Key dealers

- CBOE BZX Exchange has submitted a proposal for Canary Sui ETF, the first ETF designed to track the performance of SUI Digital Asset.

- The SUI network’s fully diluted market captain exceeds $ 22.5 billion and the network uses a unique consensus mechanism called Narwhal and Bullshark.

Asset Manager Canary Capital seeks approval from SEC to start a location Sui Bytes traded fund that has features investment.

CBOE BZX exchange has submitted a 19B-4 forms to SEC, suggest a rule change to list and trading shares in Canary Sui ETF. This is the first proposed ETF designed to track the performance of SUI, the original coin in the prominent layer 1 network.

As mentioned in the archiving, ETF can be part of its holdings through reliable suppliers.

“The sponsor can play, or cause to be the stake, all or part of the SUI of the trust through one or more reliable felling suppliers. Given all efforts that Trust can get involved, confidence would receive all or part of the allocated rewards generated by having efforts that can be treated as income for confidence,” wrote. “

A asset manager who is keen to launch crypto-bound ETFs, Canary Capital Set a Delaware -confidence for its SUI product in early March. More than a week later the company left their First registration statement with sec, officially included in the SUI ETF race.

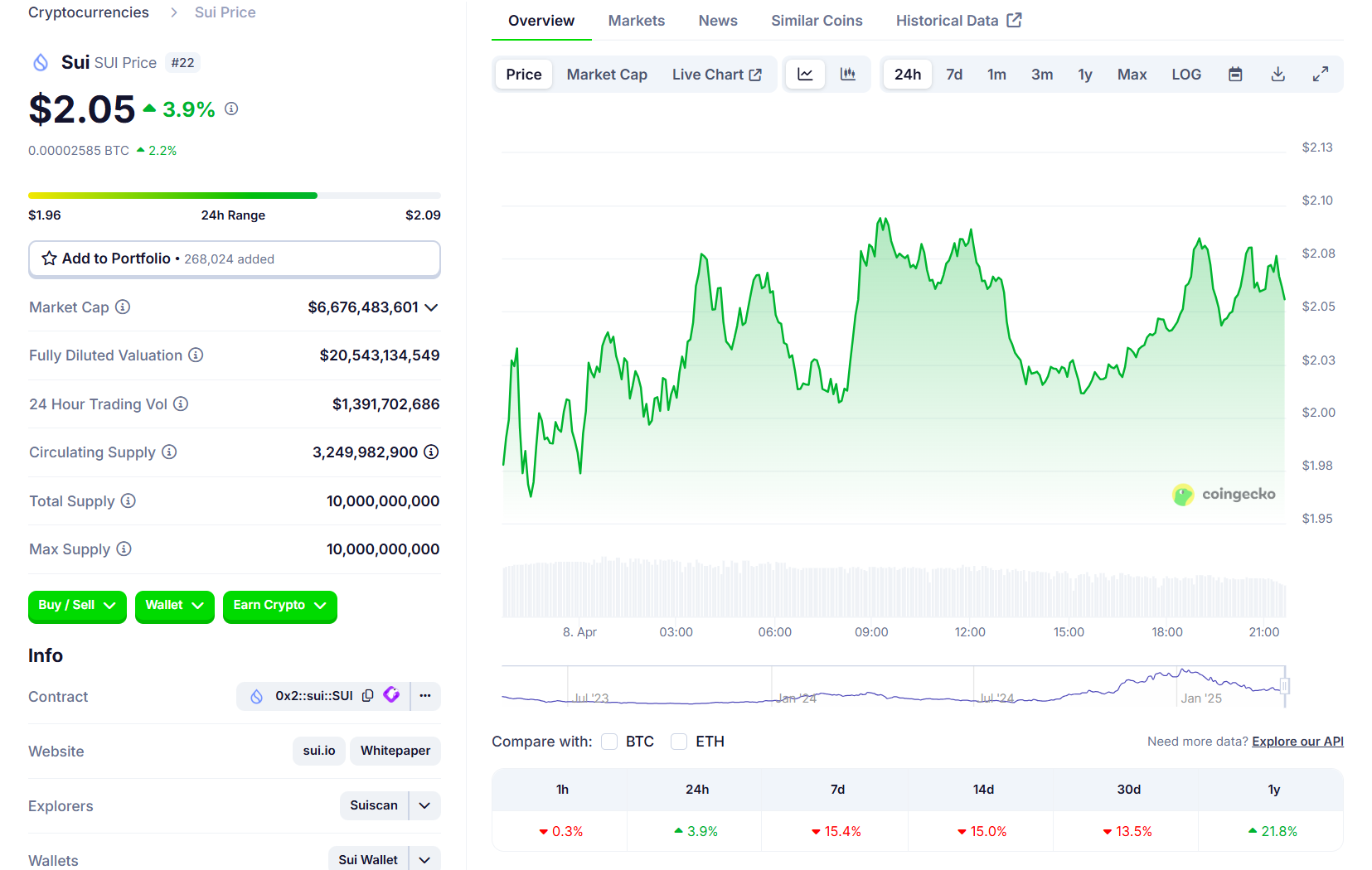

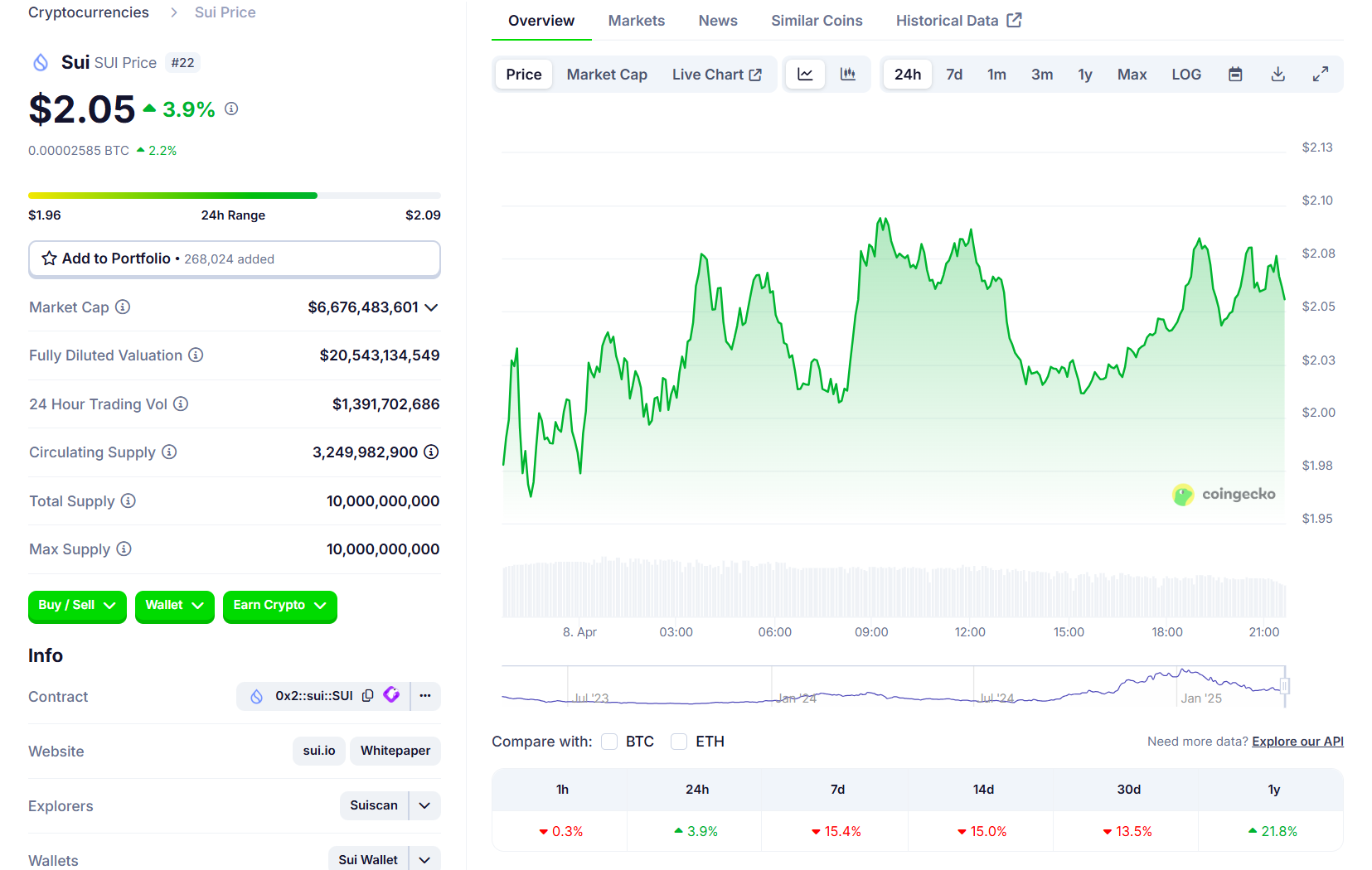

The proposed fund would trace spot prices on SUI, currently ranked as the 21st largest crypto supply with a market value of approximately $ 6.7 billion. Crypto access saw a minor increase after the new archiving support, For coytecko.

The proposal follows Sec’s approval of Tot Bitcoin and Ethereum ETF. CBOE stated that sufficient means exist to prevent fraud and manipulation, similar to the justifications accepted in the previous approvals.

Canary Capital accelerates its efforts to launch A suite of Crypto ETFS. The company examines many ETF products tied to other prominent assets, such as Litecoin, XRP, Solana and Hedera, to name a few.

The company’s driving force for one spot Sui ETF began shortly after the World Liberty Financial (WLFI)-Trump-Surrounding Crypto Company-recognized a Strategic partnership with SUI Blockchain for co -development new Products. WLFI also revealed plans to include SUI-based assets in its macro strategist.

Canary’s Litecoin ETF already has Appealed At Depository Trust and Clearing Corporation (DTCC) under Ticker LTCC, a sign that the preparations for launch may be underway.