One of four South Koreans owns a digital asset, with speculation, portfolio version and pension planning that are cited as the leading motivation motivations.

According to a New study Of the Hana Financial Research Institute, 27% of Koreans aged 20-60 have invested in a digital asset when the country’s “Crypto” Mania hits new heights. 70% of respondents said they intend to expand their holdings. On average, these holdings accounted for 14% of their total financial asset portfolio.

Investors in the 40s were the most active in Investment of digital access. Half of investors in the 1950s have digital assets as a pension plan at a time when the growth of the country’s once vibrating economy has subsided.

The East Asian Nation’s economy is projected Growing by 0.6% in the 2030s and contracts with 0.1% in the 2040s, and the older population now rushes for all investments with high returns, which have drawn millions to digital currency.

1 in 4 South Koreans are now investing in digital assets regularly, while the number of investors selling in the short term has decreased somewhat, the report noted further.

“Virtual assets play an important role in investors’ portfolios,” commented Yoon Sun-Young, one of the leadership writers to the report.

“It is necessary to prepare for the expansion of the investment ecosystem, such as diversification of virtual asset -based financial products, upgrade of integrated investment management and collaboration with the virtual asset industry.”

South Korea Has been a digital asset for over a decade. Investors’ love for high -risk investment has driven millions to digital assets, which has led to the increase of Kimchi premiumwhere digital assets trade significantly higher in South Korean exchange than on other global platforms. At the end of 2017, the Kimchi premium went as high as 50%.

Supervisory authorities have struggled to keep up. With taxes, legislators Voted In order to further extend the roll -out of 20% capital gains tax on digital asset gains by January 2027, five years after the first target period in 2022.

However, regulators have established strict policies for exchanges and Wallets. One of these is that every user must link the stock market account to a bank account, which is intended to reduce fraud. According to the new study, however, it is the biggest trouble for South Korean investors who say they prefer to link their trade accounts to several bank accounts.

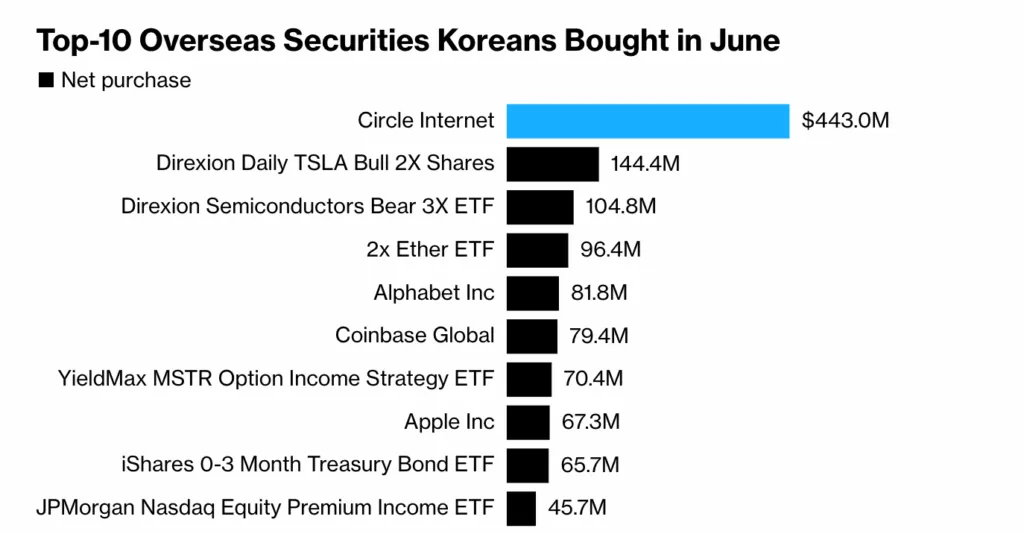

In addition to direct trade, millions of South Koreans have been directed to the shares in digital asset companies in US data from Korea Securities Depository revealed to NO lists Circle (Nasdaq: CRCL) was the most popular foreign stock for investors in June.

During the three weeks since Circle was announced on June 5, South Korean investors poured $ 443 million into its warehouse, which has increased over 500%.

South Korea’s Central Bank Dikar CBDC for StableCoin

When digital assets are floating in South Korea, the country’s central bank has abandoned plans for one Central Bank digital currency (CBDC) Pilot planned for later this year, with local reports claiming that it is now focusing on a Won-Pegged Stablecoin.

Bank of Korea (book) has explored a digital won for several years. Earlier this year, that fired The first phase of the CBDC pilot, where 100,000 South Koreans tested tokenized deposits while lenders tested one Wholesale CBDC. The second phase would start in October.

According to local stores, however, the central bank temporarily stopped the second phase when conflicts arose with the participating commercial lenders, including Hana Bank, Kookmin Bank and Cocoa Bank.

The conflict is centered on the rapid adoption of stablecoins In the country, with the lenders who are now switching to compete on the new front.

The new administration, led by President Lee Jae-Myung, has run for the Won-Pegged Stablecoins, which was one of the Democratic Party’s campaign promises. According to the Digital Assets Act, which was introduced last month, companies can issue a Stablecoin with as little as $ 400,000 in capital.

A source at one of the best banks says that the CBDC pilot has been costly for the lenders, and they are now thinking of channeling these resources to issue a Stablecoin.

Look at | The Strategic Shift 2025 Highlights: Transforming Industries with Saas & Blockchain

https://www.youtube.com/watch?v=pknzcpd50as Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted Media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”