- The market reacted quickly to Tulla break rumors, with large indexes and bitcoin increases.

- The recession is afraid, but analysts remain optimistic when it comes to Crypto’s resilience over traditional markets.

The broader market has been laughed by President Donald Trump’s customs plan, and the crypto market has also felt the impact.

In the midst of this turbulence, the latest rumors of a potential 90-day break in customs triggered a glimpse of hope for marketing return.

Trump believes that breaks in customs – fake or real?

April 7, one (now-line) post On X (formerly Twitter) of the “Walter Bloomberg” account, this speculation triggered. Posten quoted an interview with Kevin Hassett, an economic adviser for Trump. The post read:

“Hassett: Trump is considering a 90-day break in customs for all countries except China.”

Although the news was later proven falsely, it emphasized the potential impact that such a movement could have on the market term. If that happens, it can trigger a market resignation.

How did the market react?

Unexpectedly, the markets responded quickly to the now the news about a potential 90-day customs pass.

For those who were not conscious steps S&P 500 over 8%, Nasdaq climbed 9.5%and Dow Jones got 7%and added trillion to the stock market’s value in just minutes.

Bitcoin (BTC) Followed, nailed by 6.5% and topped short $ 80,000 before retiring.

However, the voltage was short -lived, as the White House “quick reply” account quickly secluded The claim as fake news, triggers a market sales.

In addition, Walter Bloomberg, the source of the misleading post, later confirmed The story was false and left the markets to re -calibrate again.

“The White House says that 90 -Day break in customs is” fake news “-cnbc”

How did society react to the fake news?

Although rumors were quickly debunk, Crypto Youtuber Lark Davis emphasized some important marketing in the section.

He emphasized that the market is eagerly embracing China trading negotiations as long as a resolution seems likely.

Davis also pointed out the market’s sensitivity and noted how even a smaller 90-day customs delay triggered an increase in shares and cryptocurrencies.

He said,, he said,

“Imagine now dozens of offers that happen to top players like India, Canada and the United Kingdom. Shit lots of money waiting for the sideline, ready to monkey at a moment.”

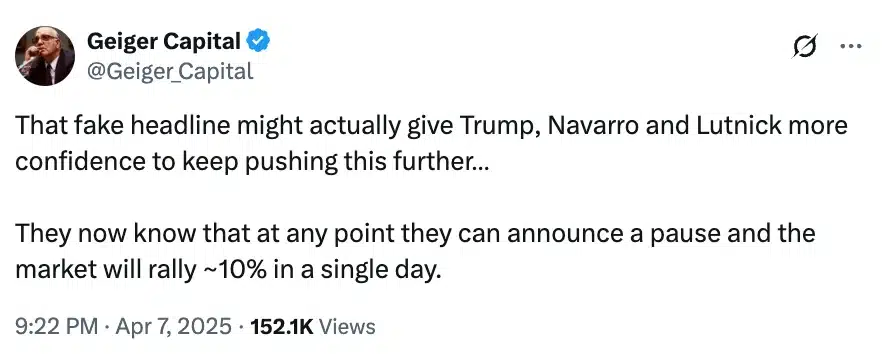

Adding fray, another X user, Geiger Capital, noted,

The aftermath of the fake news

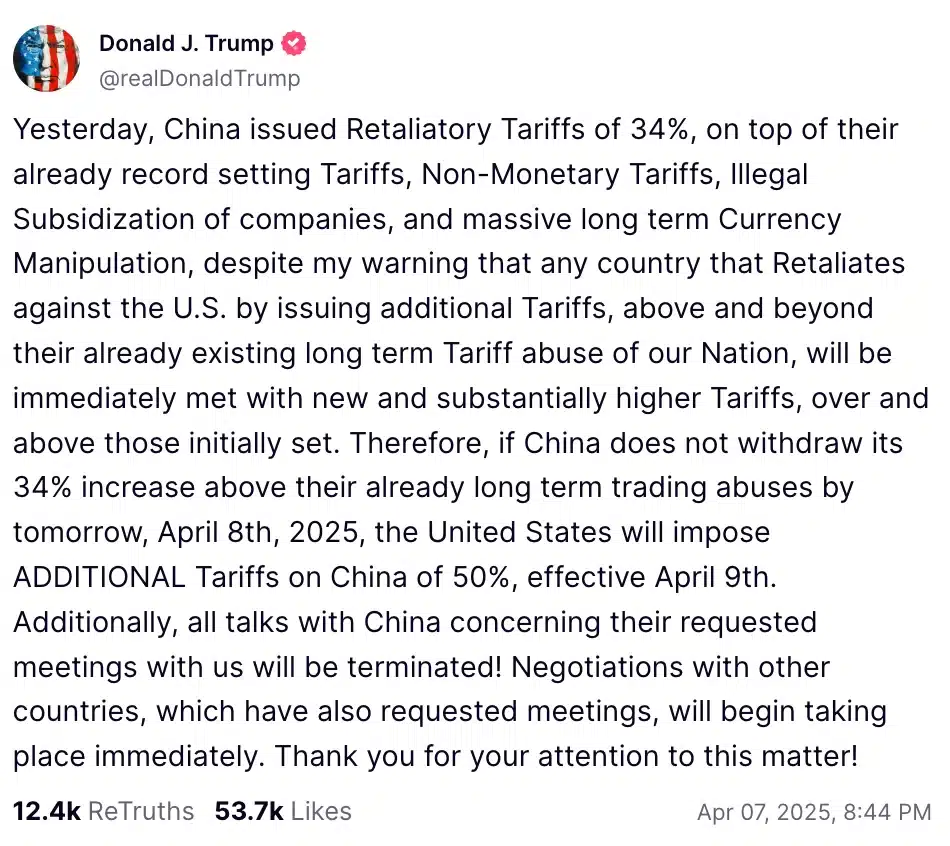

Shortly after the 90-day customs period of rumor was withdrawn, Trump took the truth social and warned China of potential additional tariffs.

He said,, he said,

In the midst of this, analyst Eric Weiss expressed optimism about Bitcoin and emphasized its potential despite the ongoing uncertainty.

“When the Customs War escalates and layers bleed, Wall St will eventually realize that there is an alternative: bitcoin.”

Refrening of the recession is rising, with prediction markets showing increased concern. The chance of an American recession in 2025 reached 64% on Kalshi and 61% on Poly brandt.

These figures are a significant jump from 20% earlier this year.

Despite economic uncertainty and escalating trade voltages, optimism remains. Analysts like Kevin Capital propose The crypto market can prove to be more resistant than traditional shares.