Digital payments Has risen over the past decade and accounts for over 80% of all e-commerce transactions in the ASIA-Stilla Sea (APAC), says a new report.

The Global payment report 2025 revealed that since 2014 digital payments have increased from 34% of e-commerce payments to 66% in 2024. Authorized by London-based WorldPay included Digital assets report, Digital walletsAnd buy now pay later platforms under digital payments.

The ubiquitous use of smartphones and rapid development in the fintech space is among the factors that have increased digital payments over the past decade. In addition, national payment systems have changed gamedominant payments in some of the largest economies.

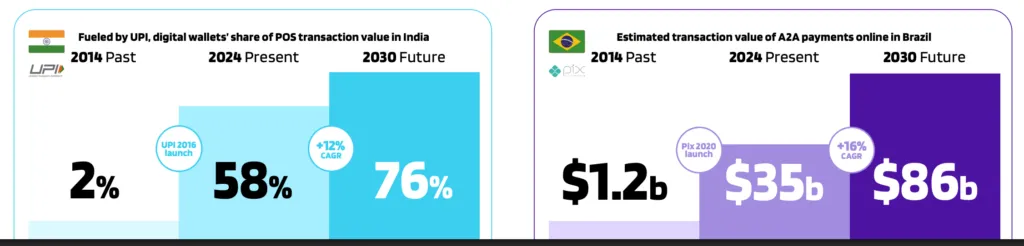

In India, Uniform payment interface (UPI) now accounts for almost 60% of all sales point transactions (POS), up from 2% in 2014, and is expected to hit 76% by 2030. Thailand’s promptpay has a market share of 41%, while it was a market share of 41% while Brazil’s pix Treated $ 35 billion in account-to-account payments last year, a huge increase from $ 1.2 billion in 2014.

But while the Digital Payment’s dominance rises, the report notes that it has been resistance to the cash of cash payment.

“The cash’s share of the payment value fell over the past decade, but still the demand for cash. Unlike many of its analog contemporary, cash may prove to be timeless,” it says.

WorldPay projects such as even if the demand for cash Will continue to dip, it is probably to find the floor. Cash accounted for $ 5.6 trillion of payments last year, and it is expected to stay over $ 5 trillion by 2030, with demand highest in some major economies such as the Philippines, Nigeria, Japan, Indonesia, Mexico and Vietnam.

Asia’s cashless revolution

The APAC region has been one of the fastest growing cashless Communities over the past decade, the report revealed. In 2014, China had an uneven lead over the other nations, but the picture is more balanced now, with digital payments Now the most popular channel for a majority of countries.

IN e-commerceDigital payments accounted for most of most APAC countries, with Taiwan, South Korea and Japan the remarkable exceptions, where credit card dominated.

In Thailand and Malaysia, the national payment services dominated Promptpay and Duitnow respectively. Thailand’s government has also operated a digital wallet initiative through which it distributes its 10,000 baht ($ 300). Prime Minister Paetongar Shinawatra recently Repeated that the government is still involved in the initiative despite local reports that it would be suspended.

China remains the lighthouse for digital payments in APAC, with digital wallets that account for 84% of all e-commerce payments and 70% of the POS transaction value. Leading digital wallets, including Alipay and WeChat Pay, have integrated local cards into their platforms, with the government Shoot them to accept foreign cards this year.

On the other extreme, Japan remains the most cash -loving nation. Worldpay predicts that cash use will only dip 2% annually to 2030 in a country where 10% of the population ages Over 80 and has cash with high consideration.

For the first time, digital currencies were included as payment methods in the report in the APAC region. However, they accounted for less than 1% in all countries, except in the Philippines, Singapore and India, where their share was 1%.

Small and medium -sized companies operating digital wallet of Asia

While peer-to-peer digital payments are at the highest time all over Asia, Deloitte says that small and medium-sized companies (SMEs) have been important driving forces to adopt digital wallets throughout the region.

“The barriers for entry have been lower for SMS. Digital penetration and the number of consumers apps And superappar all over the region has supported the SMB sector, ” says Tony Wood, the Bank Management for the Asia Stil-Sea Stat in Deloitte.

Wood noted that formal bank channels continue to rely on older infrastructure and technology, which tends to be costly and boring to integrate for smaller companies. This has driven them to Digital solutionswhich is in line with the region’s driving force against digital payments.

Professor Sumit Agarwal agrees and notes that the low installation costs, low fees and no requirement for POS machines have attracted small and medium -sized companies to digital payments. He added that consumer behavior has also played a role.

“Customers rely more and more on mobile and QR-code-based technology. SMEs are mainly obliged to provide the services for their customers,” abandoned Agarwal, professor of economics and finance at the National University of Singapore (NUS).

See: New Age of Payment Solutions

https://www.youtube.com/watch?v=W4varzerwuw Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscopes; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-Origin” Permitting Lorscreen = “” “” “”