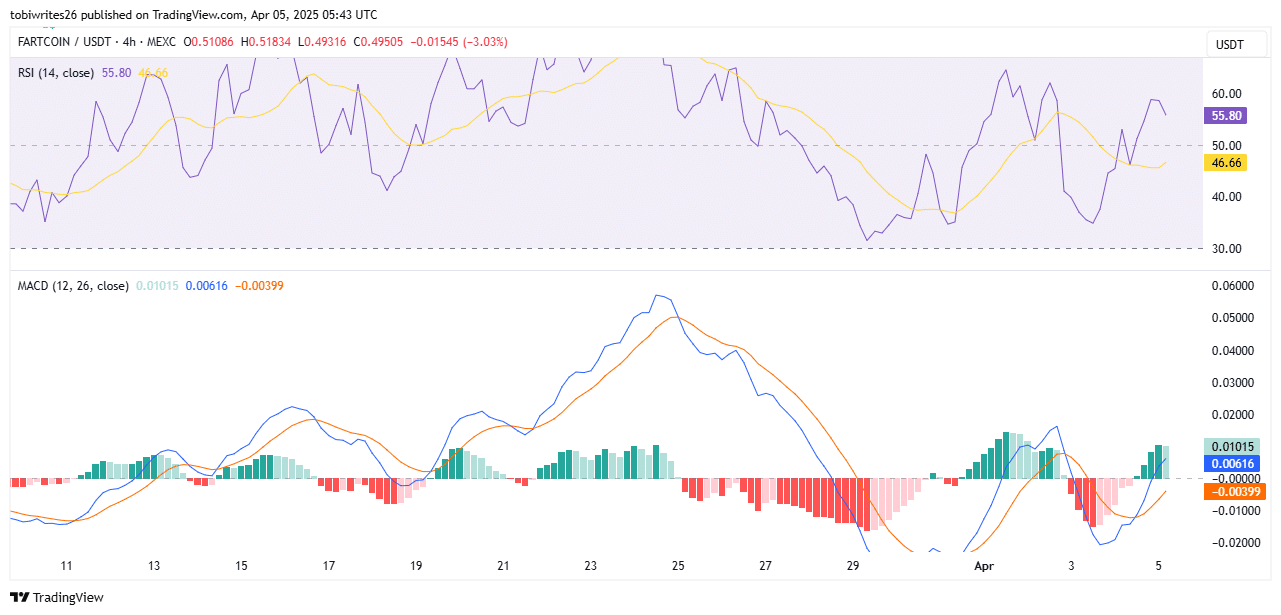

An analysis of technical indicators – relative Strength index (RSI) and moving average convergence diver’s (MACD) – confirmed a new path for speed coin.

RSI, which measures the speed and change of price movements to assess potential turns, suggests that a short -term case may occur.

However, it is important to note that the RSI line, despite dipping, remains above the 50 level, which indicates that the supply is still in hausse -like territory and the current decline is probably a minor retrace.

At the same time, MACD remained strongly Hausse. The MACD line (blue) has crossed into a positive territory with a reading of 0.00616, before the signal line (orange) at 0.00399.

The transfer of both indicators means that Fartcoin remained Hausse, with a potential for a strong rally if it hits the 50% retracing zone.

More Hausse -Tarted indicators show up

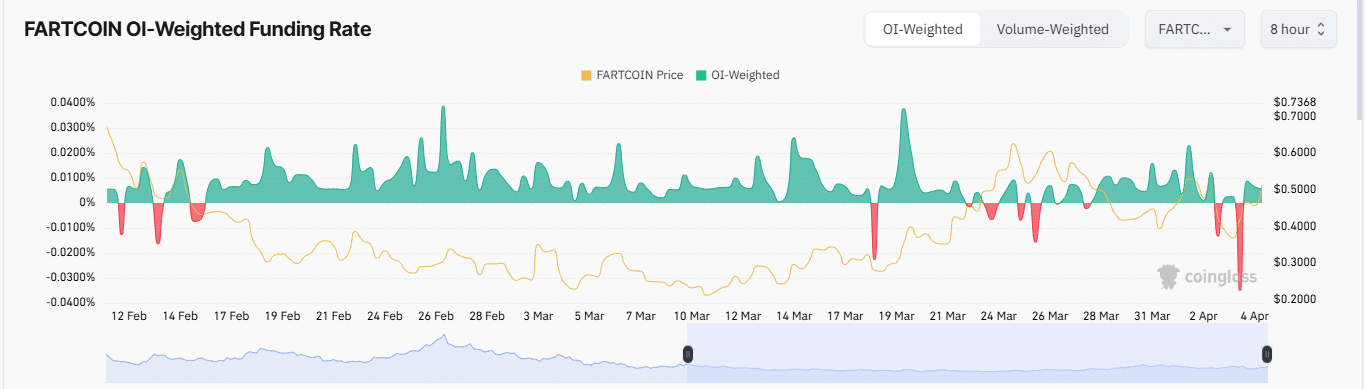

In the derivative market, the purchasing entrance remained strongly. The open interest -resistant financing rate has moved to a positive territory.

It was 0.0056% at the press time, which indicates that traders paid a premium to maintain long positions, which reinforced the hausseble outlook.

The market volume has also grown, with both general and derivative volume rising steadily.

At the time of writing, the total volume increased by 94.38% to $ 3.73 billion, indicating that the ongoing rally is supported by high speed.

The long-to-short relationship in the derivative market remained positive at 1,0004, which suggests that the volume of purchases exceeded the sales volume.