- Solana Whale sold 240,000 tokens worth $ 35 million.

- Retail investors gather, with Netflow dropping to $ -19.69 million.

After trying a breakout, Solana (sun) Met a rejection of around $ 154 and recalled to a low of $ 149, at press time. This reflected intensively downward pressure.

When Altcoin continues to fight on its price charts, whales and institutions become impatient.

Dump big units Solana?

According to LookonchainA election wallet undamaged 1 million Sol – Words $ 139 million – nine days ago. Since then, the elections have sold 240,000 sun valued at $ 35 million.

Such aggressive sales usually signal to weaken the market’s conviction. In this case, it suggests that whales lose confidence in the Altcoin view.

That said, whales not only sell, but also take a step back on the market. When we investigate Solana’s average order size, it seems that whales have disappeared completely.

With existing whales that sell, together with disappearing large election orders, it indicates that large units are becoming more and more Baisse.

However, retailing feels different

Interestingly, while Solana whales sell, small-scale traders take the accumulation road. Solanas Netflow declined to negative territory after two days in a row with positive Netflow.

According to Coinglass -data, Solanas Spot Netflow has dropped to -19.69 million at press time. When Netflow drops to negative, it usually indicates accumulation and decreasing risk of the sales side.

This type of market behavior has historically preceded upward continuation, especially when the markets are on the verge of a potential trend shift.

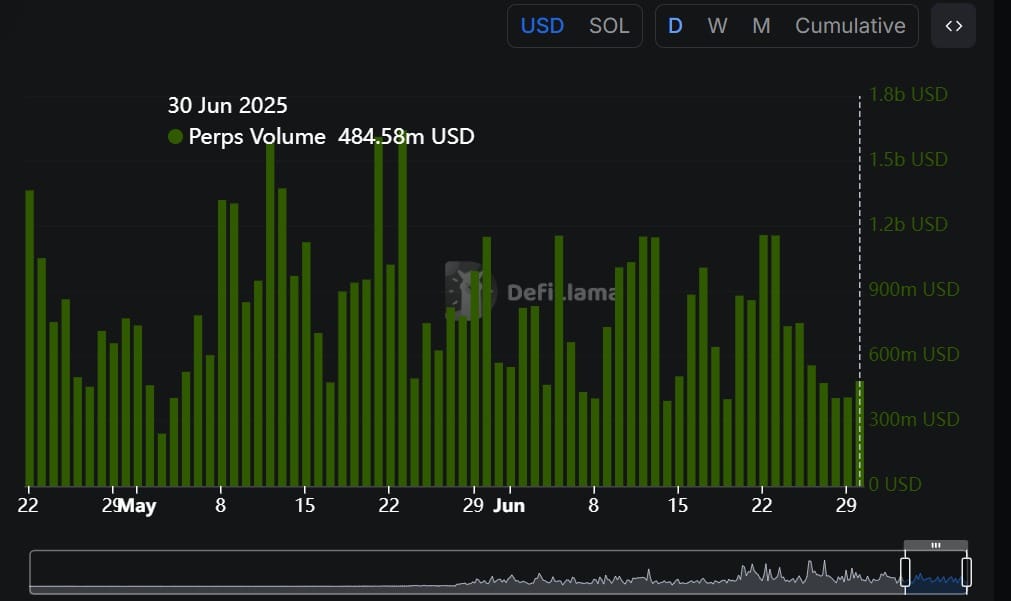

In addition to exchange activities, future markets are re -picking up Steam.

After a four -day decline, the eternal futures volume has recovered to $ 484 million at the time of writing.

A peak in eternal volume usually indicates growing speculative interest, with traders that open utilized long or short positions. This increase proposes an increase in short -term trade activity and increased market engagement.

Should you worry?

According to Ambcrypto, while some whales sell, there is no strong evidence of widespread institutional or large -scale value dumping in the sun at the moment.

This sale seems to be part of a broader trend of rotation and profit, rather than panic outputs. In fact, many whales seem to adopt a wait-and-see strategy.

New price sockets are probably just healthy market corrections, and the overall feeling remains Hausse. As a result, Solana is expected to recover.

If retail investors continue to gather, the sun may recover $ 154 and strive for $ 159.

But if the retail feeling changes and they also start selling, the price can fall below the $ 149 support level, which can potentially lead to a further decline towards $ 140.