The price of Bitcoin has had an interesting performance so far in 2025 and began the year with a run to a new highest time. However, the flagship Cryptocurrency ended the first quarter of the year with over 15% of its value shaved during the three months.

While the BTC price seems to be steady in a consolidation area, the forecast does not look positive for the world’s largest Cryptocurrency. This explains why several Short -term investors become frustrated And as a result, leave the market.

Is Bitcoin about to get up?

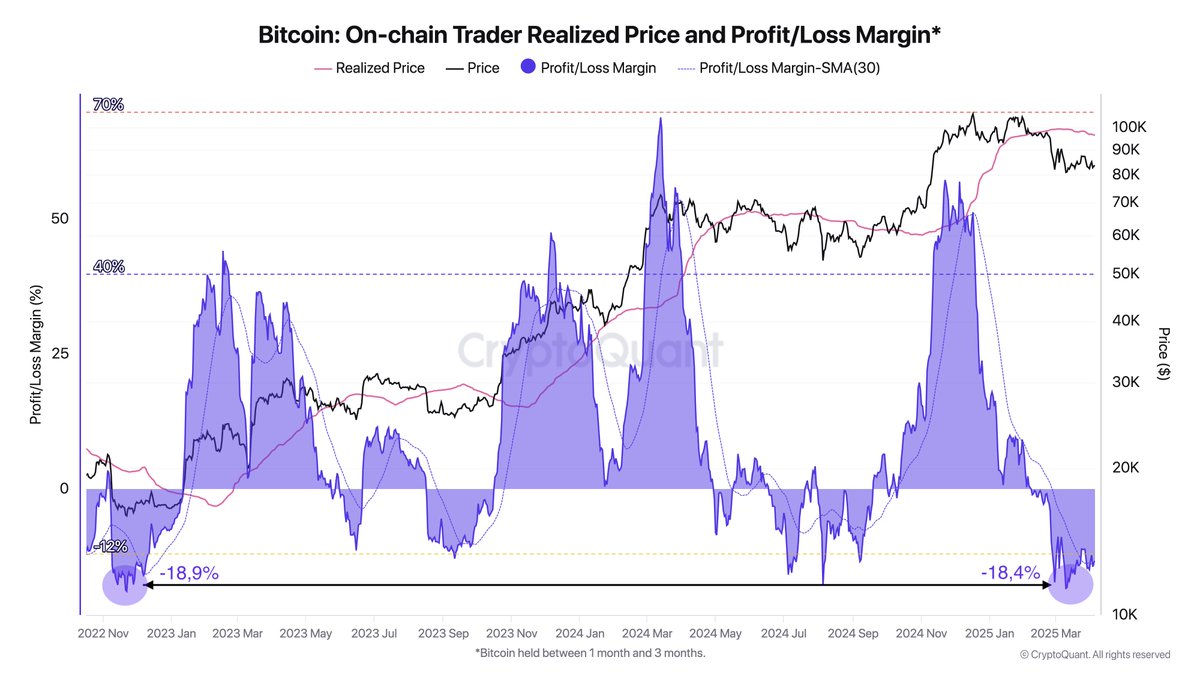

In a new post on the X platform, a chain analyst with pseudonym Darkfost revealed that a particular class Bitcoin holder has sold their assets with a loss. According to the Crypto Pundit, the sales take place at a speed that is not seen since the FTX collapse.

This observation on the chain is based on a significant reduction in the profit/loss margin, which tracks investors’ profitability by comparing their purchase price with the current price of a cryptocurrency. This metric provides insight into whether the market is in a state of unrealized profit or loss.

Specifically, Darkfost’s analysis focuses on Bitcoin investors who have held BTC for between one to three months (otherwise known as short-term holders). These traders are considered to be the most reactive class of holders, a trait highlighted by their latest activity.

Source: @Darkfost_Coc on X

According to Darkfost, BTC has short -term holders unloaded their coins with a loss since the beginning of February. These realized losses have now reached levels that last seen in the FTX crash and are even higher than the losses registered during the price assignment in 2024.

Historically Significant loss realization Substantial holders have preceded significant price movements upwards from Bitcoin, especially when long -term holders continue to gather. Therefore, the endurance of this trend means that long -term investors will take coins from the weak hands before the next hoped jump.

BTC price at a Look

From this writing, the price of BTC amounts to about $ 83,700, which reflects no significant change over the past 24 hours. According to data from Coytecko, the market leader is increased by 1% over the past seven days.

The price of Bitcoin is thickening around the $84,000 level on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.