- BTC was able to meet a new ATH over the next three months, per macro analyst.

- The real MVRV value was 1.7, which indicates a small space for growth before BTC hits a local top.

Bitcoin (BTC) Has consolidated about $ 105,000 for four days, which signals a structure for an extra rally or probable relapse.

But analysts have made price calls for $ 135K- $ 200,000 over the next 3-6 months, with reference to improving the macrofront.

On May 12, BTC dumped 4% from $ 105,000 to $ 100.7K, a typical sale of news after US-China trade.

However, the asset turned the losses on May 13 after a modest 0.2% month-to-month April CPI inflation pressure, against the expected 0.3%.

The annual interest rate came in at 2.3%and fell below the forecast 2.4%, a positive view of Fed Rate lowered expectations from the third quarter.

Low inflation, positive macro to operate BTC?

In an e -mail message, 21Shares Crypto Investment Specialist David Hernandez told Ambcrypto,

“If this path (facilitating inflation, the nation state’s adoption) continues, price targets of $ 200,000 at the end of the year now seem increasingly realistic.”

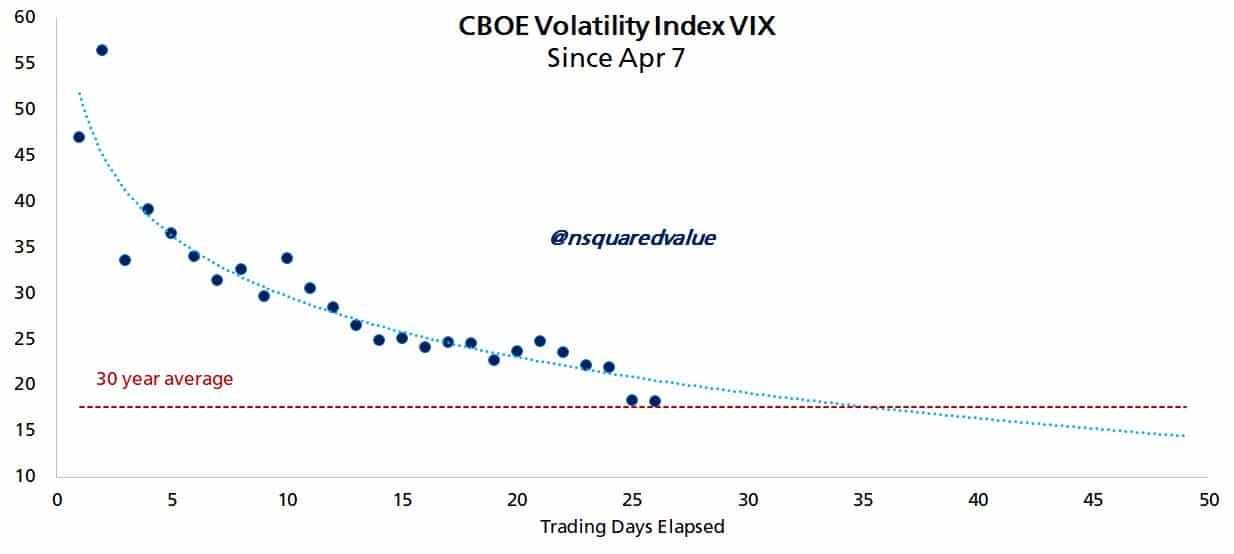

Likewise Timothy Peterson, a BTC network analyst, noted That the US and China trade agreement triggered Vix (Volatility Index) to fall to a “normal” 30-year average.

Vix decay and lower inflation was a perfect set for a “risk-on” rally, Peterson added.

“Inflation came just lower than expected. This will be a” risk of “environment for the foreseeable future.”

For the unknown, VIX traces future price fluctuations and, by extension, the market’s fear meter.

Simply put, with tariff in USA-China out of the way, Market Fear (Higher Vix) has been replaced by Risk-On (Lower Vix) sentiment.

In an x post On May 1, Peterson emphasized that a potential Vix dip to 18 could press BTC to $ 107K in 3 weeks and +$ 135K in 100 days.

“A continuation on this road, and Vix <= 18, means bitcoin to $ 107K in 2-3 weeks and $ 135,000+ in 100 days."

What is next in the short term?

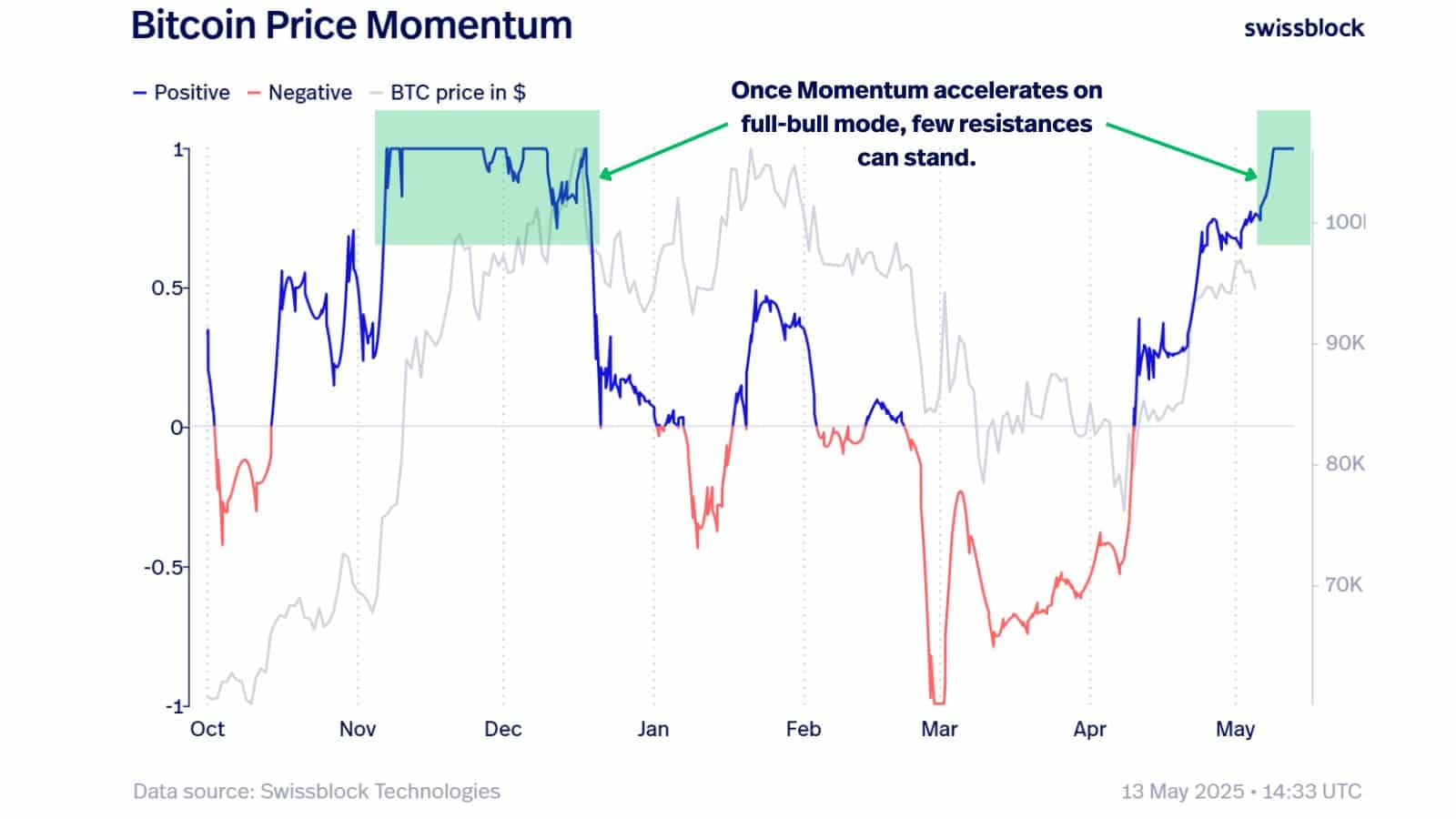

The jump to a new ath may, however, are not a smooth ride, according to one Report of the cryptocorm research company Swissblock.

The company previously quoted BTC Price Momentum and stated a potential correction to $ 104K $ 106K before a recovery to a record level was likely.

“Can $ BTC Press to unkind territory? A recovery can drive the next leg.”

The attached diagram showed that BTC was at full haissert speed, but current levels also highlighted a Rally retreat in November-December.

But True MVRV, a valuation metric that flagged early and late 2024 local tops and bottoms, was disagreed with Swissblock Outlook.

Source: Cryptoquant

The meters’ reading was 1.7, somewhat far from the potential local top level of 2. In other words, BTC still had room for growth before a probable massive dragback.

In the option market, traders placed themselves for both scenario.

Over the past 24 hours, the $ 95K alternative (baisse -like bets) was the largest after trade volume, while calling for $ 105,000 and $ 115K (Hausse with bets) ranked as second and third.

Said otherwise, traders expected BTC to meet $ 115,000 in May but were prepared for a potential dip to $ 95K.

Source: Derivative

All in all, the positive macro environment can drive additional risk-on-feel and drive BTC to a new ATH. However, there were still chances that BTC would dip under $ 100K.