Ethereum Staking Validator Everstake has announced that the validator output queue has reached its highest point in one year. The expert further explained why this development could be positive for ETH ecosystem.

Ethereum validator exit -queue reaches new high

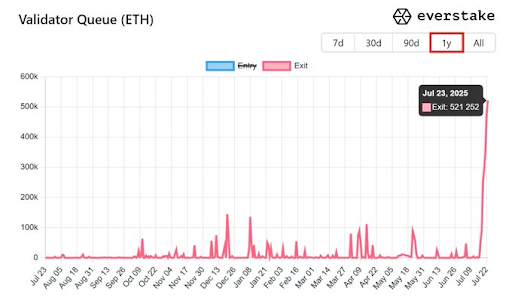

In one X postEverstake stated that Ethereum Validator Exit -queue has reached its highest level in over one year, which represents approximately 520,000 ETH, which corresponds to $ 1.9 billion at current prices. The validator noted that this queue will take about 19 days to fully do. He further explained that this starting queue is tracking how many validers leave Ethereum’s Staking System.

This usually raises concerns that enormous sales are imminent from these validers. Everstake, however, assured that the over voltage in the validator queue is not a sign of fear or collapse. Instead, the expert claimed that it is a displacement, thereby These validers are more likely to leave and restore, optimize or rotate operators than to leave the ETH ecosystem.

At the same time, Everstake acknowledged that it is still possible that these validers may want to lock in the profits, especially when Ethereum price Recently grew into a six -month highest. He noted that it is natural to assume that some stakes prepare to sell, which can create short -term sales printing and potentially get ETH to correct.

On the other hand, however, the validator pointed out that Ethereum sees the record ETF demand, with billions of dollars in net flows since the beginning of this month. As such, Blackrock, Fidelity and Other ETH ETF issuers Could match this potential sales print with similar buyingress.

Everstake also explained that this development with the validator exit is a “sign of health” and the freedom to move. He claimed that activity like this shows how mature ETH effort has become, with the protocol that did what it was designed to do. He added that this is how decentralization looks.

ETH ETF’s record inflows for 15 days in a row

SOSO VALUE DATA Shows that Ethereum ETFs have now registered 15 days in a row with net inflows. This follows the net inflow of $ 231.23 million which they registered on July 24. These funds currently have $ 20.70 billion in net assets, which represents 4.59% of Ethereum’s market value.

The significant inflow of these means support Bit by bit CIO that ETH will soon witness a demand shock. He stated that this demand comes from ETF’s and companies’ treasury and predicted that they could buy up to $ 20 billion in ETH next year.

At the time of writing, the Ethereum price is traded to approximately $ 3,630, up over 1% over the past 24 hours, according to data From Coinmarketcap.

Image from Getty Images, charts from tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.