Ethereum (ETH) has dropped 13.6% over the past week, largely due to rising geopolitical tensions in the Middle East, especially between Israel and Iran. Despite the recent price decline, Ethereum whales seem unwanted, which signals confidence in the long-term recovery of digital asset.

ETHEREUM WALKS ARE NOT SCAID DOES THE LESS LESS

According to a recent cryptoquant quicktake post by technical trader Mignolet, ETH whales are unclear of the latest Price back In Cryptocurrency. Noteworthy, digital asset has dropped from $ 2,869 on June 11 to the middle of the $ 2,200 area at the time of writing.

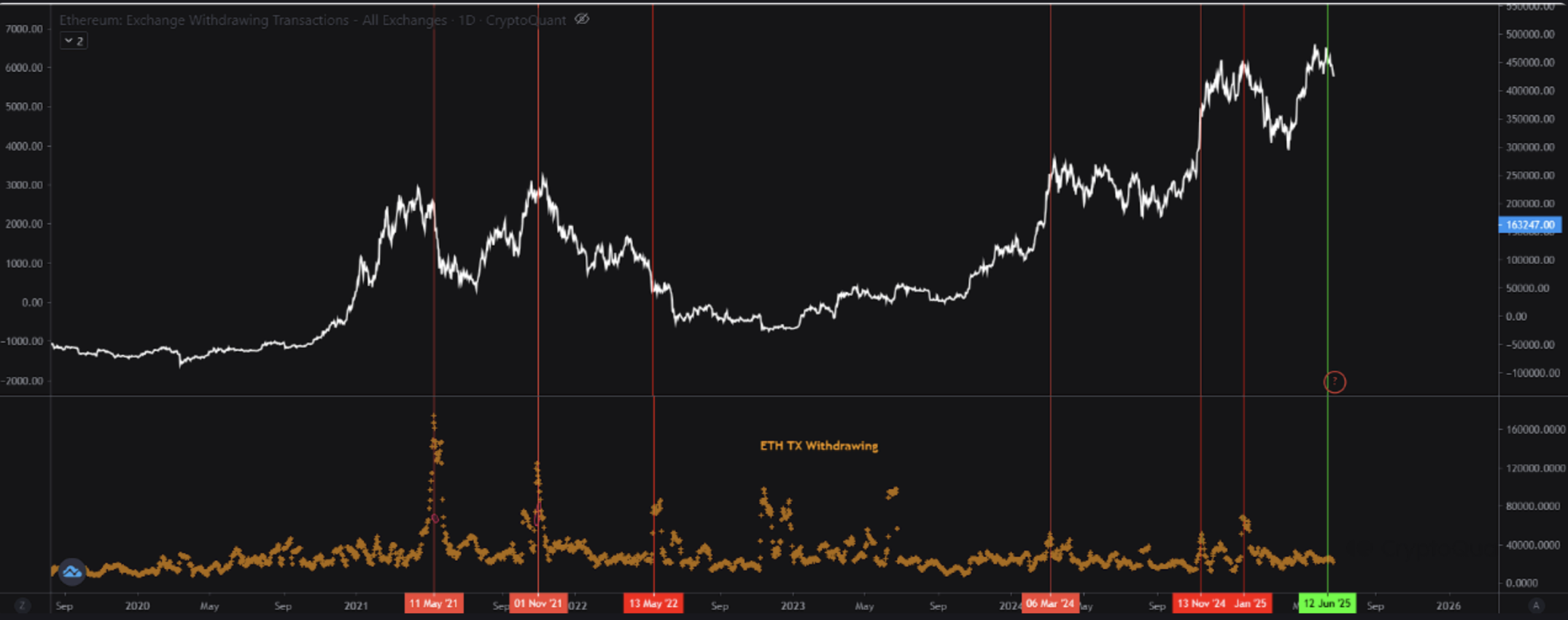

Unlike the double top pattern observed in 2021, Ethereum saw a remarkable increase in transaction outflows when whales went out near the top-thyge current data that whales do not make similar features.

The analyst shared the following comparative charts that showed that in previous market cycles, nails were followed in ETH outlets from wallets usually by large price assignments. However, such nails are currently absent, which suggests low starting activity.

In a recent post about X, crypto analyst Ted cushions Added Further support for this view and says that Ethereum whales actually buy the dip. According to the analyst, wallets holding 10,000 ETH or more collectively added over $ 265 million in ETH during the market recovery on June 21.

Still, pillows warned that if ETH does not break over the $ 2,350 resistance level soon, it can go through the $ 2,100 support. A failure to keep this level can expose the supply to a further decline compared to $ 1,800.

On the other hand, crypto dealers Merlijn Trader offered a more optimistic tag. The analyst compared Ethereum’s current price behavior with the accumulation phase seen between 2019 and 2021, with the task that “ETH to five figures is not a dream”, which means that a long -term causal vision remains intact.

Heads brewing for ETH?

Although technical indicators point Towards further upward for the second largest Cryptocurrency through market cases, some market experts believe that ETH may be about to enter a period of downward before resuming its haus -like path.

For example, experienced crypto -market expert Aksel Kibar recently commented that ETH can prepare for a period of significant decline. The analyst gave a sharp warning that ETH might fall all the way down to $ 900.

Similarly rising sales volume for ETH threatens To further disrupt the positive price of digital asset. At press time, ETH is $ 2,233, an increase of 2.4% over the past 24 hours.

Featured image from unsplash.com, charts from Cryptoquant, X and tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.