- Bitcoin’s Open Interest Delta mimics patterns that preceded previous price increases.

- A dip in the 180-day delta can signal a market base or a new accumulation cycle.

Bitcoin’s (BTC) Open Interest Delta showed signs that may feel familiar to experienced traders.

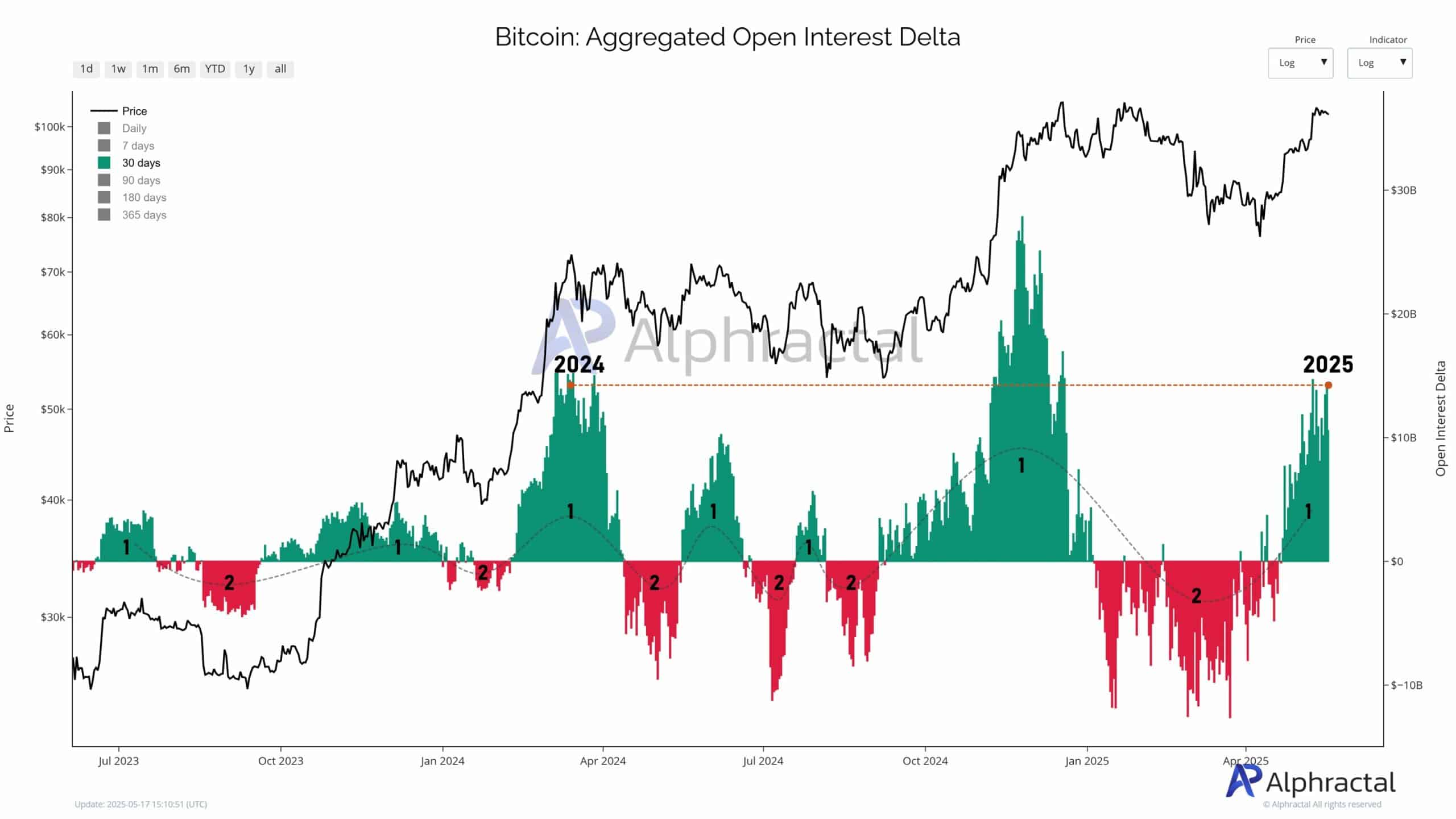

The 30-day consolidated delta reached levels that have not been seen since 2024, when Bitcoin jumped over $ 73,000 to reach its highest time.

That moment in history now seems to repeat, with the same pattern that pops up over the measurement values of the derivative.

Two clear phases play out

The open interest (OI) has generally been explained by analysts such as having two phases. Phase 1 is characterized by a rapid accumulation of positions – this usually shows a positive delta.

And then Phase 2, where the positions start to loosen and turn the delta to be negative. This back and forth process shows a rhythm of leverage and feeling.

At the time of writing, data from Alphractal shows that we may come into another phase 1. And as in previous Bitcoin Bull runs, the pace and form of this trend is observed.

What 180-day delta reveals

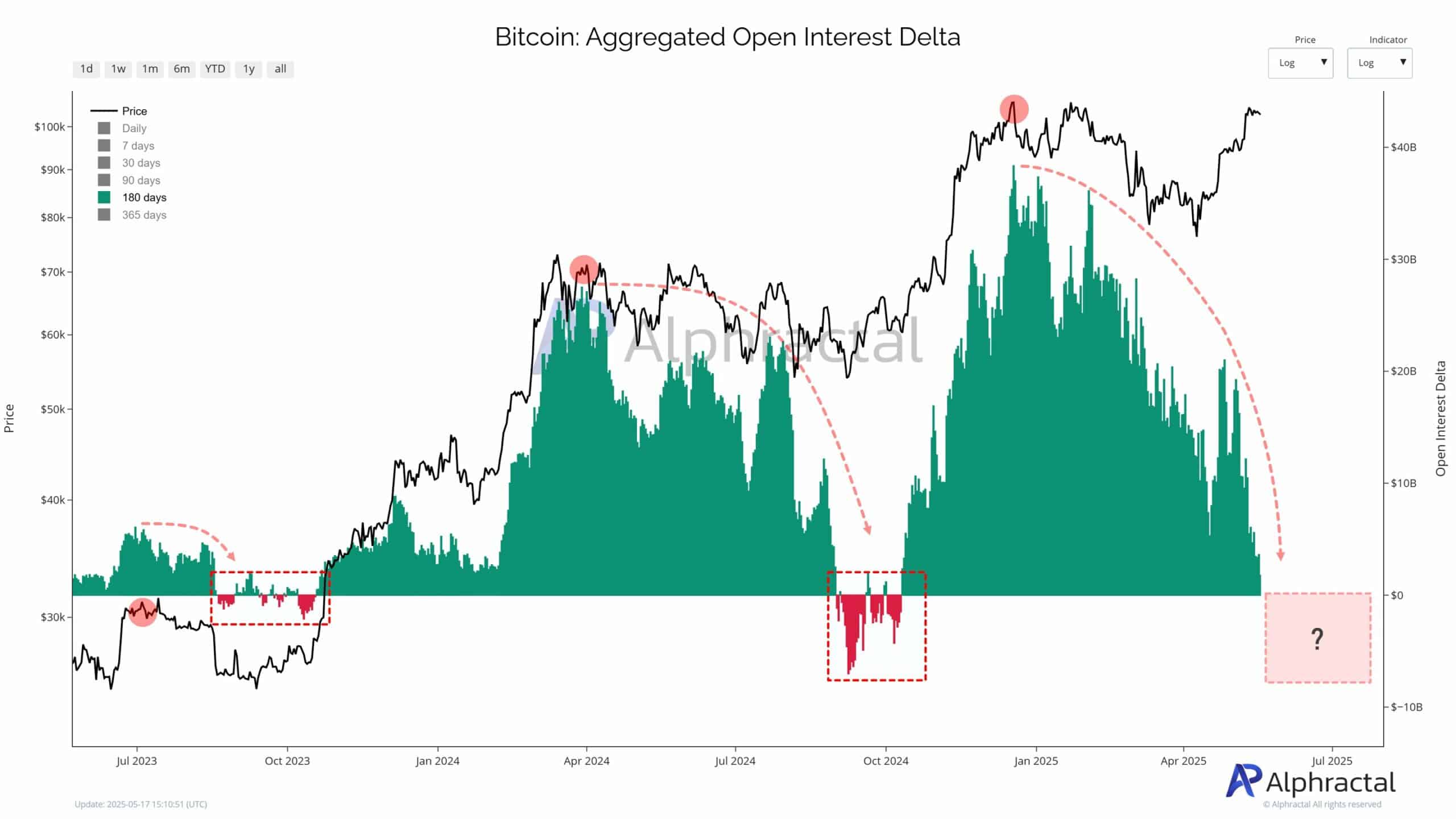

Given the short term, 180-day OI Deltaet is more informative.

Previously, sudden drops in the Bitcoin Delta roured massive liquidations. These events tend to suck through overlay long positions. Interestingly, they often coincide with the market floor.

At the press time, the 180-day delta floats just above zero. If it turns red, it can mark the beginning of another accumulation phase.

This transition is often where large investors begin to be silently uploaded.

Bitcoin whales follow a familiar pattern

Over the past two years, similar Delta shifts have preceded Stora Bitcoin -Rally, especially in October 2023 and early 2024. During these periods, aggressive Oi spikes signaled strong upward speed.

But this time the pattern has changed. OI has not increased as sharply, which indicates that big players take on a more cautious attitude.

This behavior is in line with how whales usually work – they drive market moments but pull strategically, which makes their movements important to look at.