Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

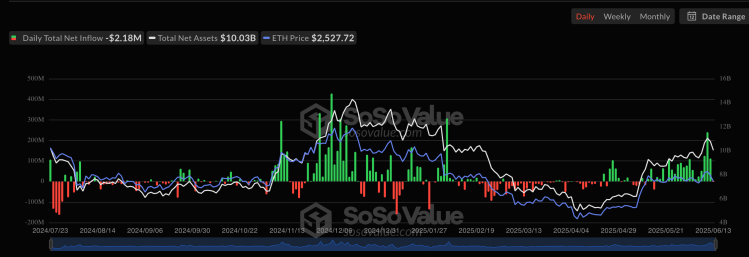

The Ethereum Prize has not been able to keep its red hot start to the second quarter of the year, with Altcoin’s value still quite a lot around where it was in early June. This slow performance comes, despite the consistent capital inflow that the US-based Spot Ethereum Exchange Funds (ETFS) has witnessed over the past four weeks.

ETFS SNAP 19-day positive inflow dashes

But this positive record ended on Friday, June 13, with the Spot ETFs who registered their first network outflow in the last 20 days. According to the latest market data, the crypto-linked financial products published a total daily net outflow of $ 2.14 million to close the week.

This round of withdrawals can be linked to the escalating tensions between Israel and Iran on Thursday evening, with risk resources such as crypto and shares that know most of the influence. Data from Sosovalue Shows that Fidelity Ethereum Fund (with Ticker Feth) contributed to most of the withdrawals during the day and registered a net outflow of $ 8.85 million.

Grayscales Ethereum Mini Trust (ETH) was the only other fund that registered any significant business and published a positive net inflow of $ 6.67 million on Friday. Cumulatively led the activities for these two exchange traded funds to a negative outflow day and ended the 19-day positive inflow.

Yet this single day performance barely a tooth in Ethereum ETFS record in the last weekwhich is $ 528.12 million. This significant performance extends the weekly funds’ weekly streaks to five weeks with positive inflow-registration a total capital inflow of $ 1,384 billion in this range.

Ethereum -Price and growing location ETF demand

As can be seen from Bitcoin and its Spot ETFs, the Ethereum Prize tends to respond to the operations of the ETH exchange traded funds. As such, periods of significant capital inflows for Spot ETFs have been correlated with upward price movements for crypto courses.

The price of Ethereum, however, did not follow exactly this trend during its last 19-day period with significant capital inflows. This positive line started on May 16, with the Ethereum price between $ 2500 and $ 2,600 region on the day.

While the Altcoin price has exceeded this level since then, it has not been able to mount a long -term upward. Recently, the Ethereum price broke over $ 2,800 on Thursday, June 12, before crashing down to $ 2500 due to the military measures in Asia.

From this writing, the price of ETH amounts to about $ 2511, which reflects an over 1% decline over the past 24 hours. With the Ethereum Prize still quite a lot where it was at the beginning of the positive ETF inflow, there is a concern for what can hold back the second largest cryptocurrency.

Featured Image Created by Dall-E, Chart from TradingView