Key dealers

- SEC-approved the grayscale transformation of its large-cap-captofond into a place ETF.

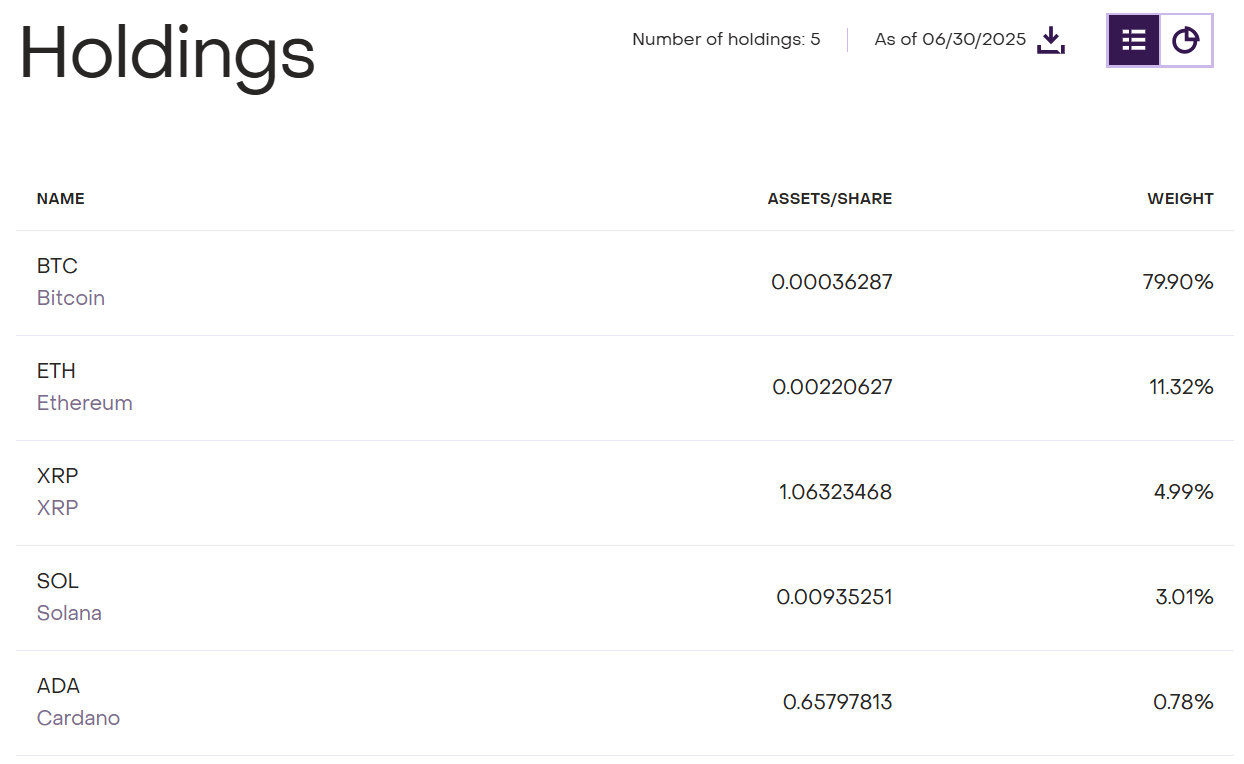

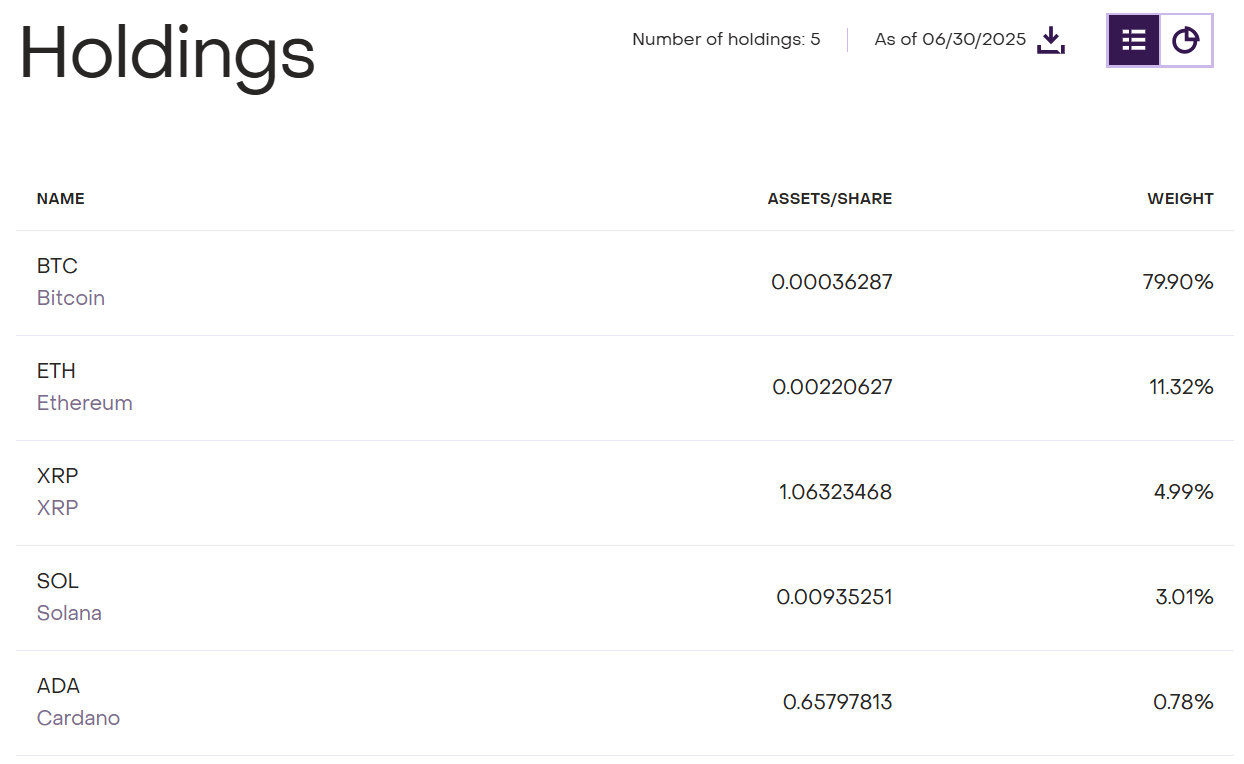

- ETF will include Bitcoin, Ethereum, XRP, Solana and Cardano, which expand regulated crypto products for American investors.

US Securities and Exchange Commission has approved listing and trade in Grayscales Digital Large Cap Fund (GDLC) as a spot Exchange-Trade Fund (ETF) on NYSE ARCA, according to a recent Published order Granted approval on July 1, was first shared by Phoenix News.

The decision follows the gray -scale submission of one Changed S-3 archiving to SEC just last week, which was seen as evidence of active dialogue between the issuer and the controller. ETF -Store President Nate Geraci assumed Grayscale’s bid would be successful.

Grayscales GDLC Fund was introduced in 2018 and offers investors a single vehicle to get exposure to five of the largest digital assets, including Bitcoin, Ethereum, XRP, Solana and Cardano. The portfolio is vigorously weighed against Bitcoin to about 80% from June 30.

The fund has grown to almost $ 775 million in assets management, according to Grayscale’s latest data.

Bloomberg ETF -Analyst James Seyffart and Eric Balchunas previously noted that SEC’s deadline To determine Graysscale’s proposal to convert its GDLC into a spot ETF, July 2. The analysts assigned high oddsAbout 95%, that SEC would approve the conversion.

NEW: @Ericbalchunas & I raise our odds for the vast majority of the site for crypto ETF applications to 90% or higher. Commitment from SEC is a very positive sign in our opinion pic.twitter.com/5DH8G8RK6Y

– James Seyffart (@jseyff) June 20, 2025

According to ETF Store’s Geraci, if GDLC gets the nod, it can clear a road for ETFs with a single access to crypto assets such as XRP, Solana and Litecoin.