- Bitcoin, who benefits from this development and progress in US legislation on Stablecoin, has reached a new highest time, an increase of 17.8% the year before.

- This increase was affected by facilitating global trade voltages, progress in StableCoin legislation and varying investors’ feelings in the midst of fiscal uncertainties.

The Cryptocurrency market witnessed significant development during the week until May 23, 2025, with Bitcoin, which reaches a new highest time. This increase was affected by facilitating global trade voltages, progress in Stablecoin legislation and varying investors emotions in the midst of fiscal uncertainties, as mentioned in Binance Research’s Weekly Market Commentary Report.

Market overview

The latest advances in trade conditions between US and China, including customs and selective cuts, have relieved market voltages and reduced immediate recession risks. Consequently, US shares have recovered most losses since the end of February, with the S&P 500 down only 1.0% the year before. Bitcoin, who benefits from this development and progress in US legislation on Stablecoin, has reached a new highest time, an increase of 17.8% the year before.

Despite the reduction of customs from top levels, the increased remains compared to war standards before trade. At the same time, the persistent federal reserve sharpening and higher market returns exhibit dual challenges: slow down growth among stubborn inflation and expansive financial expenses that can erode confidence in long-term tax sustainability. These factors have contributed to global fund flows moving away from the US dollar, with the DXY index down 8.3% year to date and a steeper tax chamber tax return curve that is likely to continue until the policy switches on improved financial control.

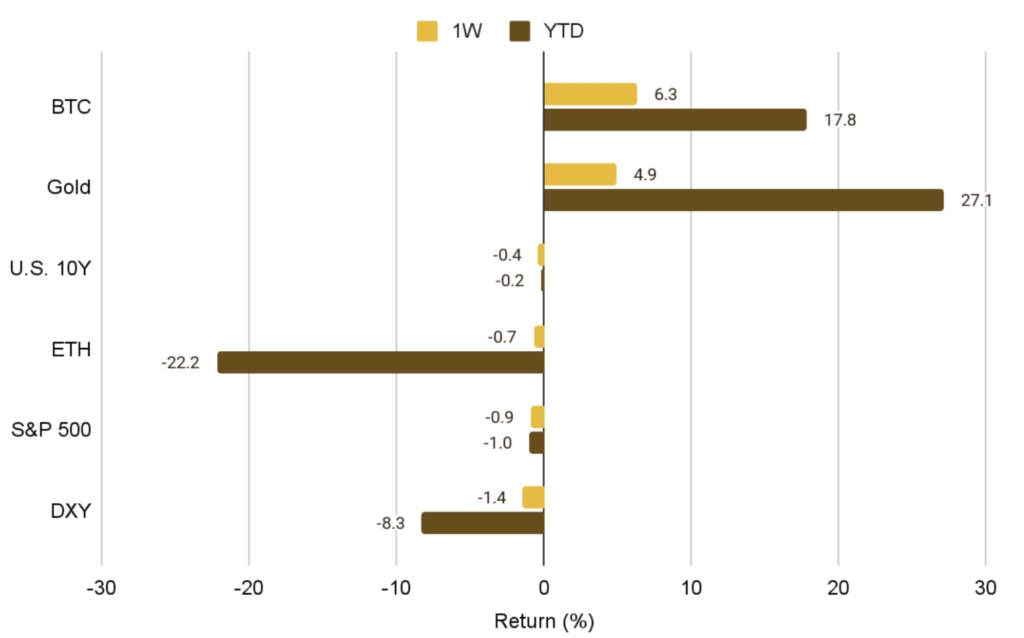

The latest market market reveals contrasting performance between asset classes. According to the weekly return data:

- Bitcoin (BTC) registered a profit of 1 week of 6.3%, which pushed its annual (YTD) return to 17.8%, which indicates continued investors’ confidence.

- Ethereum (ETH), however, saw a significant weekly case of 22.2%, giving its YTD performance to -0.7%, which reflects market volatility that is possibly linked to varying emotion or Ethereum -specific developments.

- Gold increased 4.9% a week, which increased its 27.1% surface growth, which maintained its role as a safe sea access to the midst of macroeconomic uncertainty.

- At the same time, traditional markets such as the S&P 500 and the US’s 10-year-old government funds post less declines, indicating the investor’s caution.

- The US dollar index (DXY) also fell by 1.4% for the week, with a wider YTD loss of 8.3%, which reflects weakening of the dollar force globally.

In the future, several macroeconomic and crypto events may form next week’s view. Important highlights include:

- May 22: US S&P Global Flash Services PMI and 20-year-old farmer-auction-critical indicators for US economic strength.

- May 23: Japan’s CPI edition will highlight inflation trends affecting the Bank of Japan politics.

- May 26: Fed Chairman Powell’s speech can provide important clues about future interest rates.

- May 27: Crypto enthusiasts will be close to watching the Bitcoin 2025 conference and Ethprag 2025, both potential sources for major announcements.

- May 29: US FOMC meeting protocol and Japan’s unemployment data will offer additional macroeconomic focus.

These data points and events are likely to drive volatility in both traditional and digital asset markets.

Digital assets

Ethereum (ETH), while it was largely flat this week, experienced a significant force of 43% last week and climbed from about $ 1,820 to $ 2,600. This marked its biggest 7-day win since 2021, when decentralized financing (Defi) first gained prominent.

Regulatory development: Genius Act

On May 19, 2025, the US Senate advanced Genius Act through a vote of 66-32 and paved the way for formal debate and changes. Although the bill is not yet final and requires additional senate and house approval, potential assumption may occur as early as July. The development has already led to a significant discussion about the crypto industry and is largely considered a positive signal.

- Definition of “Payment StableCoin”: Excludes the payment of stablecoins from securities and goods classification, which potentially affects Defi tokens.

- US issue and supervision: Only US-licensed units can issue payment Stablecoin’s domestic; The bill also proposes surveillance mechanisms for foreign issuers operating within US jurisdiction.

- Banking -like regulations: Issuers will be subject to regulation at bank level, with a three -year period for digital assets suppliers.

- Reserve requirements: Stablecoins must be supported by reserves in USD, government debt or similarly liquid assets.

- Prohibition on issuing returns: Licensed issuers cannot offer interest, which reinforces Stablecoins as a payment medium rather than an investment vehicle.

The proposed legislation introduces a clear regulatory framework for Stablecoins, is likely to improve market stability, legitimize the asset class and attract traditional financial institutions. As a global supervisor, the United States can also affect international standards and promote adaptation between jurisdictions.

Marketers

From May 23, 2025, global market value for Cryptocurrency amounts to $ 3.46 trillion, with 1.04% on the last day. Bitcoin traded between $ 107,250 and $ 111 959 in the last 24 hours, currently priced at $ 111 149, an increase of 0.42%.

Most major cryptocoirs through market value are traded. Market practitioners include WLD, Fold and Kernel, up with 19%, 15%and 13%respectively.

Conclusion

Over the past week, it has been crucial for the Cryptocurrency market, with Bitcoin that reaches new heights in the midst of facilitating trade voltages and significant regulatory developments. The development of Genius ACT signals a step towards clearer regulations, which potentially promotes greater stability and institutional participation in the crypto space. As the market continues to develop, investors and stakeholders will monitor this development and their consequences for the broader financial ecosystem.