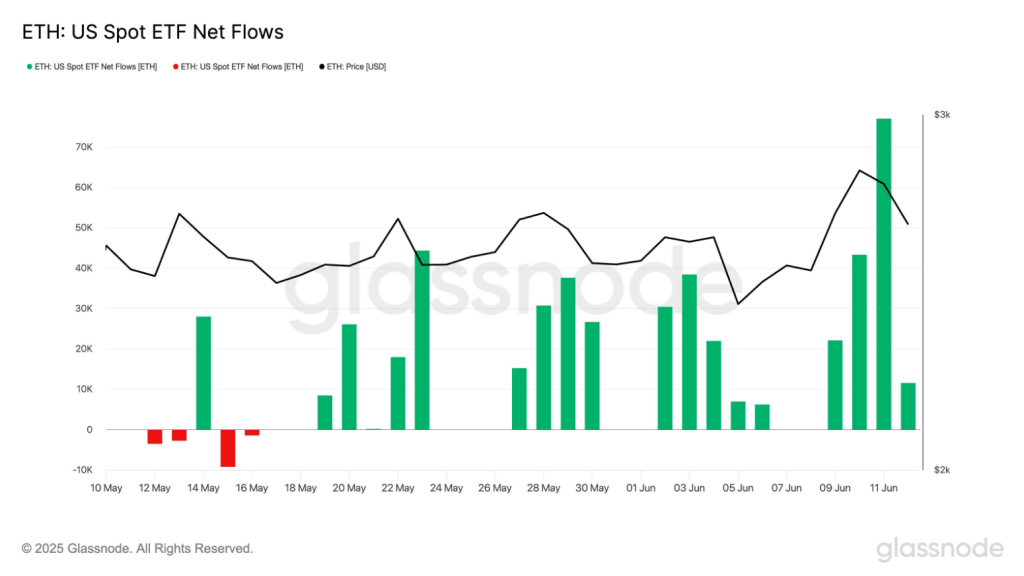

The US Spot Ethereum ETFs have attracted a sharp increase in new capital this week and has raised 154,000 ETH in the last seven days – about five times their last weekly average. However, Bitcoin funds managed only 7,800 BTC during the same period.

That gap points to a growing interest in Ethereum’s broader uses, from Defi to sticking rewards, as large investors think about their crypto allocations.

Rising ETF inflows point to varying bets

Based on reports on June 11 was a prominent day for Ethereum. Spot ETFs withdrew a record 77,000 ETH in a single session and marked the highest daily sum for the token so far this month.

Investors are looking at when the price edges close to the $ 3000 brand. A push -past that level can stimulate more purchases, especially if inflow remains strong.

$ Spot ETFs are heated. Only this week they’ve seen 154K #Eth In inflows – 5X higher than their latest weekly average. For context: the biggest single day $ The inflow this month was 77k #Eth June 11. pic.twitter.com/8xlerbc6gx

– ice cream node (@glassnode) June 13, 2025

Ethereum staking adds appeal

Another factor to play is investment. Holders can unlock ETH to secure the network and earn rewards. The word spreads that some ETFs can soon offer staking -activated shares.

This installation can make Ethereum products more attractive than Bitcoin funds, where not an option. Returned buyers may find that extra increase is hard to withstand.

Ethereum’s second -wire solutions also pay attention to. Protocols such as optimism and arbitrum lower fees and speed up transactions. This improvement is to draw more developers and users this week.

When these collections are steaming, the network’s real usability continues to climb. For portfolio managers, the growing ecosystem may look like a strong reason to support ETH.

Bitcoin flows are after

Bitcoin Still dominating in total ETF assets, but inflows have been flat lately. 7,800 BTC added this week tops the week’s usual figure and falls during May 23 a day’s height of 7,900 BTC.

In early June, some means even saw redemption, which caused flows to jump around from day to day. That volatility can drive certain institutions to explore alternatives.

Image: SKapl/iStockphoto/Getty Images

Analysts point out that investors are chasing to tokens with real world use and upward potential. Ethereum’s role in decentralized funding, non -friendly tokens and smart contracts gives it a versatile edge.

Image from Unsplash, charts from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.