On Thursday, Bitcoin (BTC) dipped awards to less than $ 101,000 as a fall between US President Donald Trump and the world’s richest man ELON MUSIC Rocked the American financial markets. Over the past 48 hours, however, Virgin Cryptocurrency has registered a rebound climbing to over $ 105,000 before slipping into a sideways movement. In the midst of this development, a popular crypto analyst with X pseudonym KnaxBT has described several scenarios for bitcoin next price action.

Behind Bitcoin’s Rebound from $ 100,000

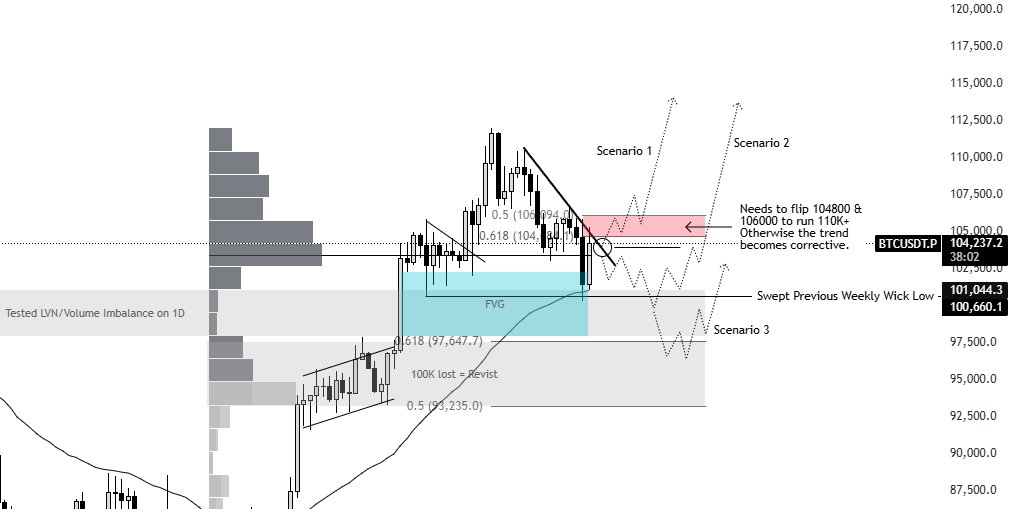

In one X post On June 7, KnaxBT provides a deep technical analysis of the Bitcoin market that discusses the latest price recovery and potential development forward. After reaching a new highest time close to $ 112,000 on May 22, BTC entered a corrective phase that fell by an estimated 10% in the price range of $ 100,000, before recently recovered over the past two days.

KillaxBT explains that this recovery is not random and was driven by a combination of technical and market factors. These factors include the daily FVG and volume balances, which are price-filled inefficiencies left on the chart.

In addition, it was a liquidity sweep when Bitcoin’s constant decline pressed prices during the previous weekly triggering many stop-losses from long positions. This development created a flushing of liquidity for large players who served as a fuel to run a market resort.

Finally, KnaxBT talks about a short squeeze installation where the Bitcoin market became shorter when the traders expected the further disadvantage after the initial price from $ 100,000. When prices started to go up, these short traders had to buy back to cover their losses and add more fuel to rally.

What now for BTC?

Given the future, KnaxBT has emphasized three potential scenarios for BTC. Currently, the analysts say that the main Cryptocurrency is testing a resistance zone between $ 104,800 $ 106,000 that adapts to 0.5-0,618 Fibonacci retracing levels in the latest price fall.

First, the scenario predicts KnaxBT a hausse article only if Bitcoin breaks and holds over this resistance region. Such a movement could catch short sellers again and potentially drive further upward speed.

But if Bitcoin is facing rejection in this specified resistance area, the second scenario will play, where the price will probably reduce and test the support level of $ 100,000. The third, last and worst case includes a price break below the $ 100,000 that leads Bitcoin to test for support zones around the $ 97,000 price region.

Interestingly, KnaxB’s personal projection expects market manufacturers to continue to drive Bitcoin’s price higher, which utilizes the latest sharp recovery that captured many short traders outside guard. Without clear “safe” long record still available, the analyst suggests to push prices would further catch more short sellers and at the same time force the side leaders to chase rally

At press time, BTC continues to trade at $ 105,600 and reflects a profit of 1.16% on the past day.

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.