- The Senate passes Trump-supported bills with deep tax cuts in the middle of a sharp two-party department.

- Crypto tax relief is excluded, which left miners and stakes in uncertainty in the legislation.

In a deeply divided Senate, Republicans managed to push through a controversial budget reconciliation invoiceCalled “One Big Beautiful Bill Act”, with Deputy President JD Vance who cast the decisive voice in a 50-50 deadlock.

‘A large beautiful count’ gets a green light

The legislation led to harsh debate over party lines.

It was criticized for proposed cuts in health care, lack of safeguard measures regarding artificial intelligence and tax policy that is generally seen that benefit the rich.

However, despite widespread calls for changes, including from GOP, the bill was adopted after a 24-hour marathon session last night.

The sweeping budget proposal now goes to the House of Representatives, where the internal Republican friction would complicate its path to final approval.

What is in the bill?

With the support of Donald Trump, who hopes to sign it in the Law on July 4 Independence Day, the bill tries to extend Trump’s tax cuts in 2017.

It will introduce new exceptions for tipped and overtime income and significantly increase funding for military operations and immigration.

At the same time, it describes steep cuts, almost $ 930 billion, from important social security networks such as Medicaid and SNAP, while dismantling many of President Biden’s Hallmark Green Energy Initiates.

The bill also includes a controversial increase of $ 5 trillion in the national debt ceiling, which intensifies the GOP fights on how to handle the balloon of $ 36.2 trillion federal liabilities.

With the risk of standard that comes, the bill has become a flashpoint in debates on financial priorities, social welfare and climate policy.

Crypto miners see no committee

Even with its extensive political changes, the bill failed to recognize the growing challenges in the Cryptocurrency sector, especially those that affect miners.

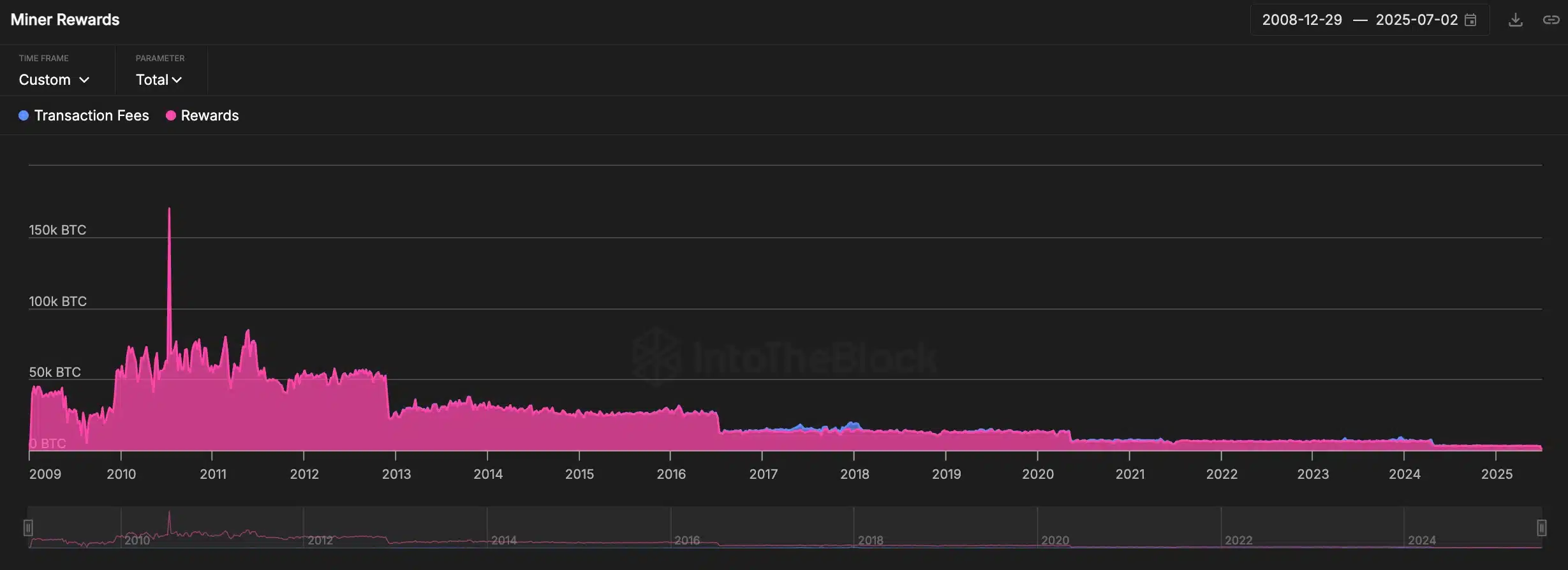

Since block rewards for bitcoin and other cryptocorate continue to decrease over time due to halving events, many miners already work on thin margins.

Thus, the absence of clear tax relief or legislative guidance in this legislation to the burden that miners encounter contributes, which potentially makes mining operations in the United States less sustainable.

Senator Cynthia Lummis was sued to apply for minor taxes for miners, advocateThe

“For several years, miners and stakes have been taxed twice. Once when they get block rewards and again when they sell it.”

However, such a reform was not noted in the final bill.

Without supporting policy, the industry can fight to remain competitive and weaken the US position in the global digital asset landscape.

The way forward

While Republicans could receive the bill through the Senate, Even strong Trump supporters such as Marjorie Taylor Greene express concerns about the proposed political changes.

Noteworthy, former Dogge -Chief, Elon Musk has even announced plans To create a new political party and oppose it, statementThe

“Our country needs an alternative to the Democrat-Republican Uniparty so that the people actually have a vote.”

Thus, when crypto advocates weigh new strategies among political rift and installation of industry challenges, the way will remain uncertain for now.