It’s yet another big week for Stablecoins. June 17th is the US Senate passed Genius Act (guide and establish national innovation for us Stablecoins) with a vote for 68-30.

The Genius is a proposed bill that, if approved, will establish the US’s first federal framework for Stablecoins. Some of its most important provisions: All StableCoins must be supported 1: 1 with cash or short -term state cash registers, issuers must reveal reserves and undergo audits, and there will be a license regime for both large and small issuers. The bill also makes it difficult for large technology companies to issue a Stablecoin without unanimous approval from Treasury, Fed and Federal Deposit Insurance Corporation (FDIC). The proposed bill also describes anti-money wash (AML) and consumer protection requirements. As a whole Genius act is the government’s attempt to regulate stablecoins For the first time.

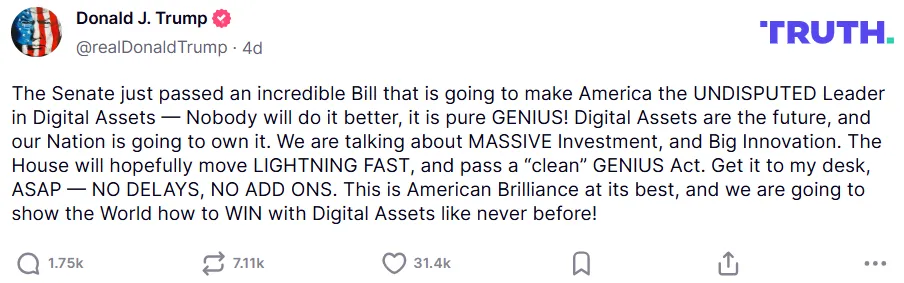

The next step is for the bill to go to the house, where it is expected to pass without resistance. After that it will land on President Donald Trump’s desk, and based on his own social media post, he seems eager to sign it.

But even though the bill has some stops on their journey before they become law, companies waste no time to get their Stablecoin initiatives in motion.

Amazon, Walmart and JPMorgan position themselves for a Stablecoin -Framtime

Even before the Genius Act advanced so far, banks and financial institutions began to lay the foundation for Stablecoin products and invested in the possible passage of the legislation. Now we start to see retail giants like Amazon (Nasdaq: Amzn) and Walmart (Nasdaq: WMT) inch in the Stablecoin world as well.

Recently, rumors appeared that Amazon and Walmart are exploration The idea of StableCoins for internal use. Shortly thereafter JPMorgan (Nasdaq: JPM) potted A brand for a blockchain-based product called JPMD, which many speculates stands for “JPMorgan Dollars”, and believes will be a StableCoin, although JPMorgan’s archiving did not explicitly use the word “Stablecoin.”

These companies saw the early movers in Krypto, especially those who launched Stablecoins as Circle, generate significant revenue from their Stablecoin offerSo they are now positioning themselves to do the same. With Genius Act about to pass, their plans to do this have accelerated.

The commercial use case for StableCoins

At present, Amazon and Walmart’s Stablecoin plans appear to be focused on internal use; They are tokens with closed loops used in their walled gardens and suppliers. This is not exactly a new concept; It resembles which circle, the issuer of USDC, has already begun to do through its Circle payment network.

The advantage of doing this is that instead of relying on credit card networks, which takes out 2-3% per transaction, or bank transfers, which can take several days, make a StableCoin-based system dealers to solve transactions directly and at significantly lower costs.

Amazon and Walmart’s interest track with a broader trend in the company’s America: The ongoing driving force to lower costs and running lean. Stablecoins offers a way to lower the cost of payment, improve efficiency and potentially unlock new income streams for its issuers.

These revenues not only come from cost savings either. Stablecoin issuers, according to Genius Act, must back tokens 1: 1 with cash or equivalent. The issuers usually choose short-term state funds (T-Bills) as their cash equivalents, which means that the issuers earn the return on these T-Bills, which is about 4% in today’s economic environment. If you handle billions in reserves, the passive returns that are shaved from Stablecoin will be significant.

The biggest obstacle to the business stablecoins

But these newly found commercial Stablecoin strategies do not come without hindrance. For an internal Stablecoin to work, the people and companies you do must also be part of your Stablecoin network.

Let’s say that Amazon starts paying suppliers with its Stablecoin. Suppliers will take advantage of faster transaction decommissioning, but they want a way to convert these tokens into Fiat It can be redirected to their other business operations. If each major company begins to issue its own ownership, we will end up with a fragmented ecosystem where each issuer will need to design a way for its network partners to replace their Stablecoins for cash. It is unclear whether retailers will build their victims or take advantage of existing, very liquid infrastructure such as Circle’s Payment Network. But every supplier, supplier or partner who does business in Stablecoins wants a quick and frictionless way to convert their Stablecoins to cash.

Can stablecoins replace global payments

We are in an era where Stablecoins every day become more embedded in the fabric on Global financial system. In today’s environment with high interest rates, where prices are significantly higher than they were five years ago during the zero interest rate policy, each company is under pressure to lower costs and improve the operational efficiency. Stablecoins show up as a solution for this in terms of payments and settlements.

But it is not all smooth sailing for Stablecoin issuers. Stablecoins only work on a scale of the units that a company transmits with also accepting them and, even more important, has a way to leave these positions. Companies are starting to roll out Stablecoins and launch payment networks, but so far we have heard much more about announcements than the results of these systems. Who actually determines transactions in Stablecoins? How is the user experience? We do not really have answers to these questions at this time.

There will be even greater obstacles if companies want to make their Stablecoin’s consumer turns. At that time, they must convince everyday users to go out of their way to get a stablecoin and then use it instead of just pulling out a credit card or pay with cash. It adds a layer of friction to the payment process that may not be worth the trouble for most consumers.

There is not enough real data to conclude how all this will play out. But in theory, Stablecoins can become a central part of, or even a compensation for, a large part of the traditional financial infrastructure: domestic and international payments.

One thing, however, is certain: since legislation that Genius Act continues and rumors about household name companies that experiment with Stablecoin’s scattered, scratches Circle reward. On June 17, after News broke that Genius ACT had cleared the Senate, CCR’s shares from $ 149.15 to $ 199.59, a 38% nail run by a strong headline about Stablecoins.

Look: Break solutions on blockchain control barriers

https://www.youtube.com/watch?v=t-v_jf4egyq Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted-Media; Gyroscopes; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-ORIGIN” permitting lorscene = “” “