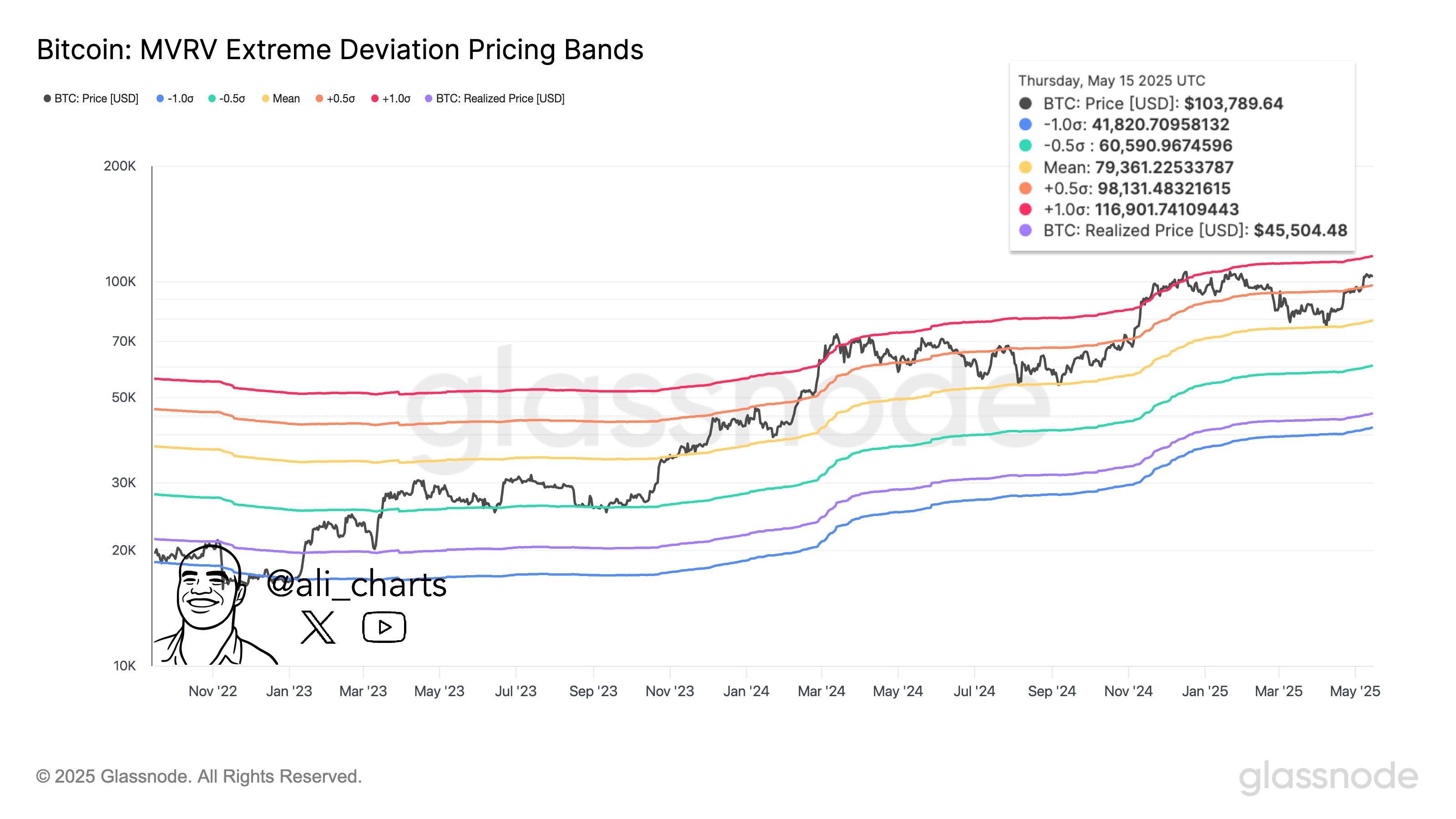

Prominent crypto analyst Ali Martinez has identified the immediate important Bitcoin price levels (BTC) using MVRV Extreme Deviation Pricing Bands model. Noteworthy, the main Cryptocurrency has remained in consolidation between $ 101,000- $ 104,000 for most of the week despite news about a 90-day customs pause between USA and China.

Price Band: Next resistance of $ 116 900, Support of $ 98,131

Bitcoin MVRV extremist deviation bands are statistical bands based on standard deviations of MVRV ratio from its historical average. They help identify extreme overvaluation and undervaluation in the Bitcoin market and are therefore useful tools to point out resistance and support levels.

According to Charts presented By Ali Martinez on May 16, Bitcoin is the next major resistance of $ 116 901, which is in line with +1σ (standard deviation) MVRV band. A price failure above this level would denote a risky overshadowing of BTC’s price and an overheated market, which suggests a lot of potential for profit.

On the other hand, Premier Cryptocurrency is immediate support about $ 98 131, represented by the 0.5σ MVRV band. A prolonged price measure above this level would indicate that Bitcoin remains in a haussey valuation zone. On the other hand, a price break below this level would suggest cooling speed or open the door for deeper retreat reports.

At the same time, the average MVRV band stands at $ 79 361 and acts as a real value anchor. If the BTC prices fall to this level, it would give the perfect accumulation option for a potential market recovery. However, the price falls to lower MVRV -bands at -0.5 fra ($ 60,590) and -1σ ($ 41,820) would indicate baisse -like retracates and bicycle bottoms respectively.

Bitcoin -holder sits at 120% unrealized profits

In second news, Martinez’s MVRV pricing band chart also shows that Bitcoin’s realized price is currently at $ 45 504. With the current market price, these data suggests that the average BTC investor is on significantly unrealized profit potentials as high as 120%.

At the time of writing, Bitcoin traverses $ 103,529 after a decline of 0.87% over the past 24 hours and 0.10% during the past week in the middle of the ongoing market consolidation. However, the main Cryptocurrency increases by 22.62% over the past week as haussearted forces remain dominant.

At present, Bitcoin is the next resistance of $ 105,000, a compelling price that is closed over which can stimulate another increase to the current holiday about $ 109,000. If BTC successfully breaks through both resistance levels, it would enter price -detected territory, which potentially accelerates gains to the estimated target about $ 117,000.

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.