- Ethereum’s Network Activity and Valancing Handed Haussely Spite In spite of the range of range

- Rising scarcity and speculative demand for cooling can support a long -term outbreak over $ 2,833

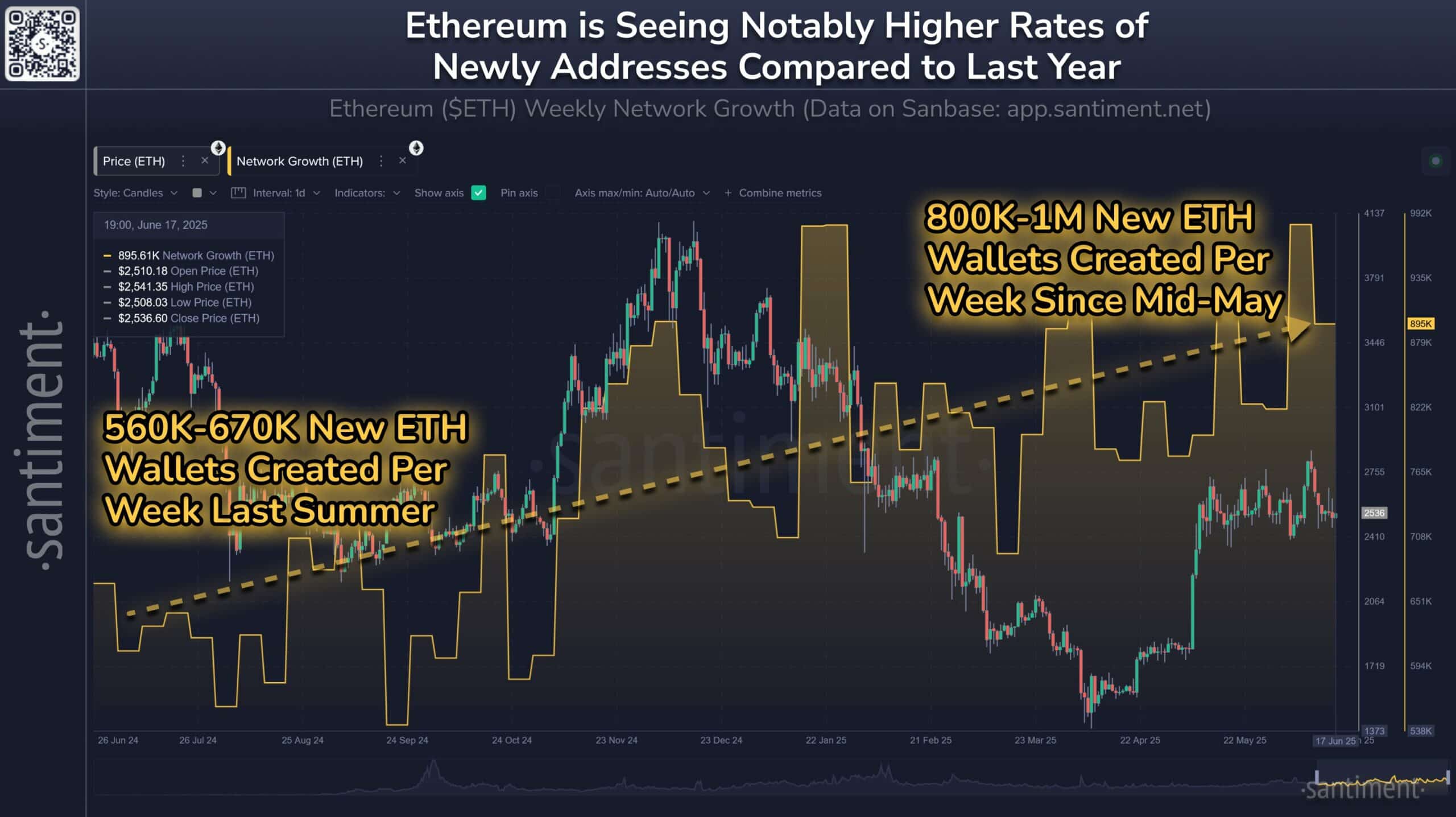

Ethereum (ETH) Have seen a consistent at the top of the week’s address creation lately, everything between 800k and 1 m since mid-May-up from 560K-670K this time last year.

With ETH trading within a narrow band close to $ 2500, surge In new wallets, this may mean that the network’s basic factors are strengthened quickly.

A hike in the user’s participation often signals deeper benefit adoption, especially when wallet creation grows together with stable price measures.

Therefore, Ethereum’s expanding network base can serve as a basis for stronger demand and long -term valuation support.

Returns will be silent to gather ETH?

Large holders Netflows have turned sharply over the past week and increased by over 7,400% after weeks of muted activity. This nail followed a prolonged period of negative flows, which may have signaled distribution or relocation.

Now the renewed inflow can mean growing confidence among whales. This trend also seemed to coincide with stable price support, which possibly reflects strategic accumulation.

In addition, this electoral behavior can precede a livelihood crash if the trend continues. Therefore, the latest accumulation trend of large holders can signal the beginning of a more haus phase.

Will Ethereum’s price break from its consolidation pattern?

ETH has remained locked up in an interval between $ 2,396 and $ 2,833, which respects a rising channel structure.

Despite several attempts, bulls have struggled to break the resistance of $ 2,833, while bears have failed to break below $ 2,396 support. This price compression reflects determination, but something similar often precedes explosive movement.

At the time of writing, the stochastic RSI was low – which meant an incoming reversal to buy the pressure increases. Until a breakout occurs, the price will probably swing in this tight zone. However, growing grounds can soon tip the balance.

Does ETH change from short -term hype to long -term value?

Finally, ETH’s short-term holding activity, measured by 0-1, realized Cap Hodl waves, a decline after weeks with sharp nails. This suggested that the latest buyers may be to leave or take profits, reduce short -term volatility and facilitate sales pressure.

At the same time, ETH’s warehouse-to-feed ratio increased to 43.2-it is maximum at the month-which indicates the growing scarcity when a new issue subscribed.

This combination of bleaching speculative behavior and rising long -term value measured values can set the stage for a more sustainable upward movement.

If long -term demand persists, it may soon break its current price ceiling and switch to the accumulation area.

Is Ethereum gear for a breakout in addition to $ 2,800?

Ethereum’s The strength of the chain is becoming increasingly difficult to ignore. With new wallet-creating accelerating, whales that return and scarcity metrics such as Stock-to-Flow Spiing, the basics can adapt to a potential rally.

While the price remains captured within a defined interval, the rising network activity and the declining short -term holder can soon move the balance. If haussearted pressure holds, ETH can break over $ 2,800.