- Bitcoin, at press time, tested its upper channel limit when inflation cooled and Trump paused customs increases

- Valing activity and rising large transactions reinforced a potential outbreak over the key resistance

Bitcoin (BTC) Returns investors’ attention again after Trump’s customs pause and cooling inflation facilitated the macroeconomic pressure, which potentially creates the perfect set for a causal breakout. These two developments have led to renewed optimism in global markets, which has reduced the need for aggressive monetary sharpening and encourages a shift towards risk resources.

Therefore, Bitcoin – often favored as both a hedge and a growth supply – to take advantage of improvement in the background. When institutional appetite gradually returns, the price structure begins and the behavior of the chain reflects this renewed momentum.

Is Bitcoin ready to escape the falling channel?

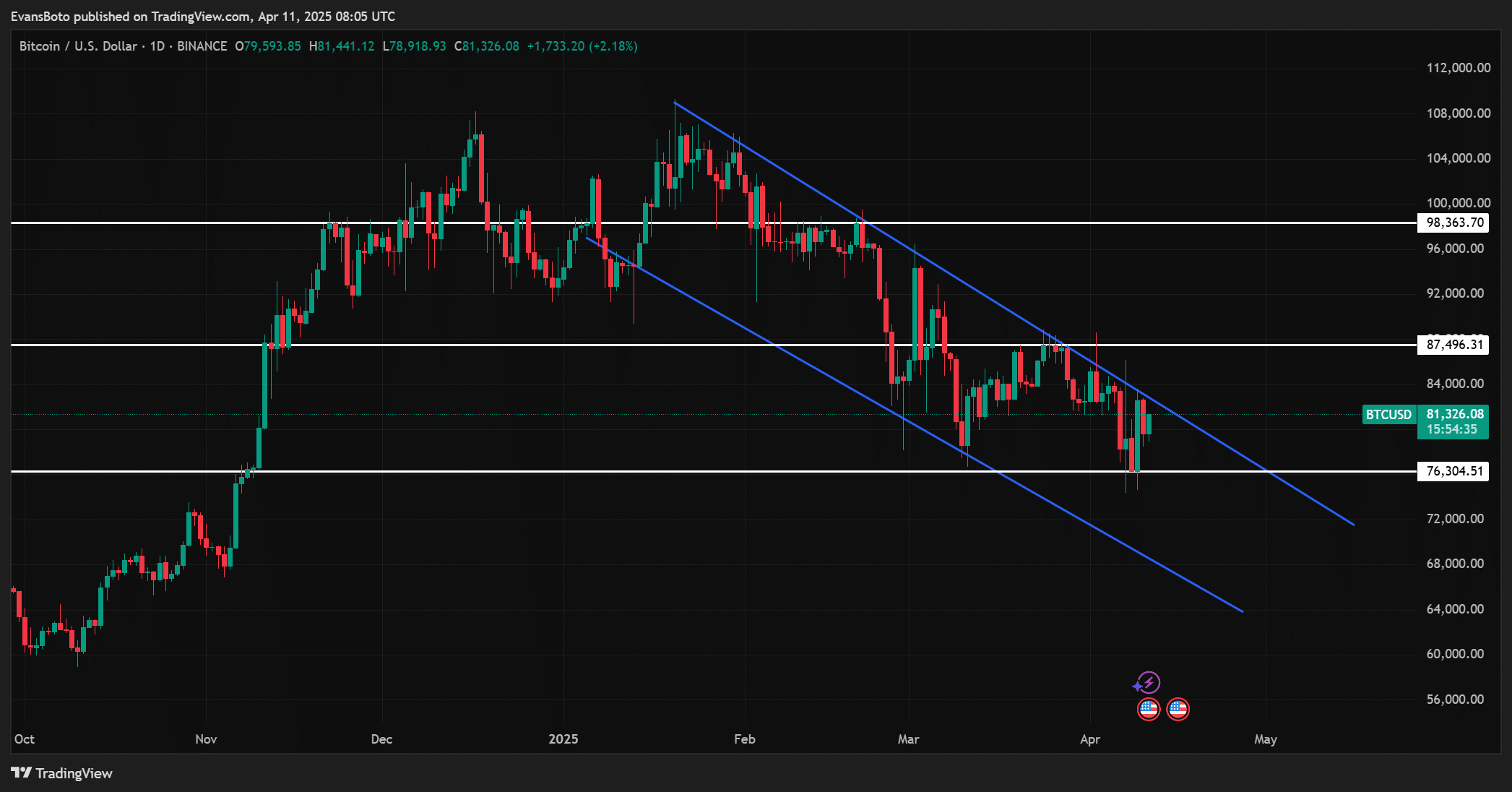

At the time of writing, Bitcoin traded to $ 81,614.11, a decrease of 0.15% over the past 24 hours. However, this little dip masks an important development on the chart. BTC seemed to test the upper limit of a falling channel after jumping off the $ 76 304 support.

A daily closing over $ 87 496 can confirm a breakout, potentially pushing the price against $ 98 363 resistance.

Therefore, the technical installation can lean Hausse, but only if buyers maintain pressure. If BTC fails to clear the channel, the risk of a relapse against its lower levels of support increases. Momentum has been built, but the confirmation remains the key.

What is the StableCoin supply quota’s signaling?

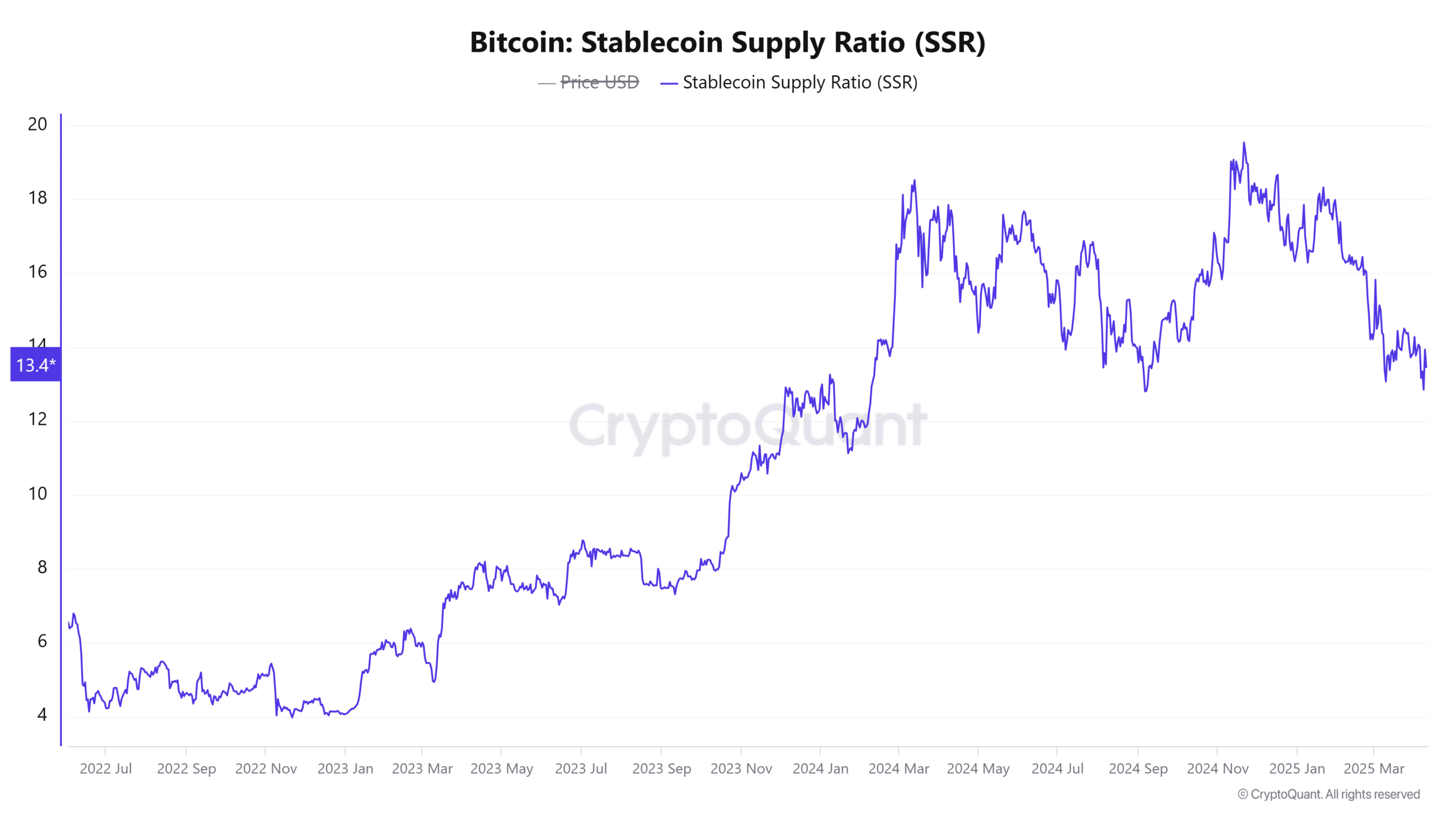

StableCoin -Supply Condition (SSR) rose at 0.97% to 13.40Which suggests some reduced purchasing power from Stablecoin’s relatively bitcoin’s market value. However, this hike has been moderate and does not indicate significant sales pressure.

Instead, it emphasized that capital can wait for a direction signal.

In addition, a stable SSR under a potential breakout scenario supports a healthier rally. Therefore, this metric seemed to only strengthen the idea that investors may be prepared to distribute funds. Especially when the technical outbreak has been confirmed.

What are bitcoin whales and institutions that signal?

Large BTC transactions increased by 1.28%, indicating the accumulation of whales or institutions. These units usually act before major price changes, and the hike in activity often precedes rally.

Therefore, this metric seemed to be in line with the hausse -like pressure formed on Bitcoin’s chart.

In addition, smart money tends to re -enter during consolidation phases. Such a top in transactions with high value further validated the possibility of a short -term outbreak.

It’s not all that lookonchain reported that a recent selection deposited 1,500 BTC ($ 120.29 million) to Binance. However, the choices still have 1,486 BTC, which signals retained exposure. This action reflects profit-making-not a complete output-after having previously collected BTC to $ 80,449 and sells some to $ 87,812.

Therefore, the behavior of the valence is a sign of confidence in Bitcoin’s strength in the longer term, despite trimming its resistance. Strategic outputs are normal in strong settings.

Conclusion

Bitcoin may be well positioned for a rebound. The combination of a customs break, cooling inflation, raising electoral activity and institutional positioning may have created a supportive environment for crypto.

While the outbreak still needs to be confirmed on the chart, all indicators seemed to suggest upward potential. Therefore, if BTC cleans the resistance, a sharp rally will be increasingly likely.