- Smart money investors have made significant profits from AVAX and still hold their positions, which continues to affect the feeling of retail.

- The market players have started loosening their assets, but the price diagram shows a clear path for a potential rally.

Avalanche (AVX) Registered a profit of 2.62% during the last 24-hour first positive performance after a month-long decline of 26.22%.

Analysis shows that these winnings come when smart money investors reap huge gains from early bets on AVAX. But the most important question remains: Will this spark renewed confidence or trigger a sale?

Smart Money Profits But Has Avax

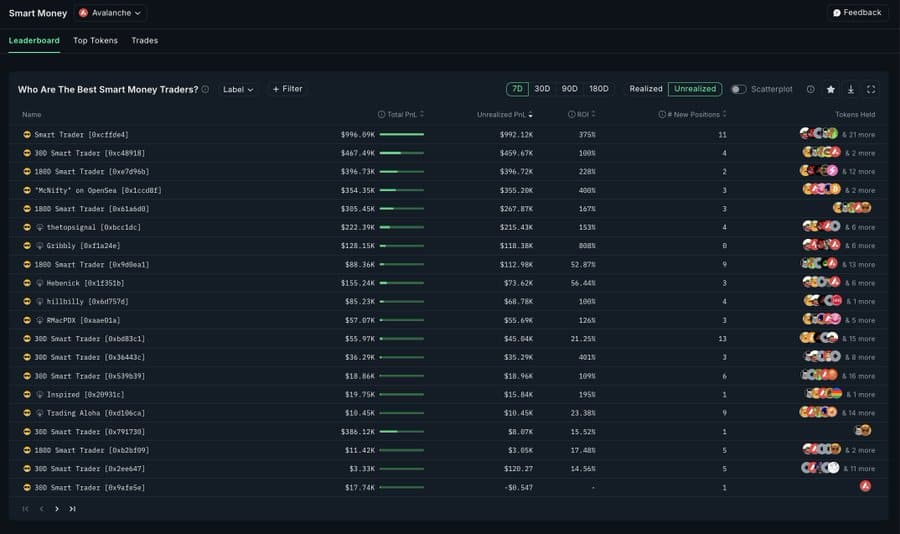

Insight from Nansen revealed that smart money investors in AVAX have made significant profits, despite a total price decline.

For context, smart money refers to investors who are known to make profitable investments, buy low and sell high.

Reports indicate that these investors have earned profits of up to 375% during this period, with unrealized profits approaching $ 1 million over 11 positions.

With such a significant return, these investors are usually expected to loosen their holdings and payments.

But at press time, they continue to hold their positions. However, detailed investors take another strategy and sell their assets.

Retail data signals Baissearted Base

According to TiledRetail investors have begun to pay and exploit the latest price profits.

At the time of writing, spot investors have turned their buying behavior from the previous week – when they collected AVAX of $ 11.9 million – and have now started selling.

In the last 24 hours alone, these investors have sold AVAX at $ 821,000 and put down pressure on the price.

Similarly, derivative traders have begun to open short positions and invested in a further decline in AVAX’s price.

This trend was confirmed with the open interest -based degree of financing – a metric used to analyze the feeling in the derivative market, which indicates if traders buy or sell.

From now on, this metric has dipped in negative territory and published a reading of -0,0022% after having remained positive in previous days.

The baisse -like position from both site and derivative investors highlights the prevailing negative feeling in the AVAX market.

AVAX -Diag signals Breakout, but resistance levels remain

On the diagram, Avax showed a raised road as it broke out of the resistance level in the falling channel pattern.

Usually, an outbreak like this can lead the price to go through the top of the channel it came out from and offers significant profits for traders.

However, rising sales pressure can make this movement more and more difficult. In addition, key resistance levels are ahead.

If the price succeeds in breaking the first resistance, it can signal that the haus -like trend remains intact.

Nevertheless, another major obstacle is $ 19.81. Exceeding this level can drive the price to the $ 22 interval, which corresponds to a 27% profit from the first breakout point.

The market shows neutral feeling

At the press time, the total value locked (TVL) has stopped stationary, which shows no significant inflows or outflows during the last 24 hours.

Current market behavior reflects investors’ determination, which can burden on AVAX’s overall momentum.

When the broader feeling changes negatively, AVAX can face a potential return and challenge the strength of its recent upward movement.